Research Article, Res J Econ Vol: 3 Issue: 1

A Purpose-Driven Customer Relationship Management (CRM), Strategies and Expected Benefits to Ghanaian Banks

Godsway KD*

Kwame Nkrumah University of Science and Technology, Kumasi, Ghana

*Corresponding Author : Godsway KD

Commonwealth Executive Masters in Business Administration (IDL), Kwame Nkrumah University of Science and Technology, Kumasi, Ghana

E-mail: gdzisenu@gmail.com

Received: August 29, 2018 Accepted: December 20, 2018 Published: January 02, 2019

Citation: Godsway KD (2019) A Purpose-Driven Customer Relationship Management (CRM), Strategies and Expected Benefits to Ghanaian Banks. Res J Econ 3:1.

Abstract

The thesis researches into Customer Relationship Management (CRM) that is driven by a strong sense of purpose and the strategies that allure to expected benefits among Ghanaian Banks. Most CRM units of service organizations exist but do not practically fulfill the expected CRM mandates for which they exist, meanwhile in today’s global economy; virtually every aspect of human life is service-centered. The consumer now looks out for the best available service quality that brings satisfaction. There is therefore an urgent need for banks as service organizations to consciously maximize service quality and customer satisfaction so as to achieve competitive advantage. The statistical sample of the research is ten (10) licensed Ghanaian Banks with (50) relationship staff and (10) CRM Unit managers. Purposive sampling was used to select the sample. Both qualitative and quantitative research techniques were used to collate and analyze data. All data collected were by means of survey research design using questionnaires and interviews. Data analysis was by the help of Microsoft Office 2007. The findings of the study are that, service quality that leads to customer satisfaction is what drives Customer Relationship Management among Ghanaian banks. The study also reveals that customer identification, customer differentiation, customer interaction and customer personalization still remain strong model as CRM strategies that lead largely to expected benefits such as customer acquisition, customer loyalty and retention, profitability and customer satisfaction across Ghanaian banks. The researcher recommends that for quality service, banks must first differentiate their customers to be able to customize their needs and demands by using CRM software to track their customers.

Keywords: Purpose-driven; Customer; Relationship; CRM; Strategies; Service

Introduction

As a result of the current dynamics in global business, this 4Ps of marketing mix are gradually exiting the market arena, rather, attention is fast shifting to sustainable strategies that will keep customers loyal with company’s products and services.

Various researches have shown that the way forward in businesses is to adopt a Customer relationship management approaches since the concept of CRM produces long term effects on both the customer and the business.

According to Dowling (2002), loyal customers are more profitable and lucrative than non-loyal customers. The customer is therefore a crucial factor to most businesses today as their attentions are beyond mere attraction of the customer to bonding the customer to the company through nurturing so that they would remain with them thus cutting down on cost of marketing.

CRM is seen as the marketing platform that manages customer information in order to better comprehend and serve them. With CRM, the customer is placed at the centre of the organization. A good customer relationship is hence the key that unlocks the door of business success, relationship building and management. When the needs of customers are understood and value-added services are offered, they become determinants of business success or otherwise.

Today, there is proliferation of many businesses all competing to catch the eyes of the customer in order to hook it to its services and products. One’s ability to retain customers is key to business success in this global competitive business arena.

On daily basis, the banking industry is more and more competitive anywhere in the world. The central product being provided to customers is practically homogenous. In view of this, it has necessitated the banks to differentiate their products and services from competitors through long-term relationships with customers [1].

In Ghana now, because the banking sector is faced with severe competitive pressures, many commercial banks are now concentrating their attention on sustaining a satisfied customer hold up [2].

It is true in the Ghanaian banking industry where reforms in the financial sector has created an enabling business environment among Commercial banks that permits consumer banking; consequently given customers substantial preference in fulfilling their financial needs [2]. As a result, many commercial banks are focusing their strategies towards growing customer satisfaction [3].

Many banks are on the search on how to build valuable customer relationships among their customers [4,5]. Companies are thus, shifting their attention to the customer for the basic purpose of satisfying and retaining them. There is therefore the growing importance and strategic need of Customer Relationship Management (CRM) as a key business marketing and monitoring tool.

According to Russell, the service sector has been the fastest growing segment and represents a major and increasing proportion in the global market. Today, the service sector represents more than two thirds of the most developed countries’ economic activities and as a result, it requires that service providers such as banks relate professionally well with clients for mutual benefits.

For the purpose of competition, banks must therefore try to keep existing customers while attracting new ones through a purposedriven customer relationship management.

Problem Statement

The issue nowadays may not be the complete non-existence of CRM Units of organizations, because more often, most companies have these CRM initiatives underway ranging from sales automation to online-enabled customer contact centers. Indeed, many organizations have created CRM Units but at the same time have failed in winning the hearts of their customers. Could it be most of these CRM initiatives are not purpose-driven, performance-driven enough, not strategic and not long-term based?

Companies face large challenges when trying to relate and manage customers while customers on the other hand also feel dissatisfied at their service providers. Consumer companies more often than not, manage their customer relationships disorderly and unprofitably. Many times, they may not effectively and adequately use their links with their customers, due to misapprehension or misinterpretations of a CRM system’s analysis. As a result, clients who want to be treated more exclusively and more like a friend may be treated like just a party for exchange, rather than a unique individual. These lead to poor service quality and delivery thus creating gross dissatisfaction among customers. This failure most importantly results in low revenue generation to many organizations with intense competitions.

Many studies show that customers are frequently frustrated by a firm’s inability to satisfy their relationship needs, and on the other side, companies do not always know how to decode the data they have gained from CRM software into a realistic plan of action thereby rendering the whole concept of CRM non-purposive.

Literature Review

Banks as service organizations

According to Verma [6], services are activities offered by providers which people patronize with the mind that they would create some level of satisfaction. Because services are intangible and indescribable, it is crucial for both the service provider and customers to interact in the creation and consumption of services whose production may sometimes be tied to goods”.

This definition according to Peck et al. [7] clearly brings out some key metrics for measuring what a service is. There are four basic characteristics of every service which makes it stands out from goods. They include: Intangibility, in separability, perishability and heterogeneity.

In every service provision, there are at least two parties: a service provider who uses competence to render service and a customer who puts together the applied competences with other resources to produce additional value [8-12].

A purpose-driven customer relationship management (CRM)

A purpose-driven CRM is that which develops a CRM vision. A CRM vision is a highly-leveled statement of how CRM will transform a business as it relates to customers.

According to Patton (2001), many companies most times jump into customer relationship management activities without first having to obtain clear-cut out objectives, strategies and approaches from senior management.

When the objectives and purpose of CRM are clearly stated and defined by CRM Units they help spell out the type of the CRM initiatives that needed to be performed by practitioners.

Strategic goals for CRM Measurable objectives when created in advance help to evaluate the performance of the CRM implementation. According to Gray and Byun (2001), in a survey involving chief executive officers, more than 57 percent of them with 191 respondents believe that the main objective and strategy of CRM initiatives is customer satisfaction and retention.

Strauss and Seidel, see CRM as an all-inclusive business approach which has the final objective of building a long-run relationship with the customer.

CRM can be defined as “the development and maintenance of mutually beneficial long-term relationships with strategically significant customers” [13-17]. It can also be defined as the art of acquiring customers and having a long-lasting relationship with them. Companies must take the initiative to actualize and implement CRM.

Dimensions of CRM strategies

Before implementing the strategies of CRM, it is very needful to understand basic principles that are foundational of every Customer Relationship Management (CRM). The following general dimensions of CRM strategies exist. According to Injazz [18], Customer Relationship Management (CRM) is a combination of people, processes and technology that seeks to understand a company’s customers (Figure 1).

Fox and Stead [19] said the above components indicate CRM success and suggests the strategic need to focus on people, technology and processes.

According to the existing literature there are three main layers that one has to consider when implementing a CRM strategy: people, processes and technology [20-22]. The three layers were defined as:

People: When implementing a CRM strategy, there are many people that are involved, across functional departments that work together so as to ensure the success of such strategy such as marketing, sales, I.T. managers, operations etc.

Processes: Processes should be aligned with the CRM strategy and sometimes these processes need to be redesigned from a macro level in order to incorporate the contact, feedback and interaction with customers from end-to-end. Most managers allude to the fact that it is more expensive to acquire fresh customers than keeping existing ones [23]. Finnegan suggests that the whole business processes should suffer a shift from focusing on product to centering on the customer instead. Focusing on the customer alone is an entirely complex process.

Technology: Technology and its impact on CRM strategies in this time of Information Technology innovations cannot be overemphasized since managers are able to collect and analyze large volumes of data with it. Some technologies like data mining, data warehousing and unified management software constitute vital tools for companies to gain competitive edge Rygielsky (2002). Data mining allows enterprises to better segment profitable customers from non-profitable ones and to predict future patterns in their behavior. Finnegan recommends that by understanding existing and future behavior pattern of customers, it is possible to create projective and tailored campaigns and to deliver more value to the customer. CRM technological infrastructure alone can be an important tool that lead organizations to large volume of information on customers but does not lead to improvements in customer relations.

Integration: For effective and efficient CRM strategies to work, the three principles of people, processes and technology have to work simultaneously. I.T solutions are available everywhere but implementing a successful CRM strategy cannot be reduced to technology alone [1,24,25]. The author substantiates that even though CRM systems play a critical role, a more detailed and integrated strategy requires several tasks oriented processes and functionaries in order to increase customer value: tailored responses, customized service, smooth processes and qualified work force.

Strategies of customer relationship management (CRM)

CRM strategy can be defined as a high-level plan of action that aligns people, processes and technology to achieve customer-related goals.

According to Ryals and Knox , the CRM objectives and strategies for service applications include: using service to delight customers, reduced cost and increased profitability and using service to improve service delivery. In another related development, Peppers and Rogers [26], a consultancy firm in their books talked about the “IDIC model” where they recommended to companies four action steps they should take in order to build intimate one-to-one relationships with their customers.

They are identification, differentiation, interaction and customization as per the diagram (Figure 2).

On CRM Strategies [27,28] summarizes the following as the basic strategies and objectives of CRM initiatives:

Customer identification: Each company must identify the customer through various marketing channels and interactions over a period of time for the customer to see the value which the product or service offers.

Customer differentiation: Every customer is unique in her or his own demands and it is this need which determines the lifetime value of the customer and so organizations should learn to differentiate.

Customer interaction: The only sure way for an organization to keep track of its customers’ behavior, needs and demands is by interacting with them. This interaction strategy must be continuous to ensure long-term relationship as well as profitability between both parties.

Personalization: It is a unique kind of treatment given to a customer with the key objective of maximizing customer loyalty. Personalization is a crucial objective of Customer Relationship Management.

The research study focuses on the following theories:

1. Customer Identification

2. Customer Differentiation

3. Customer Interaction

4. Personalization

Expected benefits of customer relationship management (CRM)

CRM is a strategic need for all organizations because when it is effectively implemented, it enhances customer attraction, satisfaction and loyalty and this also mean more sale and more buy [29-32].

In support of the valuable nature of CRM, Coltman indicates that in strategy and marketing literature, other authorities have long recommended a customer-centered approach or strategy as foundational to competitive edge and that customer relationship management (CRM) programs helps support customer knowledge, understanding and interdepartmental connectedness needed to effectively implement a customer-centered approach.

Some of the desirable benefits of CRM to organizations are customer acquisition, greater loyalty and retention resulting in profits.

1. Customer Acquisition

2. Customer Loyalty and Retention

3. Profitability

Methodology

Research methodology refers to the procedure and framework within which any study is conducted. Furthermore, the chapter sets out the overall structure of the research together with the tools and approaches which the researcher uses in arriving at the findings.

Research objectives

The overall objective of the study is to underscore the invaluable need and essence of CRM to financial service institutions such as the banks but specifically would be;

1. To establish the purposes which drive Customer Relationship Management (CRM) among Ghanaian Banks.

2. To identify and describe Major CRM Strategies which Ghanaian Banks use.

3. To identify Expected Benefits of a Purpose-Driven CRM among Ghanaian Banks.

Research questions

1. What is a purpose-driven CRM and how can it be applicable to Ghanaian Banks?

2. What key CRM Strategies do Ghanaian Banks use to achieve expected benefits?

3. What are the Expected Benefits of CRM strategies to Ghanaian Banks?

Research design

A research design refers to the entire structure, plan and ways of carrying out the investigation of a study so as to obtain answers that address the research questions.

The research design used for this study is survey because of its characteristic to assess and evaluate opinions and trends. Additionally, in view of the fact that this research is not limited to one particular bank, the researcher used the “survey strategy’ over other research designs. According to Robson thesis that used cross-sectional data from the banking industry and cross-sectional studies usually employ the survey strategy [33,34].

The researcher primarily uses questionnaires and interviews designed to collect primary data from respondents for analyses. On few occasions, the researcher relied on secondary data from online sources to complement further analysis. Altogether, both quantitative and qualitative research approaches were used.

Population of the study

The population of the research and all the research findings represent all “financial institutions” in Accra particularly, all licensed Ghanaian banks by the Central Bank of Ghana. This is for the purposes of generalization.

There are thirty-two (32) licensed universal banks headquartered in Accra Ghana as at June 2016 and this forms the population of this study.

The research population focuses on only the headquartered banks and not their branches since any authentic CRM data, being it quantitative or qualitative could be retrieved at national headquarters level.

Sample size and sampling procedure

It is manageable for the researcher to select from the (32) universal banks for the study. The researcher could not investigate all the (32) licensed Ghanaian Bank since no scientific research work or study can include or study everyone everywhere doing everything. As a result, the way to go in this study is to sample because it saves time. In view of this, ten (10) licensed headquartered banks constitute the research sample as shown in Table 1 below. Within each of the ten (10) banks are five (5) relationship staff and one (1) CRM manager who act as respondents.

| S/N | Names of Responding Banks | Locations |

Type |

|---|---|---|---|

| 1 | National investment Bank | Kwame Nkrumah Avenue, Accra | Universal Bank |

| 2 | Fidelity Bank Limited | Ridge Towers, Ridge Accra | Universal Bank |

| 3 | Ecobank | 19 Seventh Avenue, Ridge West | Universal Bank |

| 4 | Cal bank | Independence Avenue, Accra | Universal Bank |

| 5 | Sahel Sahara Bank {BSIC} | Glico House, Adabraka | Universal Bank |

| 6 | Energy Bank | 30 Independence Avenue, GNAT Height, Ridge Accra | Universal Bank |

| 7 | Universal Merchant Bank Ltd | Airport City, Accra | Universal Bank |

| 8 | Prudential Bank Limited | Ring Road Central, Accra | Universal Bank |

| 9 | GCB Bank Limited | High Street, Accra | Universal Bank |

| 10 | Agricultural Development Bank | Accra Financial Centre | Universal Bank |

| Source: https://www.bog.gov.gh/supervision-a-regulation/register-of-licensed.../banks | |||

Table 1: Samples of Licensed Universal Ghanaian Banks.

In this research however, the researcher redirects the focus to CRM staff or otherwise called relationship officers who are directly involved in routine management of customers in order to use the study to measure and determine CRM purpose, strategies and expected benefits to Ghanaian banks against the backdrop of key literatures reviewed (Table 1).

The delimitation of the population in terms of size and type of unit to analyze is to give credibility to the study. The researcher uses Purposive Sampling Technique for these selected banks in order to increase access to data collection while removing all likely barriers that might confront data gathering and retrieval.

Data collection technique

The study employs the following tools and mechanisms to gather primary data from respondents.

• Questionnaire

• Interview

Data is gathered through the administration of questionnaires and interviews on each bank’s CRM purpose, CRM strategies and CRM benefits. Data collected is both qualitative and quantitative. Additionally, information obtained from the interview will seek to authenticate findings drawn from the questionnaires administered.

Questionnaire: The questionnaire is sectioned into five parts. Part A collected socio-demographic data of CRM officers and CRM unit heads of the banks. The rest of the parts consisted of questions that sought for answers based on the research topic. Both closed-ended and opened-ended questions were administered to respondents of the ten (10) sampled banks. Likert Scale type of questioning was used to grade responses. Before the survey administration, the questionnaire was reviewed by the researcher’s thesis supervisor and one other academic professional to guarantee content validity. The researcher also pre-tested the questionnaires on relationship officers of one bank to remove any ambiguity and to evaluate respondents’ understanding of the research topic.

Interview: For the purpose of clarity and further and better data, the researcher again conducted structured interviews to Heads of Customer Relationship Management Units of the ten (10) banks. The researcher prepared an interview guide to serve as reference to the research questions. According to Yin, interview as a method of data collection is more insightful [35-38].

Data analysis: Data Analysis and interpretation are conducted using both qualitative and quantitative analysis techniques. Responses from interviewees are recorded with a device, transcribed and fitted into thematic areas of the research. The researcher uses Microsoft Office 2007 for statistical data analysis. Results are presented in tables, graphs and pie charts. The researcher uses the Likert Scale technique in his questionnaires to aid qualitative analysis.

Data validity and reliability: The interview conducted offered interviewees ample space to give details. Personal interview here suggests that information provided by respondents could be relied on as well as valid. Another sense where data collected was reliable is the opened-ended questions designed for the questionnaire.

This describes reliability as the extent to which either a test or procedures produces similar results when subjected to constant situations on all occasions. In order to reduce errors and biases in the study, interviews conducted were recorded and played back for detail analysis [35-38]. Again, the anonymity of respondents to questionnaires is kept to guard against any information hold-back while promoting free flow of responses.

Data presentation and analysis

Data presentation: Analysis of data collected was both done statistically and descriptively. All questionnaires were analyzed statistically while interviews were analyzed descriptively.

Demographic characteristics of respondents: Here the researcher among others discussed two useful socio-demographic traits of the (10) responding banks, that is, gender and number of years of existence of CRM Unit of the (10) banks.

Gender of respondents: In all, (60) questionnaires were distributed among (10) banks of which (33) males responded as against (27) females. The percentage findings from Table 2 showed that 55% of respondents who took part in the survey were males whereas 45% were females. This further suggested that there were more males than female participants.

| Gender | Frequency | Percentage %) |

|---|---|---|

| Female | 27 | 45 |

| Male | 33 | 55 |

| Total | 60 | 100 |

| Source: Field Data Results (2016) | ||

Table 2: Frequency distribution based on Gender.

Period/years of existence of CRM units

The findings from Table 3 below showed that (2) banks on one hand operated their CRM Unit for less than 5 years and another (2) banks on the other hand also operated their CRM Units for more than (10) years representing 20% each respectively. The rest six (6) banks representing (60%) nevertheless operated their CRM Units for over 5 years but not more than 10 years. This suggests that the CRM Units of most Ghanaian Banks have been in operation between (5-10 years) now.

| Year CRM Exist | Frequency | Percentage (%) |

|---|---|---|

| Less than 5ys | 2 | 20 |

| More than 5yrs | 6 | 60 |

| More than 10yrs | 2 | 20 |

| Total Banks | 10 | 100 |

| Source: Field Data Results (2016) | ||

Table 3: Frequency distribution of Period/Year of Existence of CRM Units.

A Purpose-Driven customer relationship management (CRM)

Core mandates of CRM units of banks: Table 4 is the result based on the mandates of CRM Units of Ghanaian Banks. 11(18.3%) represented “effective complaint management and enquiries”, 03(5%) represented “prompt feedback and monitoring”, 05(8.3%) represented “collection of customer data”, 01(1.7%) represented “reception” while 40(66.7%) represented “improved service quality/ satisfaction”. This implies that CRM Units of most Ghanaian Banks are established with the fundamental and core mandate of providing improved quality service and satisfaction to customers. To Ghanaian Banks, reception is not one of their key CRM core mandates.

| CRM Mandates | Frequency | Percentage % |

|---|---|---|

| Effective Complaint management and Enquiries | 11 | 18.3 |

| Prompt Feedback and Monitoring | 03 | 5 |

| Improved Service Quality/Satisfaction | 40 | 66.7 |

| Collection of Customer’s Data | 05 | 8.3 |

| Reception | 01 | 1.7 |

| Total | 60 | 100 |

| Source: Field Data Result (2016). | ||

Table 4: Frequency distribution on the mandates of CRM units of Banks.

CRM mandates that maximize result: Table 5 represented the outcome of CRM mandates of Ghanaian Banks that maximize results on customer acquisition, loyalty and retention, profit and then customer satisfaction. 16 (26.7%) represented “effective complaint management and enquiries”, 10 (16.6%) represented “prompt feedback and monitoring”, 0(0%) represented “collection of customer data”, 07 (11.7%) represented “reception” while 27 (45%) represented “improved service quality/satisfaction”. Again, this implies that among the CRM mandates, “improved service quality/satisfaction” is the one that maximizes results for Ghanaian Banks in the area of customer acquisition, loyalty and retention, profit and then customer satisfaction.

| CRM Mandates that maximize result | Frequency | Percentage %) |

|---|---|---|

| Effective Complaint management and Enquiries | 16 | 26.7 |

| Prompt Feedback and Monitoring | 10 | 16.6 |

| Improved Service Quality/Satisfaction | 27 | 45 |

| Collection of Customer’s Data | 0 | 0 |

| Reception | 07 | 11.7 |

| Total | 60 | 100 |

| Source: Field Data Result (2016) | ||

Table 5: CRM mandates that maximize result of customer acquisition, loyalty and retention, profit and customer satisfaction.

Purpose/Drivers of customer relationship management (CRM)

From Table 6 and among the CRM driving variables “Service Quality/Satisfaction scored 23 representing the highest percentage of 38.3, followed by “Increased customer needs/demands” with (18) representing 30%. “Profit” and “competition” however recorded (12) and (7) representing 18.3% and 13.3% respectively.

| CRM Driving Variables | Frequency | Percent %) | Cumulative Percent |

|---|---|---|---|

| Competition | 07 | 11.7 | 11.7 |

| Increased customer Needs/Demands | 18 | 30 | 41.7 |

| Service Quality/Satisfaction | 23 | 38.3 | 80 |

| Profit | 12 | 20 | 100 |

| Total | 60 | 100 | |

| Source: Field Data Results (2016). | |||

Table 6: Frequency distribution on a Purpose-Driven CRM.

What this suggests by implication is that, relationship officers of the (10) sampled banks choose service quality/customer satisfaction over the other (3) drivers of CRM. Increased customer needs/ demands however played second to service quality as a purpose or driver of CRM. Though competition and profit were CRM driving variables, majority respondents relegated them to the background as not very crucial enough.

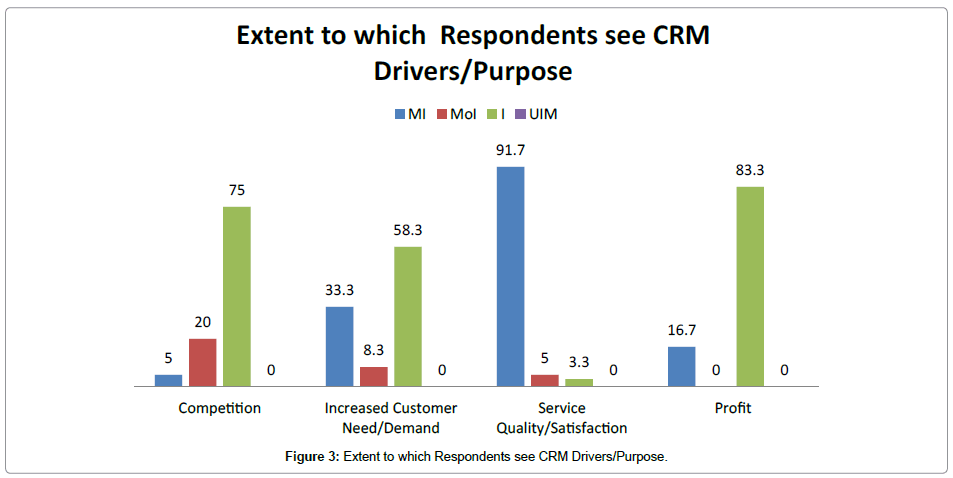

The extent to which respondents consider CRM drivers or purpose (as important or unimportant)

From Figure 3, data collected were graded using Likert Scale technique of “Most Important (MI), More Important (MoI), Important (I) and Unimportant (U). Findings showed that 45 (75%) of respondents said competition is “Important”, 12 (20%) respondents said it is “More Important” while 3 (5%) said competition is “Most Important”. On “Increased Customer Needs/Demands”, 35 (58.3%) of respondents saw it as “Important” while 20(33.3%) and 5 (8.3%) responded “Most Important and More Important respectively. Service Quality/Satisfaction however recorded 55 (91.7%) for Most Important, 3 (5%) for More Important and 2 (3.3%) for “Important”.

On Profit, 10 (16.7%) relationship officers said profit is “Most Important” and 50 (83.3%) of respondents said it is “Important”.

What this means is that when it comes to CRM drivers or purpose Ghanaian Banks place value first on quality service and then customer needs/demands. Profit though important but it is not the most important driver or purpose of customer relationship management.

(MI: Most Important; MoI: More Important; I: Important; U: Unimportant).

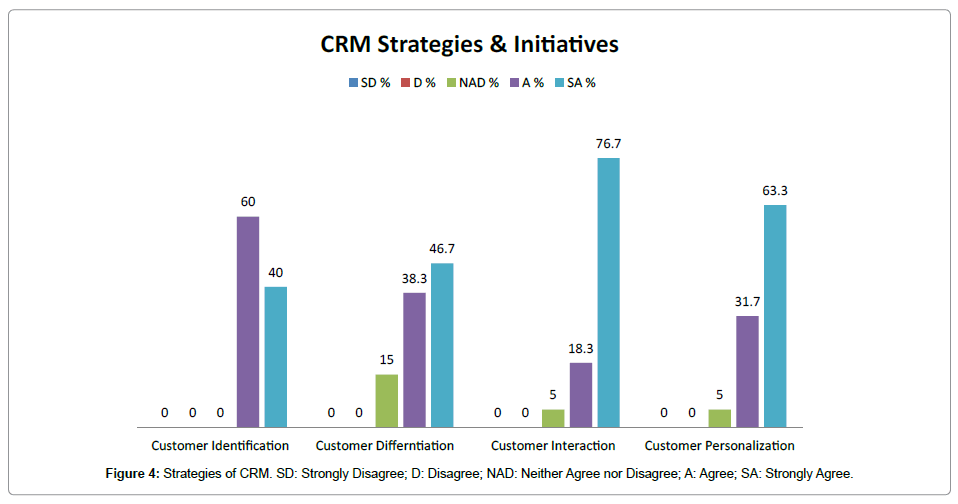

CRM strategies and initiatives

From Figure 4 below, (36) respondents representing 60% of relationship staff “agree” to customer identification strategy as against (24) respondents representing 40% who “strongly agree”. This implies that all 100% of CRM officers responded in the affirmative to “customer identification” strategy of CRM.

On “customer differentiation”, (9) respondents who represented 15% neither agree nor disagree while the rest (51) respondents representing 85% both “agree” and “strongly agree”. By further analysis, 38.3% of respondents “agree” while 46.7% of respondents “strongly agree” to customer differentiation strategy of CRM.

“Customer Interaction” strategy recorded (3) respondents who represented 5% for those who neither agree nor disagree, (11) respondents with 18.3% for “agree” and 46 respondents representing 76.7% for “strongly agree”.

On “customer personalization” respondents who neither agreed nor disagreed were (3), representing 5% as against. (19) Respondents who represented 31.7% “agreeing”. In another related development,(38) respondents representing 63.3% “strongly agreed”.

From Figure 4, which contains results of what strategies and initiatives banks use to acquire, manage and satisfy their customers, almost all (10) banks with 60 respondents consented to the strategy of identifying the customer, differentiating them, interacting and personalizing/customizing them since each customer is unique.

It is evident from the results that almost all the banks saw the need to use the above four CRM strategies to satisfy customers, but not all banks really use differentiation, interaction and personalization strategies to manage their relationships with customers. From the results presented, only “identification strategy” did all the banks agree to have been using on customers.

In a nutshell, only (3) relationship officers each, representing 5% respondents in each case of customer interaction and customer personalization was what respondents neither saw as necessary strategy nor unnecessary. This implies that a far majority of 95% banks representing 57 relationship staff on raw score basis each agreed to using both strategies of customer interaction and customer personalization. But among the four CRM strategies of customer identification, differentiation, interaction and customer personalization, customer interaction ranked far highest among all the strategies, with respondents “strongly agreeing” to its usage.

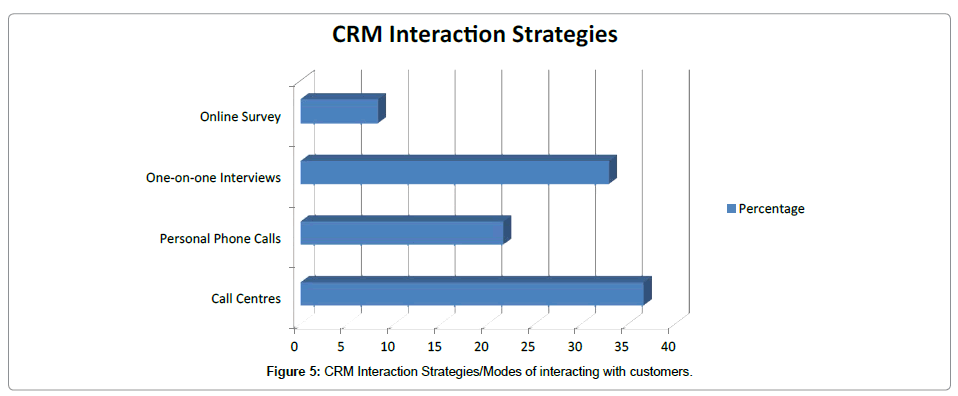

CRM interaction strategies

Results from Figure 5 indicated that 20(33%) of relationship officers said they use “one-on-one interview” to interact with clients about their products and services. Online survey/questionnaire recorded (5) respondents representing 8.3%. Meanwhile the use of personal phone calls to interact with customers on products and services were 13(21.7%) and that of call centers saw 22 respondents representing 36.7% using call centers.

This means that most Ghanaian banks often use call centers and one-on-one unstructured interviews to interact with their customers about their services and products.

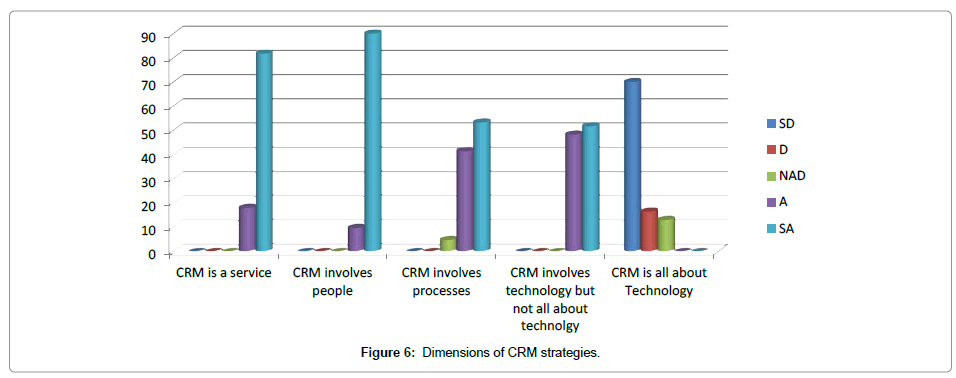

Dimensions of CRM strategies

The findings from Figure 6 beneath indicated that (49) relationship officers representing 81.7% respondents strongly agreed to the fact that CRM is a service while (11) of them representing 18.3% just “agreed”. “CRM involves people” saw 54 relationship staff representing 90% “strongly agreeing” and (6) respondents representing 10% “agreed”. As to whether CRM involves processes, while respondents “agreed” and “strongly agreed” with raw score of (25) and (32) representing 41.7% and 53.3% respectively, (3) relationship staff representing 5% respondents however “neither agreed nor disagreed”.

All respondents affirmed that CRM involves technology but not all about technology with a raw score of (31) representing a percentage of 51.7 “strongly agreeing” and (29) relationship officers representing 48.3% just “agreeing”.

“CRM is all about Technology” saw above average number of (42) respondents representing 70% respondents strongly disagreeing while (10) relationship staff representing 16.7% agreed. Respondents who neither agreed nor disagreed were (8) representing 13.3%.

From the (10) banks agreeing to the fact that the concept of CRM involves people, processes and technology playing a supporting role, it can be concluded that CRM as a service entity is understood by Ghanaian banks. CRM is therefore an integration of people, processes and technology in managing interactions between a business and its customers. These findings were no different from the thoughts of Greenberg [39-41].

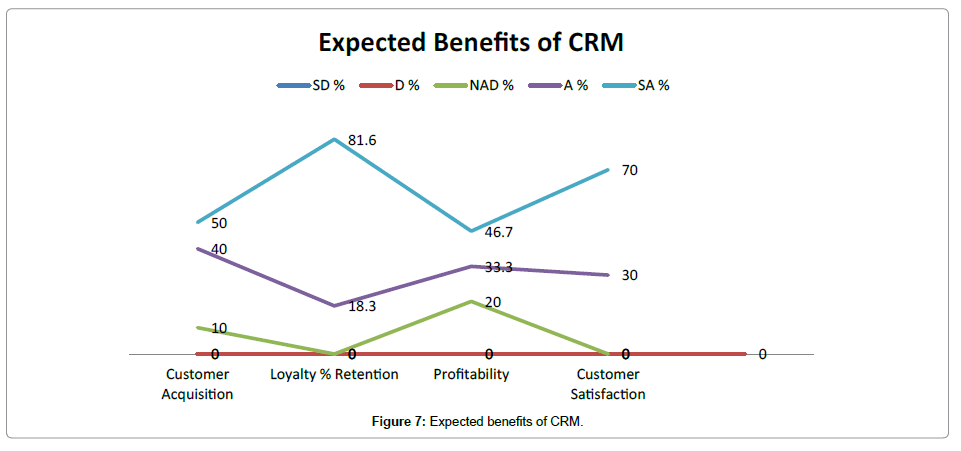

Benefits of CRM to Ghanaian banks

The findings from Figure 7 showed that 50% respondents representing half the sample strongly agreed to “customer acquisition” as benefit of CRM while (24) respondents representing 40% just agreed and the rest (6) respondents representing 10% neither agreed nor disagreed.

On raw score basis, “Customer Loyalty and Retention” saw (49) relationship staff strongly, agreeing to it while (11) of them just agreed. This represented 81.6% for “strongly agree” and 18.3% for “agree”.

“On customer profitability”, 12 relationship officers did neither agree nor disagree to profitability as a benefit of CRM strategy while (20) relationship officers agreed, with (28) of them also strongly agreeing. This represented 20% for “neither agree nor disagree”, 33.3% for “agree” and 46.7% for “strongly agree”.

In all four CRM benefits, there was nothing recorded for “strongly Disagree and “Disagree”.

Now from the result presented in Figure 7 respectively, one would deduce that most banks “strongly agreed” to customer loyalty and retention as the major benefit or return on customer relationship management, that is, after customers are satisfied with their products and services.

Profitability though was mentioned as a benefit of CRM, was the “least” the banks expected from customer relationship management since they believed that customer profitability comes naturally when service quality is at its best. This particular result is in exact consonance with the researcher’s earlier interviews with heads of CRM Units of the banks where they strongly made a case for quality satisfactory service over profitability and that it is service quality that gives birth to profitability [42-45].

There was indecision on the part of respondents regarding the choice of “customer acquisition” and “profitability” as CRM benefits. Ten (10) and twenty (20) percent respectively of relationship officers nevertheless were undecided on “customer acquisition” and “profitability” as expected benefits of CRM.

This finding however only represented a minute minority of relationship staff and so judging from the data collected as indicated in Figure 7, almost all relationship staff agreed to customer acquisition, loyalty and retention, profitability and customer satisfaction as benefits of CRM but amongst all these, customer loyalty and retention ranked highest.

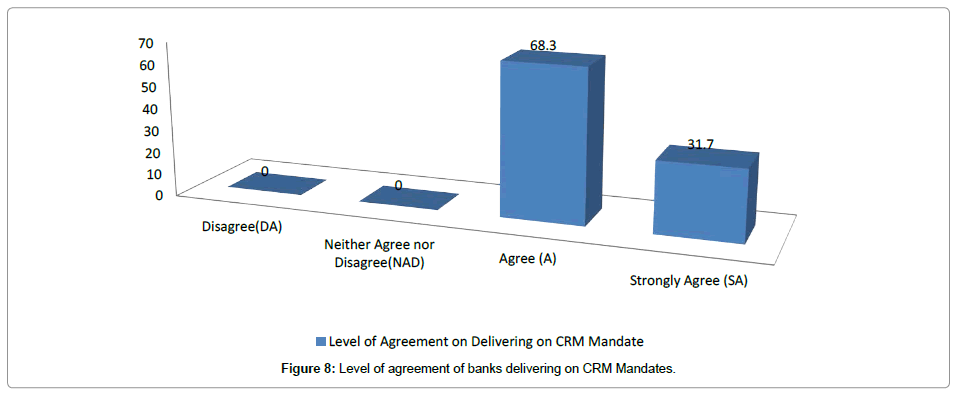

Self-assessment of banks based on mandates of CRM units

From Figure 8, 41 respondents representing 68.3% agreed to having delivered on their CRM mandates satisfactorily while 19 respondents (31.7%) strongly agreed to deliver on CRM mandate. The inference the researcher drew from this is that Ghanaian banks are confident in agreeing to use their CRM Units for the purpose intended.

Discussion of interview findings

For the purpose of clarity and further confirmation of responses gotten from the questionnaires administered, the researcher conducted interviews with CRM unit heads of the sampled banks and the following results came out.

Research Question 1: What is a purpose-driven CRM and how applicable is it to Ghanaian Banks?

Interviews with some heads of CRM Units of the banks revealed that customer relationship management should be founded on quality service that satisfies the very customer for which the service companies, particularly banks exist and not on profit as the first and foremost. Five (5) CRM Unit heads were quick to add that profit is the end-product of quality satisfactory service and is automatic.

The researcher found out further whether organizational structure, status quo, organizational interest in CRM and CRM Units being used as receptions are not necessary enough to drive customer relationship Management? This some relationship unit heads answered as secondary and that customer relationship management could only thrive if only the strategic planners and managers of service organizations have service quality as the major rationale of their existence and their operations. This they say is the only driving variable that would last the test of time.

On the whole, CRM heads described “a purpose-driven customer relationship management as a customer relationship management that has its mandate and strategies well defined towards the provision of quality satisfactory services to its clients.

Research question 2: What key CRM Strategies do Ghanaian Banks use to achieve expected Benefits?

In an interview with some heads of CRM units of these banks, some do not have CRM tool or software, nevertheless, they are able to use other basic computer software to identify, differentiate, interact and personalize their customers.

Some CRM Unit heads of some banks explained in details their differentiation strategies. At National Investment Bank, the bank is able to differentiate its customers and know the value each has with the use of “T 24” software. One area of its differentiated service based on its differentiation strategy is “Excel Banking”. This service is a prestigious, lounge banking exclusively reserved for customers with special business needs where the bank is able to serve these clients on non-business days, odd hours and at their door steps upon request. This service also has other fringe benefits attached.

On interaction strategy, the banks have service ambassadors who welcome customers into the banking halls and assist by guiding them to get the right services while account managers are responsible for routine monitoring and managing of customers’ accounts and then making follow-up calls to those that need attention. Call centers played major role in the banks interactions with customers.

Also, these banks use surveys, telephone interviews, one-onone interviews with walk-in customers and online questionnaires to interact with customers.

According to National Investment Bank, it uses its Customers Database Software to identify, differentiate and personalize its customers. As a result these banks are able to customize each client for various products and services such as corporate banking, retail banking, prestigious banking, electronic banking, SMEs facilities and many more.

The researcher asked the role technology or I.T. plays in the process of implementing CRM strategies since some schools of thought argued strongly that Customer Relationship Management (CRM) is solely technological and involves I.T. tools while others said CRM is about relationships and that technology is just an enabler of it. “In your view, what do you say”? This was the researcher’s question to heads of CRM Units of the sampled banks. This was what some had to say. “Our products and services we offer to customers are intangible and as a result we need to leave unforgettable memories in the minds of our customers. Our daily activities are all about the people we serve (customers) and we rely greatly on our software (technology) to deliver such desired services through number of integrated processes – to this end, Information Technology and related software is invaluable. Altogether, our ultimate goal as a bank is that by the end of the business transaction, the client should go away satisfied”.

Research question 3: What are the Expected Benefits of CRM Strategies to Ghanaian Banks?

The researcher interviewed CRM Unit Heads of the sampled banks about the meaning of each CRM Benefit variable such as acquisition, loyalty and retention, profitability and customer satisfaction. This is what the researcher transcribed from the interviews:

“First, Acquisition: To acquire a customer is to have him or her signed up to one’s products and services. Acquired customers are first- time account holders of bank account. Acquisition in simple terms refers to the number of customers a bank has who may be new”.

“If you ask about loyalty and retention it can be said, it is being able to nurture a client from the point of having become a first-time customer to the point where such a customer has become an advocate for your products and services. By this time, the customer now an advocate would have truly experienced the bank well enough to be able to refer others also to patronize your products and services. Loyalty and retention do not come without dint of hard work. It takes very consistent, effective and efficient customer relationship management to achieve these benefits. Let me end by saying that loyalty and retention is all about hooking customers to your products and services so long as you exist as a bank over a considerable long period of time.”

“Profit means making returns on one’s investment. As the meaning of profit suggests, it implies that one cannot expect any gain when nothing is invested. Banks must make conscious efforts to invest in customer service issues, software for managing banking operations especially customers must be the state-of- the- art type that gives every necessary data on every single customer at the click of a button.

In earlier interview with you it was mentioned that profit should and must be the end product of quality satisfactory service”

“Customer satisfaction is best defined by the customer and not by the banks. This variable to the customer is like reaching the crescendo of everything. If you ask the customer she or he would tell you the secret is “quality service”. Service quality you know stems from the multiplicity of factors, which CRM is no exception”.

From the quantitative data collected, twenty (20) percent of relationship officers nevertheless were undecided on “profitability” as an expected benefit of CRM. This made the researcher go further to conduct exclusive interview again to probe further why some relationship officers would neither agree nor disagree to profitability as expected benefits of CRM.

In my exclusive interview with one customer relationship officer, the research study discovered that their choice was purely a matter of personal philosophy. She says, “You may or may not need customer service to “acquire” a customer or make “profit” on investment. You know customers cannot do without the banks and as a result, they would always troop in here for our products and services and guess what follows – profit”.

Results, Discussion and Conclusion

The major rationale of the study was to research into “A Purpose-driven CRM, its Strategies and expected Benefits to Ghanaian Banks”. A survey research design was used with questionnaire and interview as data collection tools. Ten (10) banks were involved in the sample. Respondents were relationship staff of sampled banks and data analysis was done using Microsoft 2007. The research questions that guided the study were; what a purpose-driven CRM is, its Strategies and expected Benefits to banks.

From the result of the study, the main driver of CRM according to Ghanaian Banks is the fundamental belief or philosophy that any good customer relationship management and for that matter, successful business, is hinged on the ability to render quality service that leads to a satisfactory customer and a sustainable relationship with the customer [46-51].

The outcome of this study is evidence of the fact that Customer Relationship Management (CRM) which is driven by;

➢ Service quality with effective and efficient strategies of customer identification, differentiation, interaction and customer personalization culminated into substantial customer base (customer acquisition), customer loyalty and retention, profitability and customer satisfaction within the Ghanaian banking industry.

The banks confirmed also that their CRM activities involve;

➢ People

➢ Processes and

➢ Technology as an enabler.

In life, things must be done with a purpose in mind. Anything done without a definite intent or purpose in life lacks direction, focus and may not last the test of time. In fact, understanding the purpose and strategies of CRM is very crucial and central to the organization in order to reap the returns [52,53].

Customer Relationship Management as the name suggests is all about people companies transact businesses with and how they are able to create, handle and improve the relationship that exist between them using technology as the enabler.

It was concluded from the findings that service quality and customer satisfaction are major determining CRM drivers in achieving customer loyalty and retention, profitability, as well as competitive advantage among Ghanaian Banks.

But in order to achieve customer satisfaction as per the research findings, it is also essential to acknowledge and foresee the needs of customers to be able to satisfy them. It is common knowledge, that those enterprises which are able to quickly understand, respond to and satisfy customers’ needs, make greater profits than those which fail to understand, respond to and satisfy them [54,55]. It is hence a wake-up call for Ghanaian Banks to grow and manage a strong and healthy customer relationship with all the clients and suppliers which they do business with.

As a matter of purpose, Ghanaian Banks must consider the CRM strategies discussed if they indeed would want to build and sustain lasting and beneficial relationship with their customers.

For it is only when CRM is founded on service quality as its main driver or purpose that all other variables would automatically and ultimately yield profit.

On the whole, the study reviewed and further confirmed to CRM practitioners and managers the extent to which Peppers [26] CRM strategies of customer identification, differentiation, interaction and personalization can amass benefits such as customer acquisition, loyalty and retention, profitability and customer satisfaction to banks.

References

- Heffernan T, O’Neill G, Travaglione T, Droulers M (2008) Relationship marketing: The impact of emotional intelligence and trust on bank performance. Int J Bank Mark 26: 183-199.

- Kuranchie FK (2010) The effect of customer relationship marketing on customer retention in the Ghanaian Banking Sector: A case study of Intercontinental Bank Ghana Limited. School of Management, Blekinge Institute of Technology, Ghana.

- Bolton RN (1998) A dynamic model of the duration of the customer’s relationship with a continuous service provider. Mark Sci 17: 45-66.

- Ndubisi NO (2004) Understanding the salience of cultural dimensions on relationship marketing, its underpinnings and aftermaths. Cross Cultural Management: An International Journal 11: 70-89.

- Becker JU, Greve G, Albers S (2009) The impact of technological and organizational implementation of CRM on customer acquisition, maintenance, and retention. Int J Res Mark 26: 207-215.

- Verma H (2012) Services Marketing: Text and Cases. Pearson.

- Peck H, Payne A, Christopher M, Clark M (2004) Relationship Marketing – Strategy and Implementation. Butterworth Heinemann, Burlington.

- Alejandra CA (2007) Customer Relationship Management (CRM) as an innovative element of direct marketing and its impact on market performance. a strategy to personalize market massification creating a change in the culture of management with the client: A focus to increase company profitability through the development of customer loyalty and knowledge. Int Bus & Econ Res J 6: 7-18.

- Anderson JL, Laura DJ, Ann EF (2007) Customer relationship management in retailing: A content analysis of retail trade journals. J Retailing Consum Serv 14: 394-399.

- Dzato RK (2007) Think Customer: Why Ghanaian Banks must compete on Customer Relationship Management: A view from Afar, GhanaWeb, Ghana.

- Mendoza LE, Marius A, Perez M, Griman AC (2007) Critical success factors for a customer relationship management strategy. Information and Software Technology 49: 913-945.

- Lovelock J, Wirtz J (2007) Services Marketing: People, Technology, Strategy. 6th edtn. Pearson International Edition.

- Barnes JG (2004) Secrets of customer relationship management. New York: McGraw-Hill, USA.

- Kotler P, Armstrong G (2004) Principles of Marketing. 10th Ed. New Jersey: Prentice-Hall. Englewood Cliffs.

- Curry J, Curry A (2000) The customer marketing method: How to implement and profit from customer relationship management. New York: The Free Press, Database Group, USA.

- Harrison T (2000) Financial Services Marketing, Harlow, Pearson, UK.

- Stone M, Woodcock N, Macthynger L (2000) Customer Marketing: Get to Know Your Customers and Win Their Loyalty. 2nd edtn. Great Britain Clays Ltd: 85-98.

- Injazz JC, Karen P (2003) Understanding customer relationship management (CRM), People, process and technology. Bus Proc Manag J 9: 672-688.

- Fox T, Stead S (2001) Customer relationship management: Delivering the benefits. White Paper, CRM (UK) and SECOR Consulting, New Malden.

- Benjamin AK, Andrews KD (2010) A conceptual framework. Afr J Mark Manag 1: 37-43.

- Kubi BA, Doku AK (2010) Towards a successful customer relationship management: A conceptual framework. Afr J Mark Manag 2: 37-43.

- Lanza G, Ude J (2010) Multidimensional evaluation of value added networks. CIRP Ann Manuf Technol 59: 489-492.

- Xu M, Walton J (2005) Gaining customer knowledge through analytical CRM. Industrial Management & Data Systems 105: 955-971.

- Keith AR, Jones E (2008) Customer relationship management: Finding value drivers. Ind Mark Manag 37: 120-130.

- Lemon KN, Roland TR, Zeithaml VA (2001) What drives customer equity. Mark Manag 10: 20-25.

- Peppers D, Rogers M (2004) Managing Customer Relationships: A Strategic Framework. Hoboken, New Jersey, John Wiley & Sons, USA.

- Raymond PF (1999) Wiring and growing the technology of international services marketing. J Serv Mark 13: 311-318.

- Johnston R (1999) Service operations management: Return to roots. Int J Oper Product Manag 19: 104-124.

- Berkowitz (2006) Customer Relationship Management. 8 Common goals for a CRM Program. What are Key Drivers of Customer Satisfaction?

- Lasshof B (2006) Productivity of services. Participation and influence.

- Rai A, Sambamurthy V (2006) Editorial notes: The growth of interest in service management: Opportunities for information systems scholars. Information Systems Research 17: 327-331.

- Richardo C (2006) Methodology for customer relationship management. J Systems and Software 79: 1015-1024.

- Aaker DA (1991) Managing Brand Equity: Capitalizing on the Value of a Brand Name. New York: The Free Press, USA.

- McKenna R (1991) Relationship Marketing: Successful Strategies for the Age of the Customers. Addison-Wesley Pub. Co.

- Newell F (2003) Why CRM Doesn’t Work: How to Win by Letting Customers Manage the Relationship. Bloomberg Press, New Jersey, USA.

- Chen IJ, Popovich K (2003) Understanding customer relationship management (CRM): People, process and technology. Bus Proc Manag J 9: 672-688.

- Kim J, Suh E, Hwang H (2003) A model for evaluating the effectiveness of CRM using the balanced scorecard. J Interactive Mark 17: 5-19.

- Ragins EJ, Greco AJ (2003) Customer Relationship management and e-Business: More than a software solution. Review of Business 1: 25-30.

- Atul P, Jagdish NS (2001) Customer relationship management: Emerging practice, process, and discipline. J Econ Soc Res 3: 1-34.

- Hoyer WD, MacInnis DJ (2001) Consumer Behaviour. 2nd edtn, Boston, Houghton Mifflin Company.

- Swift R (2001) Accelerating Customer Relationship using CRM and Relationship Technologies. New York: Prentice Hall Inc, USA.

- George KA, Emmanuel A, Christiana B, Rachel KK (2011) The impact of effective customer relationship management (CRM) on repurchase: A case study of (GOLDEN TULIP) hotel (ACCRA-GHANA). Afr J Mark Manag 4: 17-29.

- Gordon IH (1998) Relationship Marketing: New strategies, Techniques and Technologies to win customers you want and keep them forever. John Wiley and Sons, Canada.

- Grönroos C (1997) Value-driven relational marketing: From products to resources and competencies. J Mark Manag 13: 407-420.

- Gummesson E (1994) Service Management: An Evaluation and the Future. Int J Serv Ind manag 5: 77-96.

- Johnston R (2005) Service operations management: From the roots up. Int J Oper Product Manag 25: 1298-1308.

- Saphye A, Wilson O (2014) The influences of e-CRM on customer satisfaction and loyalty in the UK mobile industry. J Appl Bus Finance Res 3: 47-54.

- Journal of Economic and Social Research 3: 1-34

- Khaligh AA, Miremadi A, Aminilari M (2012) The impact of eCRM on loyalty and retention of customers in Iranian telecommunication sector. Int J Bus Manag 7: 150-162.

- Leader for Change across the Corporation. Marketing Management 10.

- McDonald M, Payne A (2005) Marketing Plans for Service Businesses. Oxford, Elsevier.

- Patrick A, Amer I (2005) Objectives, Strategies and Expected Benefits of CRM.

- Payne A, Frow P (2005) A strategic framework for customer relationship management. J Mark 69: 167-176.

- Storbacka K, Strandvik T, Grönroos C (1994) Managing customer relationships for profit: The dynamics of relationship quality. International Journal of Service Industry Management 5: 21-38.

- Velnampy T, Sivesan S (2012) Determinants of customer relationship marketing of mobile services providers in Sri Lanka: An application of exploratory factor analysis. Industrial Engineering Letters 2: 10-15.

Spanish

Spanish  Chinese

Chinese  Russian

Russian  German

German  French

French  Japanese

Japanese  Portuguese

Portuguese  Hindi

Hindi