Research Article, Res J Econ Vol: 2 Issue: 1

Primary Commodity Export And Economic Growth Nexus: The Case Of Ghana

Erasmus L Owusu*

The Nielsen Company, Data Science Leader, United Kingdom

*Corresponding Author : Erasmus L Owusu

The Nielsen Company, Data Science Leader, United Kingdom

Tel: +859-525-7405

E-mail: erasmus.owusu@talk21.com

Received: December 07, 2017 Accepted: January 19, 2018 Published: January 26, 2018

Citation: Owusu EL (2018) Primary Commodity Export and Economic Growth Nexus: The Case of Ghana. Res J Econ 2:1.

Abstract

The paper empirically investigates the long term and causal relationship between real export revenue and non-export GDP in Ghana. In doing this, the paper employs the ARDL-bounds approach to co-integration and unrestricted error correction model (UECM). The paper finds that, there is negative relationship between real export revenue and non-export GDP and there is also bi-directional relationship between the two variables over the period under consideration. The paper concludes that, there is a possibility of “immiserizing growth” in Ghana. This requires implementation of policies of export diversification to make use of the abundance of labour in Ghana in order to derive the maximum impact from exports and hence, economic growth

Keywords: Economic growth; ARDL-Bounds testing approach; Ghana; Primary commodity exporter; Immiserizing growth

Introduction

Following the work instigated by the formulation of the Prebisch-Singer thesis in the late 1940s, there has been an abundant literature critical of the gains to be reaped from international trade by developing countries (DCs). The issue has received substantial attention in the studies of many development economists and international organisations in recent times. This is because, numerous studies are now available which demonstrate the distortions and harmful economic impacts resulting from policies undertaken as part of Import Substitution Industry (ISI) or inward-oriented strategies even though, vigorous industrial and overall economic growth may also occur. For some useful surveys and research summaries [1-4]. Indeed, these distortions and difficulties with ISI growth might be considered as the opportunity cost of growth and development. If economic growth through more export oriented policies were not feasible [5]. But the dramatic economic success of some countries pursuing export-oriented policies, along with the equally dramatic failures of some countries pursuing inward-oriented policies, have provided examples necessitating a re-examination of the role of exports in economic growth in DCs. In the economic literature, there is no general consensus regarding the impact of export on economic growth. Perhaps the hypothesis of widest interest is that, growth in real export tends to cause growth in real GDP. Another hypothesis based on macroeconomic models was put forward by Voivodas.

Voivodas et al. [6] uses a two-gap model to suggest that, the level of real exports is related to growth of real GDP. In his model, an increase in the level of exports allows an increase in imported capital goods which raises the rate of capital formation and hence, leading to increase in real GDP growth. Heller et al. [7] argue that the hypothesis at hand is that, export growth affects the growth of non-export GDP growth. This paper examines the role of export in the economic growth within the context of the Ghanaian economy for the period 1970-2015. The purpose of this study is to verify for Ghana, a primary commodity exporter. As at 2016, the main export commodities in Ghana are Crude oil, Cocoa beans, Gold, and other primary commodities, the nature and the strength of the relationship between export and economic growth and to ascertain the link between them (i.e. to test the export-led growth hypothesis in Ghana). The paper tests the hypothesis as postulated by Heller et al. [7] and proposes the use of Autoregressive distributed lag (ARDL) co-integration analysis to find out the existence of long-run relationship between economic growth and export growth in Ghana. The paper uses the resulting error correction mechanism (ECM) to ascertain the exportled growth (ELG) hypothesis.

The paper is divided into five sections. Section one is the introduction. Section two looks at the theoretical framework of primary commodity (PC) export as an engine of economic growth. In section three, the paper provides the reviews of some empirical studies on PC export and economic growth and some shortcomings of these studies. In section four, the paper presents the methodology that is used and the empirical results as well as the interpretation of these results. Finally, in section five, conclusions and policy implications.

Theoretical framework

Lewis et al. [8] argues that the rate of economic growth in the DCs in the last 100 years has depended on the Advanced Countries (AC). He points out that, the main channel through which the latter control or influence the former is through trade. In the Lewisian world, the engine of growth for the DCs is therefore, their export of primary commodities to the ACs (i.e. the source of economic growth is external). In contrast, the engine of growth for the ACs is through saving-investment activity (i.e. the growth source is internal). Lewis et al. [8] model is virtually identical with the one Nurkse et al. [9] advanced in the 1950s to make a case for a “balanced growth” strategy for the DCs. Nurkse advocates the build-up of non-export sectors directed at domestic consumption in the DCs. This was his case for balancing the expansion of the non-export sector with the primary commodity export sector. He expected the “balance growth” to achieve other related objectives. First, he believed that this would permit the DCs to avoid a sharp slow-down in the economic growth rates whenever there is stagnation in the ACs growth which will lead to reduction in their demand for primary exports. Secondly, he also believed that the “balanced growth” would relax political pressure in the DCs to diversify their export towards manufactured goods. He argues that comparative advantage dictates that, the ACs specialise in manufacturing and the DCs, in primary commodities exports. To preserve this pattern, DCs must develop an internal capacity to grow. In the recent past, these arguments would not have been supported by the development of the Newly Industrial countries/ Territories (NICs). For example, Hong Kong, Singapore, Taiwan and South Korea which made significant strides in economic growth and development through exports of manufactured goods rather than through primary commodity exports. However, given the current world economic outlook and the apparent slow-down of the Chinese and the other BRICS (Brazil, Russia, India, China and South Africa) economies, these theories are still pertinent to most DCs, especially, African countries which are mostly primary commodity exporters.

Review of empirical literature

One of the early empirical studies on the relationship between export growth and economic growth was undertaken by Michealy et al. [10]. Using spearman’s rank correlation for 41 DCs between1950 and 1973, he concludes in favour of the ELG hypothesis. But after dividing the countries into two groups base on per capita income of $300 as the demarcation point, he come into conclusion that growth is affected by exports performance only when a country has achieve some minimum level of development. He argues that, his predecessors in their empirical task erred. Because, they correlated the growth rate of GDP with the growth rate of export and since exports are themselves part of the GDP, a positive correlation of the two is almost inevitable whatever their true relationship. He suggests that, the appropriate test is to correlate the growth rate of per capita output with the growth rate of the share of export in GDP.

However, Heller et al. [7] point out that, Michealy et al. [10] made the same mistake as his predecessor. By correlating the rate of export share of GDP with per capita output as the rate of export share will change the output growth rate in the same direction even if it causes no change at all in the growth rate of the component of output. They suggest that, to avoid the problem of spurious correlation, the right correlation should be between growth rate of export per capita and growth rate of non-export GDP per capita. Since what we are interest in is how the growth rate of export is related to the growth rate of non-export component of GDP.

Michalopoulos et al. [11], Balassa et al. [1], Tyler et al. [5] and Feder et al. [12] also examine the relation between export growth and economic growth in a production function framework and conclude in favour of the ELG hypothesis. Feder et al. [12], however, uses an alternative formulation of the export variable and divides the effect of export on economic growth into two parts: productivity differentials due to differences between export and non-export and externalities sectors generated by the export sector.

One of the empirical works which need to be mentioned is that of Jung et al. [2]. They argue that while export growth may lead to output growth, there is an equally plausible hypothesis that output growth can cause export growth. They use Granger causality test to find the direction of causality between export growth and output growth. Out of the 37 countries they examined only 4 supported the ELG hypothesis.

Jung et al. [2] further argue that, these causality tests have certain advantages over the simple contemporaneous correlation based test that are usually employed to investigate the ELG hypothesis that is their use of information about time precedence enables them to say something about the direction of causation. They point out that, two variables may be correlated yet not causally related. Because, they are both associated with other factors and therefore by including lagged values of the dependent variable and by paying attention to the time series properties of the residuals, the Granger test remove several sources of spurious correlation. Jung et al. [2], however, have some shortcomings. They did not analyse the time series properties of the variables using recent unit root test. They did not also analyse the long-run equilibrium relationship of the variables using cointegration techniques. However, that should not come as a surprise since all the tests basically, used the same approach except Jung et al. [2] whose results did not overwhelmingly support the ELG hypothesis. A critical analysis of the studies that support the exportled growth hypothesis reveal that, most of them were based on data from semi-industrialised or middle income countries and sometimes oil-exporting countries and therefore their conclusions may be in accordance with Michealy et al. [10] shows that for export to act as an engine of growth the economy in question must have achieve some level of economic development.

Furthermore, Lee et al. [13] study the relationship between export growth and output growth using a multivariate threshold model with regimes defined by the export-import ratio in five countries (Hong Kong, Japan, South Korea, Philippines and Taiwan). They find that, except for Hong Kong, the relationship whereby exports lead output prevails in at least one regime for each of four of the countries being studied.

Shibab et al. [14] explore the causal relationship between economic growth and exports in Jordan using the Granger methodology in order to determine the direction of the relationship between the two variables for the period 2000 to 2012. They find a unilateral causal relationship between export and economic growth from the economic growth to Export but not the vice versa.

Additionally, Kilavuz et al. [15] investigate the relationship between export and import on economic growth in 22 developing countries from 1998 to 2006 using panel data and two models based on Ordinary Least Squares (OLS), Random Effects (RE), Fixed Effects (FE) and Panel Corrected Standard Errors (PCSE). In the first model, they include variables such as high and low-technology manufacturing industry exports, investment and population. They find that, only two variables (high-technology manufacturing industry export and investment) have a positive and significant effect on economic growth. Continuing their investigations, they include in the second model, effect of high and low-technology manufacturing industry imports on growth. The results revealed that, high-technology manufacturing industry export, investment and low-technology manufacturing industry import have a positive and significant effect on economic growth and population have not impact. The results of the recent empirical literature may suggest that the causal linkage between export and economic growth is at best, mixed.

Methodology

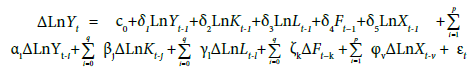

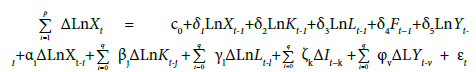

This paper employs the modern time series method to test the ELG hypothesis. Using a production function analogy, the paper incorporates two productive factors and two external factors and specified the following long term function:

LnYt = A+ αLnKt + βFt + γLnLt + λLnXt + ut (1)

Where Yt is the real non-export GDP at time t, A is a technological constant, Kt is the real domestic capital stock at time t, Ft is the real foreign capital at time t, Lt is the Labour force input at time t, Xt is the real export per capita at time t.

The importance of including foreign capital into the analysis cannot be overemphasised. This is because, since 1983 under the Economic Recovery Programme (ERP), the export base of the country has gradually been diversified and the influx of foreign capital that followed, tended to go into the export production sector. It is therefore, important to assess the relative impact of foreign capital on the economic growth in Ghana.

To improve the efficiency of capital requires trained human effort and this has been captured by including both capital stock (K) and a labour factor (L) in equation (1). This is because the endogenous growth theory posits that, human capital is one of the main sources of economic growth, especially in the developing countries. Savings will equal investments in equilibrium. However, Ghana is an open economy and hence, to capture the effects of external investment, foreign direct investment (F) have been included as a control variable. Foreign direct investments are known to have positive effects on economic growth [16] and especially, in Ghana where they (F) tend to go to the export sector.

Labour (L) and especially trained labour, is expected to enhance productivity by giving incentives for innovation. The paper will use secondary school enrolment rates as a measure for labour. This is defined as the ratio of the number of enrolment at secondary schools to the total population [17,18]. Accumulated capital stock (K) is the stock of capital that has been formed over time. In this paper, real gross capital formation will be used a proxy. Several previous studies have used this indicator as a proxy for capital formation [19]. The coefficients of all the variables are expected to be positive. The data used in this paper are taken from the World Bank’s World Development Indicators [20] and the World Bank’s African Development Indicators [21]. The econometric software used in this paper is Microfit5.0 (Oxford, UK).

The testing process will involve three steps. First, we will test for the stationarity of the variables. Second, examine the long run relationship between the variables using ARDL co-integration techniques. This involves the estimation of the long-run coefficients (which represent the optimum order of the variables after selection by the Akaike Information Criteria (AIC) or the Schwarz-Bayesian Criteria (SBC). Finally, the paper uses ARDL unrestricted error correction mechanism (UECM) approach to test the causality (precedence) between exports and real economic growth.

In the context of the ARDL, the paper specifies the following unrestricted error correction model (UECM):

(2)

(2)

(3)

(3)

Where in both equations, δi are the long run multipliers corresponding to long run relationships; c0, c1 and c2 are the drifts; αi, βj, γl,, ζk and φv are the short term coefficients; and εt is the white noise errors. The general UECM model is tested downwards sequentially, by dropping the statistically insignificant first differenced variables for each of the equations – to arrive at a “goodness-of-fit” model – using a general-to-specific strategy [18,22].

Causality test (Error correction mechanism approach)

Once the variables are found to be co-integrated, then we can use the ARDL ECM to test the existence of causality (precedence) between the variables. If the coefficient of the error correction term is statistically not significant, then any macroeconomic shock does not have impact on the variable under consideration in the short-run but if it is significant then, any shock is eliminated or corrected by that value over time. If, however, the coefficient is positive and significant then the adjustment is effected from below the long run relationship, if negative and significant, then it is from above. The reciprocal of the error correction term tells the number of periods over which short run shock will be eliminated.

Empirical Analysis

Unit root tests for variables

Tables 1-4 below show the results of the Augmented Dickey- Fuller (ADF) and Phillips and Peron (PP) [23] unit root tests for the relevant variables. The PP truncation lag is selected automatically on the Newey-West bandwidth.

| Variable | No Trend | Result | Trend | Result |

|---|---|---|---|---|

| LnK | -0.180 | N | -3.003 | S* |

| F | 1.269 | N | -0.414 | N |

| LnL | -0.786 | N | -2.774 | N |

| LnY | 0.872 | N | -1.503 | N |

| LnX | -0.499 | N | -2.349 | N |

Table 1: ADF unit root tests for the variables in levels.

| Variable | No Trend | Result | Trend | Result |

|---|---|---|---|---|

| ∆LnK | -5.857 | S*** | -5.786 | S*** |

| ∆F | -4.115 | S** | -5.012 | S*** |

| ∆LnL | -3.105 | S** | -3.684 | S** |

| ∆LnY | -4.711 | S** | -5.002 | S*** |

| ∆LnX | -4.151 | S** | -4.392 | S** |

Table 2: ADF unit root tests for the variables in first difference.

| Variable | No Trend | Result | Trend | Result |

|---|---|---|---|---|

| LnK | -0.175 | N | -2.656 | N |

| F | 2.138 | N | 0.312 | N |

| LnL | -0.327 | N | -1.481 | N |

| LnY | 1.028 | N | -1.156 | N |

| LnX | 0.050 | N | -2.036 | N |

Table 3: PP unit root tests for the variables in levels.

| Variable | No Trend | Result | Trend | Result |

|---|---|---|---|---|

| ∆LnK | -6.709 | S*** | -6.905 | S*** |

| ∆F | -5.960 | S*** | -7.175 | S*** |

| ∆LnL | -3.490 | S** | -3.520 | S** |

| ∆LnY | -7.095 | S*** | -9.860 | S*** |

| ∆LnX | -4.245 | S** | -4.266 | S** |

Table 4: PP unit root tests for the variables in first difference.

As can be seen from Tables 1-4, all the variables are either I(0) or I(1) – using the Augmented Dickey-Fuller and the Phillips and Peron (PP) unit root tests. The paper, therefore, rejects the null hypothesis that the variables are non-stationary.

ARDL-bounds test

The results of the co-integration test, based on the ARDL-bounds testing approach, are reported in Table 5. The results show that, in all the models, the null hypothesis of no co-integration is rejected. This implies that there is a long-run co-integration relationship among the variables in all the models in Ghana. The long-run results of the remaining selected models are reported in Tables 4-6 below.

| Dependent variable | Functions | F-test statistics | ||||||

|---|---|---|---|---|---|---|---|---|

| LnY LnX F LnK LnL |

FLnY (LnY| LnK, F, LnL, LnX, ) FLnX (LnX| LnK, F, LnL, LnY, ) FF (F| LnK, LnY, LnL, LnX, ) FLnK (LnK| LnX, F, LnL, LnY, ) FLnL (LnL| LnK, F, LnX, LnY, ) |

5.717*** 7.245*** 11.048*** 5.418*** 13.175*** |

||||||

| Asymptotic Critical Values | ||||||||

| Pesaran et al. [24], Table CI(iv) Case IV |

1% | 5% | 10% | |||||

| I(0) | I(1) | I(0) | I(1) | I(0) | I(0) | |||

| 3.81 | 4.92 | 3.05 | 3.97 | 2.68 | 3.53 | |||

Table 5: Bounds F-test for co-integration.

| Regressor | Co-efficient | Standard Error | T-Ratio | Probability |

|---|---|---|---|---|

| C | 1.356 | 0.376 | 3.613 | 0.001 |

| LnK | 0.641 | 0.248 | 2.583 | 0.015 |

| F | 0.150 | 0.036 | 4.164 | 0.000 |

| LnL | 1.016 | 0.362 | 2.807 | 0.009 |

| LnX | -0.735 | 0.295 | -2.487 | 0.019 |

Table 6: Non-Export real GDP and real Export Revenue - Results of ARDL (1, 1, 2, 0, 2) long run model selected on AIC (Equation 2).

As can be seen from Table 6, all the variables are statistically significant at 5% confidence level. The long term result coefficient of the real export revenue suggests a negative relationship between export revenue and non-export GDP. Thus, the results may suggest that, a 1% increase in export growth leads to about 0.74% decrease in the real non-export GDP. This may be due to the fact that, as terms of trade decline, more investment (both foreign and domestic) went into export sector, which is mainly primary commodity, in an attempt to increase output so as to maintain the level of export earnings. But other primary commodity exporter did the same simultaneously. By increasing their export output probably, with the same aim as in Ghana. This led to increase in total world output and hence further worsening the terms of trade.

In the Ghanaian context, the attempt to increase primary commodity output led to the neglect of other sectors of the economy thereby leading to what in Bhagwatian world is called “immiserizing growth”. In fact, during the period under consideration, as terms of trade decline by about 1% per year, primary commodity exports increased by about 1.6% per annum. Bhagwati et al. [25] argues that if a country which produces a large proportion of the world output of a commodity (Cocoa in the case of Ghana) and faces inelastic world demand for this commodity, and invest heavily in that commodity in an attempt to increase output in the face of dwindling terms of trade, then increase growth in the export sector may reduce domestic production (non-export GDP) hence leading to immiserizing growth. This is exactly the case of Ghana as the results may suggest, Ghana is the second largest producer and exporter of cocoa (the main export commodity) after Ivory Coast. The results of the causality test are shown in the following tables.

Causality test

First we check that all the variables are co-integrated using the ARDL approach. The results are presented in Table 7 below. It is observed from Table 5 that all the variables co-integrate with each other. This means that, there is long term relationship between the selected variables. The results of the causality test between the growth of real export revenues and non-export GDP using the error correction approach are presented in Table 7.

| Causality | Coefficient of ECM | M,N, | F-Statistics | Decision* |

|---|---|---|---|---|

| Equation 2: ∆LnY → ∆LnX | -0.428 | 1,2 | 10.702 | Do not reject |

| Equation 3: ∆LnX → ∆LnY | -0.773 | 2,3 | 10.469 | Do not reject |

Table 7: Causality test (ARDL Error correction mechanism approach).

Where m and n are the optimal lag lengths for non-export GDP and real export revenue respectively and Δ is the first difference. The results from Table 7 show there is bi-directional causality between non-export GDP and non export revenue in Ghana. However, any short term shock in the export sector is eliminated in about2 times faster than a short term shock in the non-export sector. Finally, the regression for the underlying ARDL models fits very well and they pass all the diagnostic tests against serial correlation, functional form, Normality and Heteroscedasticity based on the Lagrange Multiplier (LM) Test Statistics as shown in Table 8.

| LM Test Statistics Results | Equation 2 | Equation 3 |

|---|---|---|

| R-Square | 71.4% | 80.4% |

| Serial Correlation: CHSQ(1) | 0.444[0.505] | 1.892[0.169] |

| Functional Form: CHSQ(1) | 2.465[0.116] | 0.147[0.702] |

| Normality: CHSQ(2) | 1.046[0.593] | 2.020[0.364] |

| Heteroscedasticity: CHSQ(1) | 0.274[0.601] | 2.027[.0155] |

Table 8: ARDL-UECM models diagnostic tests.

Conclusion

This paper has empirically examined the relationship between real export revenue and non-export GDP in Ghana. The paper employs the ARDL-bounds approach of co-integration and unrestricted error correction model (UECM) to investigate the causal relationship between the two variables. According to Pesaran et al. [26], the ARDL methodology has robust properties in small sample size compared with traditional co-integration methodologies which normally require large sample size. Also, Narayan et al. [27] shows that, the ARDL method removes the uncertainty that comes with pre-testing the order of integration of the variables.

The paper finds that, there is a possibility of “immiserizing growth” as described by Bhagwati et al. [25] in Ghana. Therefore, diversification of the export base of the country is required. Since 1983, under the broad Economic Recovery Programme (ERP), Ghana has gradually shifted the export base from over-reliance on cocoa to a more diverse export base. This policy has helped to diversify the export base. However, the country still depends on the exports of primary commodities. Furthermore, since 2010 Ghana has been exporting crude oil which is also primary commodity. The results of the study may suggest that, real export revenue growth has negative impact on real non-export GDP growth. In addition, the study also finds evidence of bi-directional relationship between real export revenue and real non-export GDP over the period under consideration.

Since real exports cause (precedes) real non-export GDP and vice versa, the ELG hypothesis is not verified in the case of Ghana. Even though, Ghana continues to be a primary commodity exporter, there is convincing evidence of growth pattern in which the growth of exports and internally generated mechanism interact negatively. The policy implication of this study is that, there is optimism for the ELG hypothesis in Ghana as the diversification of the export base programme stays on course. However, attempt should be made to include processing of the raw material in the country. Especially, agro-processing should be used as part of the drive to fully expand and diversify the export base of the economy.

References

- Balassa B (1978) Exports and economic growth: further evidence. J dev Econ 5: 181-189.

- Jung WS, Marshall PJ (1985) Exports, growth and causality in developing countries. J dev Econ 18: 1-2.

- Krueger AO (1978) Foreign Trade Regimes and Economic Liberalisation.

- Little I, Scitovsky T, Scott M (1970) Industry and Trade in Some Developing Countries, London.

- Tyler WG (1981) Growth and export expansion in developing countries: Some empirical evidence. J dev Econ 9: 121-130.

- Voivodas CS (1973) Exports, foreign capital inflow and economic growth. J Int Econ 3: 337-349.

- Heller PS, Porter RC (1978) Exports and growth: An empirical re-investigation. J dev Econ 5: 191-193.

- Lewis WA (1980) The Slowing Down of the Engine of Growth. American Econ Rev 70: 555-564.

- Nurkse R (1959) Notes on Unbalanced Growth. Oxford Economic Papers 11: 295-297.

- Michaely M (1977) Exports and growth: an empirical investigation. J dev Econ 4: 49-53.

- Michalopoulos C, Jay KE (1973) Growth of exports and income in the developing world: a neoclassical view, Bureau for Policy Coordination, USA.

- Feder G (1983) On exports and economic growth. J dev Econ 12: 59-73.

- Lee CH, Huang BN (2002) The relationship between export and economic growth in East Asia countries: A multivariate threshold autoregressive approach. J dev Econ 27: 45-68.

- Shihab RA, Soufan T, Abdul-Khaliq S (2015) The Causal Relationship between Exports and Economic Growth in Jordan” Int J Bus Soc 5: 302-308.

- Emine K, Topcu BA (2012) Export and Economic Growth in the Case of the Manufacturing Industry: Panel Data Analysis of Developing Countries. Int J of Econ Fin Issues 2: 201-215.

- Bengoa M, Sanchez-Robles B (2003) Foreign direct investment, economic freedom and growth: new evidence from Latin America. Euro J Polit econ 19: 529-545.

- Shahbaz M, Ahmed N, Ali L (2008) Stock market development and economic growth: ARDL causality in Pakistan. Int Res J Fin Econ 14: 182-195.

- Owusu EL (2012) Finacial liberalisation and sustainable economic growth in ECOWAS countries (Doctoral dissertation), Pretoria, South Africa.

- Mansouri B (2005) The interactive impact of FDI and trade openness on economic growth: Evidence from Morocco.

- World Bank (2016) World Development indicators, Washington DC, USA.

- World Bank (2011) African Development indicators, Washington DC, USA

- Poon WC (2010) A monetary policy rule: The augmented Monetary Conditions Index for Philippines using UECM and bounds tests.

- Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75: 335-346.

- Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J app econ 16: 289-326.

- Bahgwati J (1957) Immiserizing growth: a geometric note. Rev Econ Studies 25: 58.

- Pesaran MH, Shin Y (1998) An autoregressive distributed-lag modelling approach to cointegration analysis. Econometric Society Monographs 31: 371-413.

- Narayan PK (2004) Reformulating critical values for the bounds F-statistics approach to cointegration: an application to the tourism demand model for Fiji, Australia.

Spanish

Spanish  Chinese

Chinese  Russian

Russian  German

German  French

French  Japanese

Japanese  Portuguese

Portuguese  Hindi

Hindi