Market Analysis, J Polym Sci Appl Vol: 3 Issue: 2

Market Analysis on Recycling and Waste Management

Daniele De Wrachien

Retired Professor University of Milan, Italy, E-mail: daniele.dewrachien@unimi.it

Keywords: Biodegradable materials

Scope and Importance:

Efficient recycling technology is becoming increasingly more important and it is estimated that the worldwide recycling equipment and machinery market will exceed US$ 1.2 billion (EUR 1.05 billion) by 2025. Baler presses will dominate the machinery landscape with a 30% share in the overall recycling equipment and machinery market, according to the report. Analysts anticipate that metal baling will record a compound annual growth rate of 5.7% over 2018-2025, with a target revenue of US$ 390 million by 2025.

Meanwhile, the plastic recycling equipment and machinery sector is expected to witness ‘significant gains’ over the coming eight years. This niche market will see a year-on-year growth rate of 6.3% during the 2018-2025 periods, with target revenue of US$ 470 million by 2025. The study points out that an estimated 7.7 billion tonnes of plastic is manufactured across the globe every year; out of which 5.4 billion tonnes is not recycled.

The Asia Pacific region’s market is forecast to exceed US$ 450 million by 2025, with China as a major revenue earner. PET bottle recycling generally encompasses the procedures of waste collection, sorting, shredding, and molding. Market Research Future (MRFR) indicates a CAGR of 5.28% in the global PET bottle recycling market over the forecast period of 2018-2023. The global PET bottle recycling market was valued at USD 4,381.3 Mn in 2017 and is due to reach USD 5,933.6 Mn by the end of 2023.

Industrial waste management is a method of utilizing a diverse set of mechanical and chemical processing practices on the industrial wastes to diminish their hazard potential. Industrial waste management is critically important for the conservation of the environment, protection of human health, and for restoring the capacities of functioning units in manufacturing plants. Moreover, industrial wastes account for around 50% share of the overall waste generated globally. Industrial waste is the most hazardous waste type, as it comprises various hazardous impurities, such as industrial chemicals, toxic metal particles, grease, oils, raw material residuals, dirt, gravel, masonry, concrete, scrap metals, solvents, scrap lumber, and even vegetable matter from restaurants.

Rapid industrialization is the major factor driving the industrial waste management market globally. Elevated industrial output has inherently increased the volumes of industrial wastes generated, which has further stimulated the industrial waste management market growth. Furthermore, industrial waste management is effective in waste recycling that can be used for core industrial applications or any other productive purposes, which results in improvised cost-efficiency of industrial operations. Enhanced environmental awareness is also fuelling the industrial waste management market development. Moreover, industrial waste causes long-term degradation of natural resources, which has led to stringent norms and regulations set by international regulatory bodies, national governments, and local authorities for mandatory, safe, and careful industrial waste management. However, low awareness, an insufficient supply of capital, and ineffective inspection and monitoring of industrial waste management in developing nations may hamper this global market.

The industrial waste management market is segmented on the basis of service, waste type, type, and end-user. By service, the industrial waste management market includes incineration, landfill, collection, and recycling. The collection segment held the largest share, more than 50%, of the global market in 2018 and is estimated to dominate the market in the future as well. According to waste type, the global market includes manufacturing, energy, agriculture, nuclear, power plant, oil and gas, construction and demolition, chemical, mining, and others. Manufacturing waste held the largest share of the global market in 2018. By type, the industrial waste management market includes non-hazardous and hazardous waste. In 2018, the non-hazardous waste dominated the global market and will hold its position in the global market in the years ahead as well.

North America held the second-largest share of the industrial waste management market in 2018 globally. This region is historically known for the presence of several well-established industries, such as oil and gas, automobile, pharmaceuticals, nuclear power plant, mining, and food and beverages. The flourishing industrial sector in the region has contributed to the region’s formidable position in the global landscape. Moreover, North America is characterized by enhanced environmental awareness, easy access to required capital, superior technical knowledge, and competent workforce required for industrial waste management.

Europe accounted for the third-largest share of the industrial waste management market in 2018 globally. Europe has enacted stringent guidelines and regulations for industrial waste management. The UK, France, Germany, and Italy hold major shares of this regional market. Many key players of the industrial waste management market, such as Mid UK Recycling, Hulsey Environmental Services, and Russell Reid Waste Management, are headquartered in Europe.

The Middle East and Africa is expected to register significant growth in the industrial waste management market in the future. The region is historically a key supplier of petroleum products globally. With the increased production of crude oil, the region is expected to show notable growth in the industrial waste management market. Latin America is expected to grow modestly in this global market, owing to low environmental awareness and the lack of capital and technical knowledge.Some major players of the industrial waste management market are Stericycle, Waste Management, Sembcorp Industries, Veolia, Suez, Reclay Group, Daiseki, Enviroserv Waste Management, Clean Harbors, WeatherSolve Structures, Summit Equipment, and Superior Water Screen.

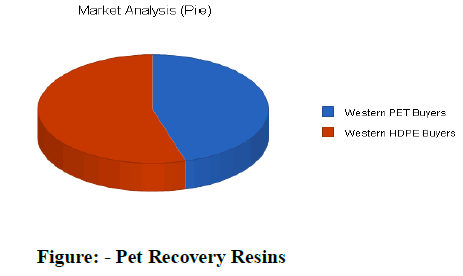

PET leads the recycled recovered resins as the most visible and valuable, and its use is increasing. Of the total 3.7 billion pounds of PET consumed in 1997, just 16% was from recycled sources. Of the more than 90 billion pounds of plastics produced annually in the United States, less than 5% is from recycled sources. Plastics, after aluminium, represent the second highest value material in the waste stream and have the highest projected growth rate.

Spanish

Spanish  Chinese

Chinese  Russian

Russian  German

German  French

French  Japanese

Japanese  Portuguese

Portuguese  Hindi

Hindi