Research Article, Res J Econ Vol: 2 Issue: 2

Stock Market Development and Economic Growth in Nigeria: A Camaraderie Reconnaissance

Osakwe CI and Ananwude AC*

Department of Banking and Finance, Nnamdi Azikiwe University, Nigeria

*Corresponding Author : Amalachukwu Chijindu Ananwude

Department of Banking and Finance, Nnamdi Azikiwe University, Anambra State, PMB 5025, Awka, Nigeria

Tel: +2348032276209

E-mail: amalision4ltd@yahoo.com

Received: December 01, 2017 Accepted: January 02, 2018 Published: January 09, 2018

Citation: Osakwe CI, Ananwude AC (2018) Stock Market Development and Economic Growth in Nigeria: A Camaraderie Reconnaissance. Res J Econ 2:2.

Abstract

This study on camaraderie reconnaissance explored the long run relationship between stock market development and economic growth in Nigeria from 1981 to 2015. Market capitalization ratio and turnover ratio were used to measure the depth of development of Nigeria’s stock market, whereas growth rate of real gross domestic product facets economic growth. Secondary data were sourced from Nigerian Stock Exchange (NSE) and National Bureau of Statistics (NBS) analysed using Autoregressive Distributive Lag (ARDL) model. From the analysis performed, the depth of development in Nigeria’s stock market has positive but insignificant relationship with economic growth both in short and long run. The granger causality analysis dispelled the adeptness of Nigeria stock market to propel growth. Stock market is growth inducing but in the context of Nigeria, economic growth is independent of stock market operation. The government need to steadfastly tackle inhibiting factors such as infrastructural inadequacy, weak institutional and regulatory framework encumbering the stock market from realization of its objective of capital mobilization for economic growth.

Keywords: Market capitalization; Turnover ratio; Economic growth

Introduction

Stock market development and economic growth is not a virgin issue in economic literature and it has its origin from the concept provided by Schumpeter in 1912 [1]. The role of stock market in mobilizing resources from surplus units and allocating same to deficit units is a stimulus to investigate development in Nigeria’s stock market in relation to economic growth. To accelerate economic growth and development in Africa has propelled the establishment of many stock markets in many African nations. Yartey et al. [2] note that reforms in the financial system of most African countries are focused to the development of the stock market to help in capital accumulation through effective financial intermediation. This is because of the vital role of finance in economic growth and development of developing countries. Emerging economies are faced with financial constraints which are due to underdeveloped nature of the financial system. Oke et al. [3] opine that sustainable growth and development will be attained through effective intermediation function of the stock market.

The growth of an economy depends on the level of development in the financial system which may be banks based or market based. In the bank based financial system, the banking system plays the greater role of capital mobilization for economic development compared to the stock market. On the other hand, in stock market based financial system, the stock market is seen as heaven for mobilization and allocation of resources for long term economic growth and development. In further affirmation of this assertion, Demirguc- Kunt et al. [4] states that in bank-oriented financial systems such as Germany and Japan, banks play a leading role in mobilizing savings, allocating capital, overseeing the investment decisions of corporate managers, and in providing risk management vehicles, while in market-oriented financial systems such as England and the United States, securities markets share centre stage with banks in terms of getting society’s savings to firms, exerting corporate control, and easing risk management. Nigeria financial system is bank-oriented as firms’ source financial resources mostly from the banks. The stock market is seen as the market for the “big guys”, that is, firms’ with great financial muscle. However, due to the developing nature of the Nigeria stock market and the financial system in general, only few firms are listed on the exchange when compared to its counterpart in South Africa.

The contribution of the stock market activity to national economic growth and development has been widely acknowledged in literature [5]. Proper functioning of the stock market guarantees availability of liquidity [6], and is seen as a heaven for mobilization of capital necessary for economic, especially for developing economies. Despite the several functions of the stock market, the liquidity aspect is adjudged to be distinct [7]. Levine as quoted in Adekunle et al. [7] notes that investors may shy away from undertaking long term investments if the stock market does not provide liquidity. This is attributable to unwillingness of savers to tie up their investments for long periods of time. A well-functioning stock market enhances firms’ access to finance for business expansion as their share would be easily exchanged for investors’ money without much encumbrance. The finances from the stock market is much more lower compared to the banking system credits which are mainly short term based, and in few cases medium term. Through the stock market, resources are pooled from surplus units and transferred to deficit units for productive economic activities which translate to improved national output. From the standpoint of Ologunde et al. [8], attainment of a desired level of growth and development in an economy is dependent on the availability of long term fund which most savers are reluctant to provide.

The content of this paper is outlined into sections. In section one, a precise introduction was given. Section two reviewed relevant literature, Section three detailed the methodological approach applied. Section four discussed the findings from data analysis and section five concluded the study.

Literature review

Stock market provides an avenue for raising medium to long term finances. Mobilization and allocation of long term funds for growth and development is better done by the stock market than the banking industry. This is because of the fragile financial structure of banks consisting mostly of demand deposits which are short term obligations banks owed to their customers. Mishra et al. [9] see the stock market as the market for dealing in long term financial instruments. Operational efficiency of the stock markets in emerging economies are adversely affected by the issue of information asymmetry where borrowers are believed to have more information than the lenders about the riskiness of the project funds are sought for. To achieve the status of a developed economy, the problem of information asymmetry in stock markets of emerging economies must be dealt with. Osakwe et al. [10] stated that the positive influence of stock market on economic growth has dominated empirical findings from across the world relative to independence of economic growth on stock market as well as the no connection between stock market and economic growth. The Nigerian stock market has witnessed some development over the years following reforms by different governments to make available long term resources for developmental projects. Market capitalization of the Nigeria Stock Exchange increased from N5 billion in 1981 to N16, 185.7 billion in 2016, while the all share index which captures how the market has performed stood at 26, 874.6 points from 127.3 points in 1985. Economic growth is the monetary worth of the goods and services produced in an economy over a specified period of time. The growth rates of the economy have positive relationship with development in the stock market (Singh, 2008 as cited in Echekoba et al. [1]). The higher the growth rate of the economy, other things being equal, the more favourable it is for the stock market as equity prices may rise due to the potential for higher profits from a healthy business climate [1].

Theories explaining the connection between development of the stock market and economic growth have divergence postulations. Basically, there are two major views on the alleged linkage between stock market and economic growth. One school of thought known as the finance led economic growth model or the supply leading theory/ hypothesis argues that stock market development is necessary for the achievement of growth and development of the economy. The theory states that economic growth requires huge long term resources which are only obtainable from the stock market. This is on the premise that huge resources can be effectively and efficiently mobilized by the mechanism of the stock market. This theory was traced to the pioneering work of Schumpeter in 1912. However, it became more popular following the study of Mckinnon and Shaw in 1973. From that time till date, most scholars have validated the positive influence of stock market activity on economic growth across the globe. The opposing view to the finance led growth theory contended that it is the level of development in the economy that determines the depth of development in the stock market. They argue that creation of more credit than required in the economy would retard long term growth of the economy. Robinson et al. [11] a supporter of demand following hypothesis stated that it seems to be the case that where enterprise leads finance follows. As stated by Robinson “the same impulses in an economy which set enterprise on foot make owners of wealth venturesome, and finance, devices are invented to release it, and habits and institutions are developed”

Empirical investigations regarding development of stock market and the growth of the economy are mixed. The role of stock market in economic growth of Nigeria was ascertained by Adam et al. [12] using granger causality test and regression analysis. The study reported a one-way causality between GDP growth and market capitalization and a two-way causality between GDP growth and market turnover. The relationship between turnover ratio and economic growth was found to be positive and significant.

The causal linkage between stock market and economic growth in Nigeria during the period 1970 to 2008 was assessed by Afees et al. [13]. Market capitalization ratio, total value traded ratio and turnover ratio were used as the indicators of stock market, while economic growth was proxied with trend in gross domestic product. The result of the granger causality test provided the existence of bidirectional causality between turnover ratio and economic growth, a unidirectional causality from market capitalization to economic growth and no causal linkage between total values traded. In all, economic growth in Nigeria was said to be propelled by stock market.

Josiah et al. [14] studied the developmental role of the Nigerian stock market. The methodological aspect of the study employed Ordinary Least Square and Cochrane – Orcutt interative methods. Empirical findings revealed that the Nigerian stock market positively does not contribute to economic development of Nigeria. Using similar methodology, Idowu et al. [15] examined how financial development has influenced stock market in contributing to the growth process from 1986 to 2010. The model was estimated using Ordinary Least Square (OLS), while the effect of stock market reform introduced in 1995 ascertained with Chow-Breaking-point Test. Their result revealed that financial reform of 1995 impacted significantly on capital market development in Nigeria.

Kolapo et al. [16] from 1990 to 2010 determined the impact of the Nigerian capital market on economic growth. Gross domestic product reflected the growth of the economy, whereas market capitalization, total new issues, value of transactions, and total listed equities and government stocks summarized stock market development indices. Estimation using Johansen co-integration and Granger causality showed that Nigerian capital market and economic growth are related in the long run. Causality analysis evidences bidirectional causation between economic growth and value of transactions and a unidirectional causation between market capitalisations to economic growth. Furthermore, there was independence “no causation” between economic growth and total new issues as well as economic growth and listed securities in the market.

Oke et al. [3] assessed the contribution of stock market operation in Nigeria towards the development of the oil and gas sector which provides over 90% of Nigeria’s foreign exchange. Model estimation with co-integration and error correction model indicated the presence of a long run relationship between stock market operation and oil and gas sector development. Similarly, Oke et al. [17] evaluated stock market reforms influence on economic growth between 1981 and 2010. The results of application of different econometric tools revealed that stock market reforms have contributed positively to economic growth of Nigeria.

The effect of stock market development on economic growth was conducted by Okonkwo et al. [18]. The study also captured the causation between stock market development and economic growth. Market capitalization, number of deals, all share index and total value of market transaction were applied to present stock market development. The Johansen co-integration envisaged the unvarying long run relationship between stock market development and economic growth. The granger causality analysis showed that the level of development in the economy tends to influence depth of development in the stock market.

Adigwe et al. [19] studied whether the level of development in Nigerian stock market has empirically propelled growth in the economy or not from 1985 to 2014. Ordinary Least Square (OLS) was the estimation approach adopted in the study. It was deduced that the development in the Nigerian stock market was very poor in contributing to the growth of Nigerian economy.

The short and long dynamic of the causal linkage between the depth of development in Nigerian stock market and economic growth from 1981 to 2015 was researched by Echekoba et al. [1]. Two stock market development indicators via stock market capitalisation and value of stock traded ratio were applied, while the rate at which the gross domestic product changes was used to measure economic growth. The ranger causality test showed no causal linkage between depth of development in Nigerian stock market and economic growth. The depth of development in Nigerian stock market and economic growth is related in the long run. The overall result showed the weakness of the Nigerian stock market in contributing to growth process.

Methodological Approach

The Autoregressive Distributive Lag (ARDL) model was applied to investigate the co-integration relationship between stock market development and economic growth. The effect of stock market development on economic growth and its direction was aided by the granger causality analysis. The ordinary least square regression technique was the framework for short run relationship. The data for analysis were sourced from National Bureau of Statistics (NBS) and Nigerian Stock Exchange (NSE) from 1981 to 2015. Real Gross Domestic Product Growth Rate (GDPGR) substituted economic growth, while Market Capitalization Ratio to GDP (MKTCR) and Turnover Ratio (TUNR) were products of stock market development based on World Bank indicators on measurement of the depth of development of the stock market. We relied on the linear regression estimation and mimicked the model of Oke (2012). Thus we functionally developed our model as follows:

(1)

(1)

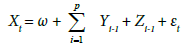

Inculcating stock market and economic growth variables individually in Equation 1 we the have:

GDPGRt = βo + β1 MKTCRi + β2 TUNRi + εt (2)

Where Xt = economic growth, ω = coefficient of the constant, Σ = coefficients of the stock market development indices, Y = market capitalization ratio to GDP, Z = turnover ratio, i-1 = time trend and εt = error term.

Following the supply leading hypothesis, we posit a positive relationship between economic growth and stock market development as reflected by market capitalization ratio to GDP and turnover ratio.

Results and Discussion

Descriptive features of data

The analysis began by aggregating the descriptive features of the data as presented in Table 1. The descriptive features of the data house the mean, median, maximum value, minimum value, standard deviation, skewness, kurtosis, Jarque-Bera, p-value and number of observation. Market capitalization ratio to GDP and turnover ratio recorded a mean of 13.82 and 7.46, whereas growth rate of GDP was 3.67. The median of 4.28, 10.39 and 6.10 were traced to growth rate of GDP, market capitalization ratio to GDP and turnover ratio respectively. 33.74 And -13.13 depicted the maximum and minimum values of GDPGR, 51.00 and 3.35 for MKTCR and 34.79 and 1.05 for TURN. The leptokurtic nature of the data was affirmed by the Kurtosis statistic which was more than three (3). The Jarque-Bera (p-value<0.05) communicated that the data were normally distributed and have no outlier that may impede the regression result.

| Mean | Median | Maximum | Minimum | Std. Dev. | Skewness | Kurtosis | Jarque-Bera | P-Val. | Obs. | |

|---|---|---|---|---|---|---|---|---|---|---|

| GDPGR | 3.67 | 4.28 | 33.74 | -13.13 | 7.67 | 1.18 | 8.59 | 53.70 | 0.00 | 35 |

| MKTCR | 13.82 | 10.39 | 51.00 | 3.35 | 11.36 | 1.45 | 4.80 | 17.05 | 0.00 | 35 |

| TUNR | 7.46 | 6.10 | 34.79 | 1.05 | 6.31 | 2.54 | 11.46 | 141.90 | 0.00 | 35 |

Table 1: Descriptive features of data.

Model diagnostic

The model was subjected to diagnostic tests of serial correlation, heteroskedasticity, Ramsey reset specification and multicollinearity. Table 2 asserts that the data were not serially correlated (p-value>0.05). In terms of heteroskedasticity, Table 3 absolve the model of any heteroskedasticity issue (p-value>0.05), while Table 4 stated that the model was correctly specified (p-value>0.05). The correlation between market capitalization to GDP and turnover ratio is 0.34 as evidenced in Table 5 which implies that the inclusion of market capitalization to GDP and turnover ratio in the model does not lead to problem of multi-collinearity.

| Obs*R-squared | F-statistic | Prob. |

|---|---|---|

| 0.346982 | 0.144348 | 0.8662 |

Table 2: Serial correlation LM test.

| Obs*R-squared | F-statistic | Prob. |

|---|---|---|

| 0.944784 | 0.285820 | 0.8352 |

Table 3: Heteroskedasticity test.

| F-statistic | df | Prob. |

|---|---|---|

| 2.591335 | (1,29) | 0.1183 |

Table 4: Ramsey reset specification.

| GDPGR | MKTCR | TUNR | |

|---|---|---|---|

| GDPGR | 1.000000 | 0.234691 | 0.249050 |

| MKTCR | 0.234691 | 1.000000 | 0.344895 |

| TUNR | 0.249050 | 0.344895 | 1.000000 |

Table 5: Multicollinearity test.

Prove of stationarity of data

Stationarity of the data was perfected with Augmented Dickey- Fuller (ADF) Test and Phillips Perron (PP) estimations. This is to establish that the data are free from stationarity defects linked with virtually all time series data. The ADF and PP analysis were done at first difference at intercept and trend having confirmed the nonstationarity of the data at level form. Tables 6-9 detail the results of the ADF and PP test.

| Variables | ADF Test Statistic | Test Critical Value at 1% | Test Critical Value at 5% | Decision |

|---|---|---|---|---|

| GDPGR | -8.688280 (0.00)* | -3.646342 | -2.954021 | Stationary |

| MKTCR | -6.327757 (0.00)* | -3.646342 | -2.954021 | Stationary |

| TUNR | -6.595290 (0.00)* | -3.646342 | -2.954021 | Stationary |

Note: (*) and (**) denote significance at 1% and 5% respectively.

Table 6: ADF test output at intercept only.

| Variables | ADF Test Statistic | Test Critical Value at 1% | Test Critical Value at 5% | Decision |

|---|---|---|---|---|

| GDPGR | -8.583421 (0.00)* | -4.262735 | -3.552973 | Stationary |

| MKTCR | -6.265128 (0.00)* | -4.262735 | -3.552973 | Stationary |

| TUNR | -6.491194 (0.00)* | -4.262735 | -3.552973 | Stationary |

Note: (*) and (**) denote significance at 1% and 5% respectively.

Table 7: ADF test output at trend and intercept.

| Variables | PP Test Statistic | Test Critical Value at 1% | Test Critical Value at 5% | Decision |

|---|---|---|---|---|

| GDPGR | -21.63413 (0.00)* | -3.646342 | -2.954021 | Stationary |

| MKTCR | -6.327757 (0.00)* | -3.646342 | -2.954021 | Stationary |

| TUNR | -8.032276 (0.00)* | -3.646342 | -2.954021 | Stationary |

Note: (*) and (**) denote significance at 1% and 5% respectively.

Table 8: PP test output at intercept only.

| Variables | PP Test Statistic | Test Critical Value at 1% | Test Critical Value at 5% | Remark |

|---|---|---|---|---|

| GDPGR | -25.64304 (0.00)* | -4.262735 | -3.552973 | Stationary |

| MKTCR | -6.265210 (0.00)* | -4.262735 | -3.552973 | Stationary |

| TUNR | -7.924630 (0.00)* | -4.262735 | -3.552973 | Stationary |

Note: (*) and (**) denote significance at 1% and 5% respectively.

Table 9: PP test output at trend and intercept.

Regression estimate

The estimated output of the model was presented in Table 10. From the result, stock market development indices: market capitalization ratio to GDP and turnover ratio have positive but insignificant relationship with economic growth. Assuming that market capitalization ratio to GDP and turnover ratio are held constant, economic growth would amount to 1.17%. From the coefficient of market capitalization ratio to GDP, economic growth would rise by 0.05% following a unit increase in market capitalization ratio to GDP, while a percentage rise in turnover ratio raises economic growth by 0.19%. In terms of variation in economic growth, Adjusted R-square attributed stock market development to influence economic growth by only 2.67% which is not significant judging from the p-value of F-statistic of 0.29 which is greater than 0.05. There is no element of autocorrelation as envisaged by the Durbin Watson value of 2.0.

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | 1.170835 | 2.185878 | 0.535636 | 0.5962 |

| MKTCR | 0.058481 | 0.117056 | 0.499600 | 0.6210 |

| TUNR | 0.199701 | 0.208311 | 0.958667 | 0.3454 |

| GDPGR(-1) | 0.182542 | 0.165787 | 1.101064 | 0.2796 |

| R-squared | 0.115208 | Mean dependent var | 4.166765 | |

| Adjusted R-squared | 0.026729 | S.D. dependent var | 7.199550 | |

| S.E. of regression | 7.102679 | Akaike info criterion | 6.868952 | |

| Sum squared resid | 1513.441 | Schwarz criterion | 7.048524 | |

| Log likelihood | -112.7722 | Hannan-Quinn criter. | 6.930191 | |

| F-statistic | 1.302096 | Durbin-Watson stat | 2.034286 | |

| Prob (F-statistic) | 0.291915 | |||

Note: GDPGR-1 is the lagged Dependent Variable

Table 10: OLS regression estimation.

Camaraderie reconnaissance

The long run relationship between stock market development and economic growth was explored using the ARDL methodology. From the data output in Table 11, there is a long run relationship between stock market development and economic growth in Nigeria. The F-statistic of 7.76 is higher than the lower and upper bound values of 3.79 and 4.85 respectively. This point to the importance of stock market in economic growth and development of an economy, Developed countries of the world have vibrant and efficient market which pool resources and allocate efficiently to required sectors. Subsequent to the verification of the presence of a long run relationship between stock market development and economic growth in the context of Nigeria, the study proceeded to determining the speed of adjustment to equilibrium and the result condensed in Table 12. The error correction is negatively signed and significant at 5% level of significance, an inference that the model shift towards equilibrium consequent to imbalances in previous periods. About 81.74% of error generated in past year is corrected in current year. It is also observe in Table 12 that stock market development indices are positively but insignificantly related with economic growth both in short run and long run.

| T-Test | 5% Critical Value Bound | Remark | |

|---|---|---|---|

| F-Statistic | Lower Bound | Upper Bound | |

| 7.765938 | 3.79 | 4.85 | Null Hypothesis Rejected |

Table 11: Bound test.

| Short Run Co-integration Form | ||||

|---|---|---|---|---|

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| D(MKTCR) | 0.058481 | 0.117056 | 0.499600 | 0.6210 |

| D(TUNR) | 0.199701 | 0.208311 | 0.958667 | 0.3454 |

| CointEq(-1) | -0.817458 | 0.165787 | -4.930763 | 0.0000 |

| Long Run Coefficient | ||||

| MKTCR | 0.071540 | 0.141298 | 0.506308 | 0.6163 |

| TUNR | 0.244296 | 0.251831 | 0.970079 | 0.3398 |

| C | 1.432289 | 2.680417 | 0.534353 | 0.5970 |

Table 12: ARDL error correction model.

Direction of relationship

The direction of relationship between stock market development and economic growth as well as the effect of stock market development on economic growth was dispelled by the granger causality analysis. As can be seen in Table 13, there is no causal relationship between stock market development and economic growth in Nigeria. Market capitalization ratio and turnover ratio does not granger cause economic growth, neither does economic growth granger cause market capitalization ratio and turnover ratio.

| Null Hypothesis: | Obs | F-Statistic | Prob. | Remarks |

|---|---|---|---|---|

| MKTCR does not Granger Cause GDPGR GDPGR does not Granger Cause MKTCR |

34 | 0.10359 0.43130 |

0.7497 0.5162 |

No Causality No Causality |

| TUNR does not Granger Cause GDPGR GDPGR does not Granger Cause TUNR |

34 | 0.95871 0.23500 |

0.3351 0.6312 | No Causality No Causality |

Table 13: Direction of relationship.

Discussion of empirical result in relation to previous studies

The positive relationship both in short run (Table 10) and long run (Table 12) between market capitalization ratio to GDP, turnover ratio and economic growth hinges on the influential paradigm of the stock market on economic growth. With this result, the previous studies of Adam et al. [12], Afees et al. [13], Oke et al. [17], Okonkwo et al. [18], Adigwe et al. [19], Josiah et al. [14], Kolakpo et al. [16] and Echekoba et al. [1] are confirmed. In terms of the direction of relationship running from market capitalization to economic growth as documented by Adam et al. [12], Afees et al. [13] and Kolakpo et al. [16] was faultlessly refuted (Table 13) but vehemently in unison with Echekoba et al. [1] on the powerlessness nature Nigeria’s stock market to predict economic growth. This difference would be as result of using the raw values of market capitalization without deflating to GDP based on World Bank standard, or perhaps the use of real GDP instead of the growth rate which is better in measuring economic growth over a specified period of time. In summary, the stock market has a great capacity in contributing to economic growth as envisaged by supply leading hypothesis but then, influence of stock market on economic growth in Nigeria is negligible [20-23].

Conclusion

The short run and long run association between stock market and economic growth over a period of thirty five (35) years was explored in this study. Data for the analysis were obtained from National Bureau of Statistics (NBS) and Nigerian Stock Exchange (NSE). The model estimation followed the linear regression technique. The ARDL outcome divulged positive relationship between stock market development and economic growth both in short run and long run. The granger causality output dispelled the adeptness of Nigeria stock market to drive growth. In conclusion, we assert that stock market is growth inducing but in the context of Nigeria, economic growth is independent of stock market operation. The government need to steadfastly tackle inhibiting factors such as infrastructural inadequacy, weak institutional and regulatory framework encumbering the stock market from realization of its objective of capital mobilization for economic growth.

References

- Nwaolisa EF, Chijindu AA (2016) The linkage between the depth of development in Nigerian stock market and economic growth: A Johansen co-integration approach (1981–2015). Front Acc Financ 1: 16-28.

- Yartey CA, Adjasi CK (2007) Stock market development in Sub-Saharan Africa: Critical issues and challenges, South Africa.

- Oke MO (2012) Nigeria capital market operation and economic growth: A case of the oil and gas sector. Asian J Bus Manage Sci 1: 62-72.

- Levine R (1999) Bank-based and market-based financial systems: Cross-country comparisons, USA

- Abbas IO, Pei YX, Rui Z (2016) Impact of stock market on economic growth evidence: Dar-es Salaam Stock Exchange – Tanzania. J Fin Acc 4: 321-327.

- Ezeoha A, Ebele O, Ndi Okereke O (2009) Stock market development and private investment growth in Nigeria. J Sustain Dev Africa 11: 20-35.

- Adekunle OA, Alalade YS, Okulenu SA (2016) Macro-Economic Variables and Its Impact on Nigerian Capital Market Growth. Int J Econ Bus Manage 2: 22-37.

- Ologunde AO, Elumilade DO, Asaolu TO (2006) Stock market capitalization and interest rate in Nigeria: A times series analysis. Int J Econ Bus Manage 13: 36-47.

- Mishra PK, Mishra US, Mishra BR, Mishra P (2010) Capital market efficiency and economic growth: The case of India. European J Econ Fin Admin Sci 27: 130-138.

- Osakwe CI, Ananwude A (2017) Stock market development and economic growth: A comparative evidence from two emerging economies in Africa – Nigeria and South Africa. Archives Current Res Int 11: 1-15.

- Robinson J (1952) The rate of interest and other essays, Macmillan, London.

- Adam JA, Sanni I (2005) Stock market development and Nigeria's economic growth. J Econ Allied Fields 2: 116-132.

- Afees AS, Kazeem BA (2010) The stock market and economic growth in Nigeria: An empirical investigation. J Econ Theory 4: 65-70.

- Josiah M, Adendiran SA, Akpeti EO (2012) Capital market as a veritable source of development in Nigerian economy. J Acc Taxation 4: 7-18.

- Idowu A, Babatunde MA (2012) Effect of financial reforms on capital market development in Nigeria. Asian J Bus Manage Sci 2: 2047-2528.

- Kolakpo T, Adaaramola AO (2012) The impact of capital market on economic growth. Int J Dev Societies 1: 11-19.

- Oke MO, Adeusi SO (2012) Impact of capital market reforms on economic growth: The Nigerian experience. Aus J Bus Manag Res 2: 20-30.

- Okonkwo VI, Ananwude AC, Echekoba FN (2015) Nigeria stock market development and economic growth: A time series analysis (1993 – 2013). Scholars J Econ Bus Manage 2: 280-293.

- Adigwe PK, Nwanna IO, Ananwude A (2015) Stock market development and economic growth in Nigeria: An empirical examination (1985-2014). J Policy Dev Studies 9: 134-154.

- Adenuga AO (2010) Stock market development indicators and economic growth in Nigeria: Empirical investigation. Central Bank of Nigeria, Economic and Financial Review 48: 33-711.

- Aderibigbe JO (1997) Monetary policy and financial sector reform. Central bank of Nigeria bulletin 10-12.

- Mbat DO (2001)Financial Management, Uyo, Nigeria.

- Senbet L, Otchere I (2008) Beyond banking: Developing markets–African stock markets, Tunisia.

Spanish

Spanish  Chinese

Chinese  Russian

Russian  German

German  French

French  Japanese

Japanese  Portuguese

Portuguese  Hindi

Hindi