Research Article, Res J Econ Vol: 2 Issue: 3

The Regional Economic Environment And Cash Flows Of The Industrial Sector For The Department Of Risaralda Colombia

Gabriel Eduardo Escobar Arias1, Jairo Carmona Grajales1, Jairo Toro Díaz1*, Isabel Redondo Ramírez2 and Carlos Andrés Díaz Restrepo3

1Research Group in Entrepreneurship, Member of the Accounting and Finance line, Universidad Autónoma de Manizales, Colombia

2Catholic University of Pereira, Specialist in Pedagogy and University Teaching, Universidad La Gran Colombia, MBA Student in Business Administration, Autonomous University of Manizales, Manizales, Colombia

3Universidad Cooperativa de Colombia Sede Pereira, Manizales, Colombia

*Corresponding Author : Jairo Toro Díaz

Tripura University, Department of Forestry and Biodiversity, Suryamaninagar, Agartala- 799 022, India

Tel: +91- 8974236218

E-mail: tselvan@tripurauniv.in

Received: July 26, 2018 Accepted: August 22, 2018 Published: August 29, 2018

Citation: Arias GEE, Grajales JC, Diaz JT, Ramírez IR, Restrepo CAD (2018) The Regional Economic Environment and Cash Flows of the Industrial Sector for the Department of Risaralda, Colombia. Res J Econ 2:3.

Abstract

Objective: To establish the relationship between the cash flows of the Risaralda of Colombian companies of the industrial sector that reported financial statements to the Superintendency of Companies during the period 2002-2011 and the regional gross domestic product (GDP). Methodology: The investigation was carried out in a first phase, debugging the cash flow accounts of financing, investment, operation, and total cash flow of the databases obtained from the superintendence of companies, from a purely documentary and descriptive perspective, in a second instance, establish possible correlations with the time series of the economic variables described above, by applying correlation indexes and regression models using statistical packages such as SPSS and computer tools such as Excel. Results: No significant correlation was found between the cash flows with the regional economic growth represented by the GDP, although the industrial sector continues to contribute to GDP, it has been displaced by sectors such as services and trade as architects of growth. Conclusions: the cash flows presented very low correlations of significance with the variables of the regional economic environment; likewise, the net cash flows showed variations that generated resources related to the liquidity of the companies.

Keywords: Cash flows; Economic variables; Financial indexes; Industrial sector of Risaralda

Introduction

The article makes an approach to the financial reality of the companies of the coffee axis, the business group of the Autonomous University of Manizales (Colombia), develops a study of the cash flows of some companies in the department of Risaralda in the industrial sector during the period 2002-2011, specifically in its operating, financing and investment cash flows, and determine possible relationships with the regional economic environment during the same observation years, said environment represented by economic variables such as the Gross Domestic Product (GDP), the unemployment rate, financial indexes such as the Consumer Price Index (CPI), the Market Representative Rate (TRM) and the Fixed Term Deposit (DTF).

This study is a continuation of the research processes developed within the Entrepreneurial Group of the UAM® (Colombia) and that continue with a description of the financial reality of the companies in the region, for which a study was made of the cash flows of some companies of the department of Caldas for the commercial, industrial, services and agricultural sectors, during the period 2002-2010 in their operation, financing and investment structures and their relationship with some macroeconomic variables was determined during the same period of time, for previous work was also based on the information of the companies of Caldas and the economic sectors supplied by the Superintendence of Companies.

On this research, it was demonstrated that by relating the net cash flows of the industrial sector with the regional gross domestic product, this correlation showed insignificant results, demonstrating that this sector is not a great contributor to the development of this macroeconomic indicator, additionally according to the report of the economic regional situation of Caldas of 2002, it was not consolidated during the beginning of the decade an outstanding growth of this sector influenced by the low dynamics both the external sector and the coffee; taking into account that this product was the great driver of the regional economy for several decades and that it still continues to be a great contributor to the growth of the región.

For the study of cash flows and their possible relationships with regional macro-economic variables, we must take into account the importance that these flows have for finance, being important information for making business decisions such as those mentioned by Solomon et al. [1]. Decisions on financing, operation, investment and payment of dividends, decisions focused on the creation of value and permanence of the company in the market.

Methodology

According to the report of funds, liquidity and financial flexibility, in some countries the economic environments where companies operate are marked by high interest rates in the market and this means that companies reveal high levels of profits and low cash levels, which generates a concern for the usefulness and real analysis of the information from the financial statements. For this reason, the presentation of cash flows as an additional financial statement to improve the analysis of the information generated by the accounting was implemented in Colombia starting in the 1980s. In these cash flows, the operating, financing and investment activities were differentiated, in order to formulate and forecast the cash results and thus complement the information presented in other financial statements, such as the balance sheet, the statement of income and changes in equity.

The cash flows among other applications, determine where the resources came from and where there are used and are the fundamental basis for determining the liquidity and growth of the company, as well as the value of the organization and the investment long and short term decisions. Also from these is that financial institutions make the decision to grant monetary resources to companies for their investment and operation; therefore, cash flows became more of a managerial tool than a simple financial statement that yields accounting information and to the extent that the result of these can be related to the economic environment, the decisions made there they will have a greater basis to try to determine the path that the company should take according to the relationships presented by the different cash flows with the environment in which the organization operates. In accordance with the previous approaches, the following problem arose:

Is there a significant relationship between the cash flows of companies in the industrial sector of the Department of Risaralda (Colombia) that reported financial statements to the superintendency of companies during the period 2002-2011 and the behavior of the variables of the regional economic environment during the same periods of time.

To answer the previous research question, the following objectives were proposed: General objective was proposed: Establish the relationship between the cash flows of Risaralda (Colombia) companies in the industrial sector that reported financial statements to the Superintendence of Companies during the period 2002-2011 and the regional gross domestic product (GDP). Among the scope of the study, the possible relationships between the variables regional gross domestic product (GDP), Unemployment Rate (TD), Fixed-term deposit rate (DTF). The consumer price index (CPI) were searched.

The representative market rate (TRM) with the change in cash flows of companies in the industrial sector of Risaralda that reported to the Superintendency of Companies in the period 2002-2011, in the same way determine if the companies in the sector were generating positive or negative results in their cash flows generated from the main activity or other activities as well as establishing whether or not they were profitable in the analysis period.

Once the scope of the study is considered, two essential concepts are addressed to understand the central research topic: cash flows and economic environment.

Cash flows

the preparation of certain financial statements for the evaluation and functioning of organizations is of real importance and the cash flow statement is one of them, which provides information to the financial analyst to know the origins and applications of the financial resources within the organization, which is also used to forecast the future funds of the medium and long term, unlike the preparation of the cash budget that allows to establish the forecast of short-term resources, Gitman et al. [2] Finances, apart from being a result of the short term, are also long term and financial planning is a fundamental tool for this process, since as the author García et al. [3] points out, the companies for the fulfillment of the basic financial objective, the which is a long-term concept, these must remain and grow. This is why the cash flow statement is a fundamental tool for making long-term decisions within organizations.

For Weston et al. [4] The commission on financial accounting principles formulated the need to build a financial statement that would improve the information provided by the basic financial statements such as the balance sheet and the income statement, cash flows, which was a mandatory presentation for companies as of 1987. Cash flows are presented in three categories, which are the cash flow of operating activities, investment activities, and cash flow activities. This adoption was made as it is of vital importance for employers to determine if the main activity to which the company is engaged is generating cash or otherwise it is necessary to make an injection of resources so that the company can operate normally without setbacks.

Cash flow has become a key tool for making business decisions, as it explains where the money movements that are made within the company's key activities come from, as well as alternative activities.

Cash flows are divided into three: Cash flow from operations, financing activities and investment activities, which when added together result in the Total Cash Flow.

Cash Flow of Operations is understood as the inflows and outflows of cash for exercising the main activity of the business, that is, product of the manufacture and sale of some goods or for the commercialization or provision of a service. The Cash Flow of the Investments shows the entry and exit of monetary resources product of different investment activities different to the main activity, an example of this, could be the interest of the bank deposits through different financial products. The Cash Flow of Financing shows the inflows and outflows of monetary resources that are given to the interior of the organization by third parties and their owners or shareholders.

The calculation of the cash flows can be done through the construction of the EFAF (State of Sources and Applications of Funds) financial statement that shows where the monetary resources are in the organization and what was the use that was given to each one of these resources, in order to determine the direction that each of the monies is given, whether they were destined to their main activity, in the financing activities or in the investment activities. In the EFAF, different consecutive financial statements (Balance Sheet and Income Statement) are compared in order to know the source and use of resources.

A company can obtain resources with capital contributions from the owners, with external credits, with sale of fixed assets, with the issuance of shares and through the Internal Generation of Funds (GIF) that refers to resources generated within the company. The organization to exercise the main activity of the business and other alternative activities such as financing and investments. All the above items are called funds, understood by these, those economic resources that the company has or expects to obtain for the normal operation of this.

The establishment of the future cash flows of the companies is based on the internal information of the same that is, making use of basic elements of the financial statements such as income, working capital, investments, among others.

Once the concepts on cash flows are understood, these are not only determined by intrinsic variables of the company but also influenced by the regional, sectorial and country environment where the same is performed, for which it is necessary to carry out a review of the environment economic and the variables that compose it.

Economic Environment: the term "GDP" was introduced to the world by the economist Simon Kuznets researcher focused on the analysis of economic cycles and quantitative studies. For the author Dornbusch (1994) the gross domestic product (GDP) "is the value of all final goods and services produced by a country in a given period". To the extent that an economy produces, housing, discs, vehicles, machinery, clothing, hairdressing services, health, education, etc. Like Delong et al. [5], who also addresses the term described above.

The GDP depends on variables such as consumption, investments and the external sector mainly, that is to say, that according to the result or performance of these variables depends the increase or decrease of the GDP. Consumption is mainly composed of the demand for goods and services by domestic economies which acquire all kinds of products and services such as food, education, public services, transportation, housing, etc. This consumption is given according to the ability of the inhabitants of a country to acquire these goods and services; this capacity is determined mainly by the income of families and the level of inflation of the economies.

Investment can be defined as "the increase of the capacity of the economy to produce in the future" Fisher et al. [6]. This investment is fundamental, since it is what generates the resources for the future and companies also make investments to increase their income in the long term.

This item is fundamental within economies, since it is the main variable that guarantees economic growth in the long term, consumption contributes to GDP growth, but only in the short term since this type of expenditure does not produce returns or that we commonly know as profitability, while the investment is the guarantee for the achievement of income in the long term by the economies.

Net exports, which are the result of exports less imports, are also a fundamental variable to increase the value of GDP, to the extent that the goods and services that are produced within the economy and are consumed in other countries. This increases the internal production, which makes the income for the economy increase.

Solow et al. [7] presents an initial basic model, which indicates that GDP is equal to a productivity parameter multiplied by the amount of capital and number of workers in the economy. And as capital increases with a constant level of workers, an increase in GDP will result. The model demonstrates how in those economies where there is a good level of savings and investment, GDP grows in a greater proportion than in those economies where the level of investment is very low.

Antúnez et al. [8] shows another relevant growth model, which is raised by in his theory, states that the growth rate of an economy has a positive relationship with the manufacturing sector, thus being considered the engine of growth [9]. Kaldor also focused on the role of saving in the economy, stating that the rate of profit that a society has depends on the propensity to save compared to the income level.

The growth model proposed by Kaldor defended the theory that said that those regions belonging to a country where the free movement of productive factors prevails, restrictions at the level of demand tend to curb economic expansion. The problem of economic growth is largely related to the efficient provision of a fairly broad set of public goods, that is, in this growth model the main difficulty for the development of a region is not the few incentives, on the contrary, the shortage of resources.

Growth models such as Kaldor attempt to explain the differences in the economic cycles of a country. Economic cycles are defined as increases and decreases, that is, fluctuations that occur recurrently in global economic activity, within a given period. The phases of the cycles do not appear in the same way since their intensity, duration or behavior vary and can have ascending and descending phases.

It can be concluded that the models of economic growth are used constantly in the economic daily life and are related in an important way to the problems that occur directly in the regional economies and within the companies. Macroeconomics suggests that a balanced and well functioning economy seeks to fulfill certain objectives which aim to generate a high level and rapid growth of production, this is achieved through the improvement of productivity and growth of regional companies managing to increase revenues and the amount of goods and services needed Ríos y Sierra et al. [10]. We know that economic growth in a country is measured by the behavior of national production, we observe how companies manage to generate an impact on GDP growth and this is mainly due to the internal strengthening they have, productivity and the situation of the cash flows.

This study is important because it will benefit the industrial sector of the department of Risaralda, given an analysis and correlation of cash flows will be implemented with the macroeconomic variables previously described. Entrepreneurs will be able to adopt the recommendations of the study and will be able to make financial decisions to improving their competitiveness, because they can use of the information extracted and the results of the study.

It is important to highlight that this study is also novel, to the extent that entrepreneurs can make use of the information provided by this study to facilitate the decision-making process within their organizations, since it is expected depending on the same results, that entrepreneurs according to the trends that macroeconomic variables can take, align their policies in order that the cash flows really relate to the economic environment in which the company or the sector is located and thus optimize a little plus the use of resources.

This was a documentary research, it was based on the financial reports and cash flows reported by companies to Superintendecia de Sociedades de Colombia during the years 2002-2011, also the research is descriptive and correlational, they were identified the operations of cash flows, financing and investmen, and correlated with the different economic variables of Risaralda such as GDP, Unemployment Rate and CPI, interest rate (DTF) and Exchange Rate (TRM), identifying on each year the increases or decreases that cash flows may present and their relation to the behavior of the economy for the same periods. These correlations were direct or inverse, direct when the results of the correlation coefficient was positive, the cash flows increases in the same way whit the macroeconomic variables under study and inverse when the results of the negative correlation coefficient, the cash flows increase and the macroeconomic variables studied decrease or viceversa. It is considered a documentary research because the primary sources of information were extracted from the Supersociedades, Banco de la República, Bolsa de Valores and Dane, among others.

For the development of the study, reference was made to the time series of the financial statements of the companies that, having reported to the supersociety, did so in a continuous manner during the periods under study, of which only twelve companies in the industrial sector of the Risaralda Department met the inclusion criteria.

The time series of the financial statements were taken from the Sirem (information and business registration system), in which period by period are the financial statements, such as the income statement, the balance sheet and the cash flows. For the processing of the information, we worked with the Microsoft Excel computer tool and the SPSS statistical package.

Results

Next, the data and results are presented based on which the different relationships between the variables proposed in the study were established (Table 1).

| Data for correlation Industrial sector Risaralda | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| YEAR | GDP Industrial Sector Risaralda thousands of millions of weights |

Taoa I'm happy Risaralda |

IGBC Variation Annual (NATIONAL) |

DTF Average annual (NATIONAL) |

Placement Rate average (NATIONAL) |

Colombian peso exchange rate (NATIONAL) | Index of Prices at Consumer |

Average of flow of net Cash in activities of Operation |

Average of Flow of Net Cash in Activities of inversion |

Average of Flow of Net Cash in Activities Financial |

Flow of Net Cash Total |

| No. | PIB | TD | IGBC | DTF | TC | TRiM | IPC | FENO | FENI | FEF | FENT |

| 2002 | 549.000.000.000 | 16,27% | 22,10% | 9,03% | 14, 11% | $ 2 .506,55 | 6,68% | 374.760.667 | 1.130.878.250 | 1.045.853.417 | 289.735.833 |

| 2003 | 574.000.000.000 | 16,15% | 45,07% | 7,79% | 12,81% | $ 2 .875,91 | 6,71% | 2 .122 .571.417 | 2 .514.645.917 | 641.287.250 | 249 .2 12 .750 |

| 2004 | 721.000.000.000 | 15,96% | 86,22% | 7,89% | 13,07% | $ 2 .628,47 | 5,53% | 1.844.857.083 | 113.519.917 | 1.919.369.333 | 39.007.667 |

| 2005 | 795.000.000.000 | 14,21% | 118,91% | 7,07% | 12,58% | $ 2 .32 1,49 | 4,46% | 5.602 .147.417 | 3.995.044.750 | 1.110.648.917 | 496.453.750 |

| 2006 | 866.000.000.000 | 12,62% | 17,32% | 6,25% | 11,51% | $ 2 .358,96 | 5,60% | 3.961.534.000 | 3.538.601.500 | 692 .332 .417 | 1.115.264.917 |

| 2007 | 866.000.000.000 | 11,91% | -4, 18% | 7,94% | 14,32% | $ 2 .076,24 | 5,77% | 3.587.105.500 | 3.710.913.083 | 400.539.583 | 524.347 .167 |

| 2008 | 965.000.000.000 | 12,58% | -29,30% | 9,68% | 16,36% | $ 1.967,11 | 7,20% | 1. S85.194.083 | 664.326.500 | 1.154.299.417 | 66.568.167 |

| 2009 | 1.077.000.000.000 | 17,71% | 53,45% | 6,33% | 12,49% | $ 2 .153,30 | 1,77% | 5.269.804.167 | 3.360.775.167 | 428.971.083 | 2 .338.000.083 |

| 2010 | 1.114.000.000.000 | 18,25% | 33,57% | 3,68% | 8,84% | $ 1.898,68 | 2,84% | 5.007.617.167 | 1.278.659.500 | 899 .508.250 | 5.386.768.417 |

| 2011 | 1.209.000.000.000 | 14,90% | - 18,27% | 4,13% | 10,86% | $ 1.846,97 | 3,74% | 74.958.250 | 2 .349 .508.000 | 883.570.917 | 1.390.978.833 |

Table 1: Data for Industrial Sector Correlation, Source: Own Elaboration with data provided by SuperSociedades, DANE, Bank of the Republic, Colombian Stock Exchange.

Initially, the results of the relations between GDP and other macroeconomic variables were analyzed, starting with the relationship between GDP and DTF, showing a value of r=-0.693 **. The variables analyzed have an inverse relation to each other. In the study there is no relationship between GDP (Gross domestic product) and DTF (fixed term deposit). This is because the GDP (Gross Domestic Product) regional and the DTF (fixed term deposit) a National indicator.

The value resulting from the correlation between GDP and TRM was r=-0.889 ** Negative value. The correlation between the variables is very significant and an inverse relationship is shown. Among the variables studied there is a close relationship between exports and imports of the industrial sector of Risaralda, therefore, as the TRM decreases (market representative rate) there may be greater investment in machinery and goods that allow a better production at lower cost generating better prices to the final consumer. The profitability of companies is affected by variations in the exchange rate. There are random effects that show that the exchange rate does affect profitability. The exchange rate affects the functioning of the economy by several means, one of which is domestic trade. This occurs because the companies that focus their activities on the international market depend to a large extent on the fluctuations of the exchange rate.

The correlation between GDP and CPI showed a value of r=-0.700 showing an inverse relationship, if GDP (Gross Domestic Product) increases the CPI (Consumer Price Index) it tends to fall. According to studies carried out within the economic theory, inflation has a negative effect on economic growth, which means that monetary policy focuses on achieving a low level of inflation that does not disturb the economy. For its part, GDP and TD showed a correlation of r=0.063, which showed that the two variables have a direct relationship with very little significance. This relationship shows us that as productivity increases in the department, unemployment increases. This may be evidence that the department is not having growth and development processes that can translate into a decrease in the unemployment rate.

Correlations between cash flows and macroeconomic variables showed that GDP and FENO showed a result of r=0.299 being a direct relation between both variables, but the statistical significance is low showing that the sector is not a big contributor to the generation of income, its contribution to GDP is very low. If the companies in the region are not being strong in operating activities, this will not be reflected in the economy and the GDP of the region will not increase. The value found between the GDP and the FENI was r=0.079 Positive value, direct relation. The little significance that is evident among the variables shows us that there is little investment in the financial system, therefore it contributes little to GDP. Although the investment activities within companies are considered fundamental for its operation, the correlation obtained shows that in the companies of the region these operations are not strengthened and has a minimum contribution to the GDP growth of the region.

On the other hand, the GDP and the FEF correlation is r=-0.325, being an Inverse relationship and a low one in significance, which evidences the little relation that exists between the GDP and the financing activities, which shows that the industrial sector of the region thus invests financial resources for its growth, these will not affect the GDP according to the study carried out. The correlation between FENO and TD was r=0.015, showing a direct relationship and a very low significance. This indicates that there is a direct relationship. To the extent that the net operating cash flow increases, unemployment can increase. Although there is a direct relationship between the variables, there is almost an absence of relationship between the variables, this is due to the fact that the companies in the region are not strengthened in operating activities and fail to generate an impact on the unemployment rate and that this translates into economic growth, that is, an increase in GDP.

Likewise, in the correlations between the FENO and the DTF, the result was r=-0.30, 1 showing an inverse relationship and with a very high level of significance. It is logical what happens in this relationship given that, if interest rates fall, the operating results of the organization tend to increase. For its part, FENO and TRM had a found value of r=-0.295, that is, they have an inverse relationship but this value is low and shows that the very low significance that these two variables do not have a high degree of correlation and the TRM is not having a direct effect on net cash flows in operating activities; while the income of the industrial sector is related to alternative markets and not only to the local one.

The FENO and the CPI showed a correlation of r=-0.475, which shows that the CPI tends to have an inverse influence on the industry's operation. On the other hand, the FENI and the TD presented a correlation of r=0.474, a direct relationship that indicates that the contribution of the net cash flows of investment to the unemployment rate is low, taking into account that for this relationship to be optimal its result must be at least 0.75. The investment activities carried out by the region's company in the capital market is contributing to the growth of the department's employment, this may be due to the fact that investments of a temporary nature and of an indirect type have been increasing and are being carried out in a successful because the investment is in a process of attraction in the department.

The FENI and the DTF presented a value of r=-0.095, an inverse relation being a too low correlation and a very low level of significance. The value found in the correlation between FENI and the TRM was r=-0.122 showing inverse correlation, as the representative market rate decreases, incentives are generated for investment in foreign currency. The resulting correlation is not significant and reflects that the exchange rate is not having significant effects on investment activities within the companies of the department. As long as the exchange rate increases, a devaluation takes place and the activities within the companies will benefit, these moments of devaluation should be used by businessmen to strengthen their exports, diversify production.

The correlation between FENI and the CPI was of r=0.039, it is a direct relation and with very little significance between the variables, the investments made by the industry generate little reaction as the CPI grows. On the other hand, the correlation between the FEF and the TD was r=0.253, a direct relationship that shows that if it increases or decreases the financing cash this will help to increase the unemployment rate, but the level of significance is low and the impact is little.

The value found between the FEF and the DTF variables was r=0.026, which showed a direct and too low relation, evidencing that the DTF does not greatly influence the financing activities of the companies in the region. On the other hand, the correlation between the FEF and the TRM was r=0.532 **, a direct relationship and a representative correlation. It is necessary that as the TRM increases it is necessary to lower the debt in foreign currency and trade in local currency. Fluctuations in the exchange rate are benefiting the cash flows in financing activities, while the exchange rate increases that will result in an increase in financing activities in the companies of the department.

Finally, the correlation between the FEF and the CPI was r=0.085, with direct relation and little statistical significance, the financing activities have little relation with the variations of the consumer price index. The relationship of the variables is positive, showing how the financing activities benefit from the increases in inflation, but in a very small proportion, evidencing almost a possible independence in the correlation of the variables. Inflation will affect the value of the shares and the stock market in general.

Some authors like Solow et al. [7], uses capital and labor as main variables to explain economic growth; Romer et al. [11] shows how growth is driven by technological change which comes from the investment decisions made by the agents that want to maximize their benefits and Grossman et al. [12], demonstrate by using a product improvement model, as when research and development (R&D) is stimulated to new products, it leverages economic growth in some countries. This theoretical vacuum is motivating to establish a system that can explain this relationship from the existing theory.

The economic growth of a country is given more by the supply than the same demand, since the model is based on the level of production, as a fundamental variable that explains the growth, where this offer is linked to the goods and services that are offered in the economy of a country. And this offer will increase or decrease according to the level of production. To increase the level of production, investment in capital must be increased, which will necessarily lead to growth in the economy.

The fundamental variable that explains the economic growth of a country is investment in capital. According to the above concepts, as mentioned above, Solow et al. [7] highlights how investment in capital is the basis for generating economic growth in a country, and it is from this element that the relationship between cash flows and economic growth, since there is a fundamental link between these two variables, which is LIQUIDITY as shown below:

The cash flow mentioned by García et al. [3], shows the availability of resources available to a company to meet its financial obligations, make investments or distribute profits, therefore, the investment becomes a fundamental part of the flow of funds. Cash since this (cash flow), is that resources are generated for the development of this activity within the companies.

Both private and public investments generally require large outlays of money (liquidity) and often neither entrepreneurs nor governments have these to carry them out, this is why the financial system becomes part of this relationship, since this is the one in charge of channeling the sufficient monetary resources so that these are transferred to the investment.

The cash flow determines the necessary liquidity that can be carried to the investment, which in many cases the flow itself, does not contain the resources for the realization of the same and this is why businessmen turn to the financial system to get the necessary liquidity to be able to boost their investments, Levine et al. [13]. But for this to occur, companies must have sufficient liquidity or capacity to generate resources to be able to return these monies loaned to financial institutions at adequate interest rates in a prudent time (Figure 1).

The financial system injects liquidity to companies resources that are invested in capital accumulation and technological innovation which contribute to the growth of the economy. The cash flow in turn is liquidity that can be used for investment in capital accumulation and technological innovation, which, for the most part, require large amounts of monetary resources for this reason is that entrepreneurs are leveraged in the system financial support to carry them out. This is why financial institutions are a fundamental part of the economic growth of a Levine country [13].

Based on the reports of regional economic situation of Risaralda published by the DANE and the study showed how the industrial sector in the Department of Risaralda presents a constant growth keeping in agreement with the departmental and national average, this is how in 2004 in the Risaralda region generates a growth in its GDP, essentially the most representative sectors are: construction, trade, telecommunications, transport and the industrial sector. It is also found in the aforementioned report that GDP growth was succeeded by an increase in the levels of confidence of investors and consumers, thanks to the great supply and rapid growth of the world economy.

In Risaralda, the Industrial sector has grown steadily, but at very low rates, which does not allow an appropriate development, nor a high contribution to the GDP of the region. According to the Chamber of Commerce of Pereira in 2004, there was a decrease in the creation of establishments, motivated by the decline of the industrial sector, but in turn was offset by other activities especially trade and services.

According to the DANE in its report of the magazine Coyuntura Económica, in 2005 a very good level of investment was generated, a consumption given by the confidence of the buyers, low financial intervention rates, good performance of the commercial portfolio, which resulted in in a better performance of the industrial sector. The industry at the national level has grown very little, as an example we can say that the industry went from an average of 7% between 2006 and 2007 to be reduced in such a way that it reached 3.9% in 2009.

In 2007, according to the report of the regional situation of the Bank of the Republic, the manufacturing industry was one of the largest contributors to the National GDP; In turn, the industry was one of the largest contributors to exports made by the Department of Risaralda with a representation of 98.72%. Likewise, imports from the Region were 97.12% related to the industry, which are dedicated to the manufacture of transport equipment. In 2009, Risaralda participated with 1.3% of total exports at the national level, of which 95.8% corresponds to the contribution of the industrial sector with high influence of food products in its vast majority. According to the report on the industrial sector published by the National Department of National Planning, in 2010 the industrial sector showed some improvement, reaching a growth of 4.5%.

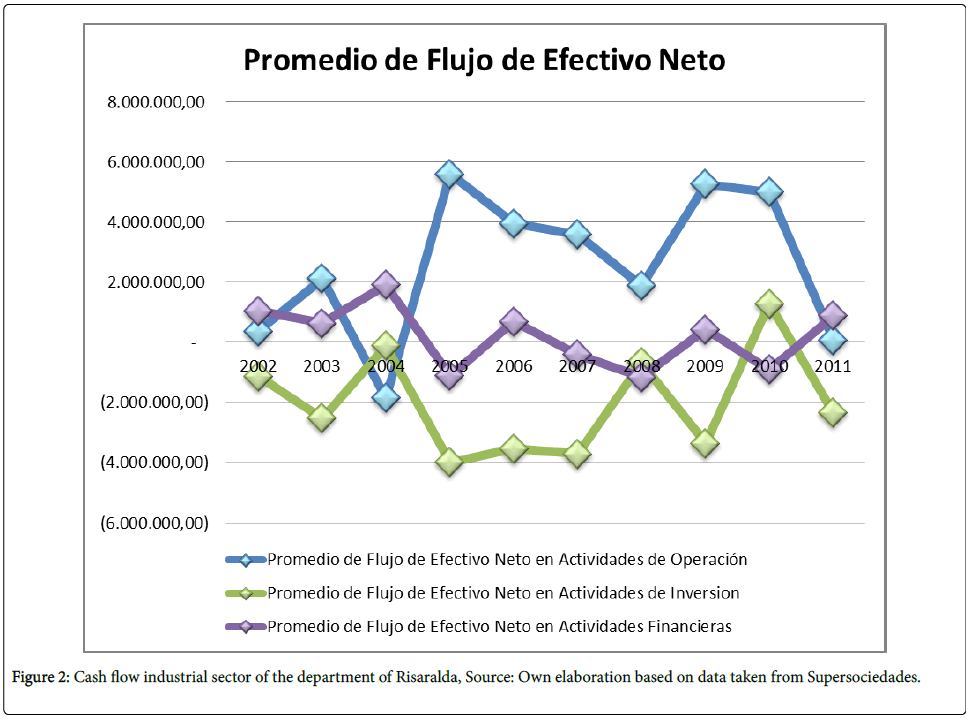

Although industrial activity in Risaralda has shown a good performance, this is not the main economic activity on the department, because according to the business census conducted by the Cámara de Comercio de Pereira, Risaralda's main economic activities are trade and commerce services and these are going to replace the industrial sector. This es the razon to seek and achieve greater growth of the industrial sector in the region, generating alliances between academia and the sector that facilitate the growth and increase competitiveness and innovation. Next, the graph in which the different cash flows are shown is shown (Figure 2).

The Net Cash Flow of Operation clearly shows the different ups and downs presented, in which its greatest growth was between 2004 and 2005, which coincides with the good performance of the Colombian economy of that time. And it presents its biggest collapse between 2010 and 2011 due to the economic slowdown in the country in which the most affected were the areas of industry and agriculture.

The Cash Flow of Investment, shows not very marked investments, which is not very affected by financial indexes and leaves in a good position to cover the cash levels and its operative and non-operative activities, thus avoiding recourse to financial means for indebtedness.

Discussion and Conclusion

In this section we presented the main deductions based on the results of how the industrial sector contributes to GDP, the behavior of the different cash flows, and the growth of the companies under study. All the above sustained based on authors who have referred to the subject studied.

The industrial sector, although contributing to GDP, is no longer the main architect for its displacement by sectors such as services, trade, according to the analyzes carried out by the Risaralda Chamber of Commerce, given that the investments in capital assets of the sector Industrial production has been drastically reduced, which does not allow sustained economic growth, as argued by Solow et al. [7]. In the analysis performed on the cash flows of the industrial sector, it could be seen that the net cash flows presented positive and negative variations, which generated resources related to liquidity. The total cash flow was positively influenced by the cash flow generated in the operations and the derivatives of the financing activities, while the cash flows from the investment activity had a negative impact. The foregoing can lead us to deduce that the industrial sector of Risaralda does generate resources through its operating activities, which continue to demonstrate that the sector is viable and can grow and mark the growth of the region, the foregoing supported by Kaldor et al. [9] in his theory. The net cash flow presented positive averages, explaining this, that the industry in the department of Risaralda resorted to loans to be able to finance its operating expenses and acquisition of assets for the operation, this could be deduced at the time the correlation was made Gross domestic product and financing cash flows. Now, if operating assets have the characteristics of investment goods, we must remember that the higher the demand for investment goods in the manufacturing sector, this would lead to greater savings in the sector, therefore, more liquidity will be generated, which will result in in a greater capacity of internal or external financing, ending in investment capacity thus leaving the economy to the future Fisher et al. [14].

Among the 12 companies in the industrial sector of Risaralda that were analyzed, there is a positive return, calculated at 8.29% average for the 2002-2011 cycle, which does not show that all companies are growing uniformly, but rather those that are growing faster they mark the average of the sector, since all are not profitable in their main activity.

References

- Solomon E (1972) Theorie of Financial Management. Dumond, Paris.

- Gitman JL (1978) Fundamentals of financial administration. Editorial Harla SA, Mexico.

- Garcia O (1999) Financial administration fundamentals and applications. Cali Colombia.

- Weston J, Copeland T (1995) Finance in administration. Mexico.

- Delong M, Hung M (2003) An empirical analysis of analyst's cash flow forecast. J Acc Econ 35: 73-100.

- Fisher R (1925) Stadistical methods for research workers. UK.

- Solow R (1956) A contribution to the theory of economic growth. Quarterly J Econ 70: 44-68

- Antúnez C (2009) Economic growth. USA.

- Kaldor, Nicholas (1976) Inflation and Recession in the World economy. The Econ J 1: 703-714

- Ríos M, Sierra H (2005) Readings on regional economic growth, Risaralda Popular Catholic University, Colombia.

- Romer P (1990) Endogenous technological change. The National Bureau Econ Res 98: 71-102.

- Grossman G, Helpman E (1991) Quality ladders in the theory of growth. The Rev Econ Studies 58: 43-61.

- Levine R (1997) Financial development and economic growth: Approaches and agenda. J Econ Literat 35: 688-726.

- Dornbusch R, Fischer S (1994) Macroeconomics. Madrid Spain

Spanish

Spanish  Chinese

Chinese  Russian

Russian  German

German  French

French  Japanese

Japanese  Portuguese

Portuguese  Hindi

Hindi