Research Article, Res J Econ Vol: 1 Issue: 2

The Nexus between Stock Indices and Bond Yields in the Recent Hyperinflation Era in Venezuela

Dimitrios G Tsoutsas*

Department of Economics, University of Thessaly, Greece

*Corresponding Author : Dimitrios G Tsoutsas

Department of Economics, University of Thessaly, 28th October 78 Street, PC: 38333, Volos, Greece

Tel: 24210-74771/24210-74776

E-mail: dts@hotmail.gr

Received: September 22, 2017 Accepted: October 15, 2017 Published: October 22, 2017

Citation: Tsoutsas DG (2017) The Nexus between Stock Indices and Bond Yields in the Recent Hyperinflation Era in Venezuela. Res J Econ 1:2.

Abstract

The aim of this paper is to cast light on the relation between the Bursatil Financial (IBCF) stock index and the long-term (15-year) and longer-term (20-year) government bond yields in Venezuela during the recent hyperinflationary period that was set off in 2009. Weekly data are used and a Vector Error Correction Model specification is employed in order to examine the nexus between the Venezuelan financial sector and the real economy. Results provide evidence of a negative and statistically significant dependence of the stock index by the 15-year and the 20-year government bond yield, whereas the relation the other way round is also negative but weak and non-significant.

Keywords: Venezuela; Hyperinflation; Financial markets; Vector error correction model

Introduction

An increasing volume of academic papers and financial press articles have aroused by the hyperinflationary episodes in Venezuela Bjørnland et al. [1] and especially during the last eight years Chortareas et al.; Ruprah et al. [2,3] Money printing by Venezuela’s monetary authorities has increased, leading to levels of price growth higher than 600% during 2016, and predictions of the 2017 overcoming a level of 720% are made. Not surprisingly, economic experts talk about a ‘‘runaway inflation’’, mainly based on a fixed exchange rate in relation to the US dollar, which leads to consequent devaluations of the Venezuelan bolivar and to bulks of paper money needed to purchase even goods of the slightest value of consumption in the country. Even non-expert Venezuelan citizens would no longer fall victims of the ‘‘money illusion’’ phenomenon that Irving Fisher talks about in his seminal work with such a dexterity. Fisher I (2014) The money illusion; Notes and coins’ production and introduction of new paper notes by the central bank as well as ample liquidity provisions by commercial banking institutions have become the primordial characteristic of the country, leading the necessity of the Automatic Teller Machines (ATMs) refilling with cash many times during a day. Moreover, consumers are in need of large buckets to carry inflationbubbled fiat money characterized by extravagant differences between nominal and real values, in order to buy basic commodities for living. The worst of all is no other but the extremely high levels of economic uncertainty that leads to a never-ending economic unpredictability that further renders the modern financial system into looking as malicious as possible.

When trying to detect the root causes for this rapidly growing problem of the real economy and financial markets in Venezuela, many market participants could focus on political instability, but commendations on political issues is far from the purpose of this study. By strictly economically speaking, the main two causes of this highlyprominent hyperinflationary era in Venezuela are: the tremendously high level of this national economy’s dependence from oil-exports, as well as the laxity of regulation and law-enforcement which renders the development of black markets very easy as concerns currency circulation. As oil exports constitute nearly 95% of Venezuela’s exports, which is translated into almost half of the country’s Gross Domestic Product (GDP), the huge negative shock in global oil prices in 2014 Weisbrot et al. [4], unavoidably led to tendencies for devaluation of the Venezuelan bolivar and triggered a dominoeffect on the Venezuelan economy, due to the interconnection of Venezuelan investments to oil exports Wilpert et al. [5] Thereby, economic stagnation due to lower profits from the oil industry, condemned other industry activities in Venezuela to suffering from a so-called ‘’Dutch disease’’ that rendered also them incapable to grow and survive. In the face of such a money peril and the immense risk of very large devaluations needed for remaining competitive as regards oil exports, Venezuelan authorities decided to control the exchange rate by ‘’tying’’ to the US dollar, whereas at the same time no adequate measures about prevention of black market phenomena in the currency market were taken. Speculators in Venezuela started and kept up purchasing US dollars thereby creating a smaller pool for the US currency, and these dollars were later given in exchange for Venezuelan bolivars, rendering the supply of the latter continuously higher. This way, the devaluation of the bolivar has been continuous, driving the Venezuelan currency to an extremely high level of its fiat character and bringing about explosive price increases, thereby bubbling inflationary pressures.

The aim of this paper is to shed light on the nexus between the real economy and financial markets in Venezuela during these highly volatile in terms of inflation pressures times during the last eight years. The rest of this paper is structured as follows. Section 2 describes the data and methodology. Section 3 presents and discusses the results from the econometric estimations. Finally, Section 4 concludes.

Data and Methodology

The data employed are extracted from the investing.com financial website. They concern the Bursatil Financial Index (IBCF) in Venezuela and the long-term (15-year) and longer-term (20- year) government bond yields in Venezuela. All data are in a weekly frequency and are transformed into logarithmic differences. The time period employed spans from 31 May 2009 until 21 May 2017. In Table 1, the descriptive statistics of the variables employed are shown.

| IBCF | GB15Y | GB20Y | |

|---|---|---|---|

| Obs | 416 | 416 | 416 |

| Mean | .0181046 | .000905 | .0008005 |

| Std. Dev. | .0597013 | .0426305 | .0429366 |

| Variance | .0035643 | .0018174 | .0018435 |

| Skewness | 1.946845 | .6767832 | .6055254 |

| Kurtosis | 12.3121 | 5.545213 | 5.372734 |

Table 1: The descriptive statistics of the variables employed.

It can be easily observed that there is a high level of kurtosis regarding the Bursatil Financial Index, which strengthens the perspective of high values of the index having taken place during the financial crisis. Furthermore, this variable presents a somewhat high level of positive skewness, probably due to the high volatility that distressful times in Venezuela have brought about in the respective financial markets.

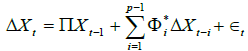

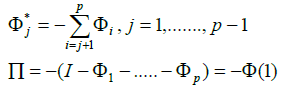

The methodology employed in order to estimate the effect of the IBCF stock index on the 15-year government bond yield, as well as the other way around, is a Vector Error Correction Model Engle et al. [6]. This is based on a vector of Xt variables, which are of I (1) order

![]()

And there stands an error correction term representation of the form

Where Π and the Φ* are functions of the Φ’s.

Econometric Results

The outcomes from the VECM estimations are exhibited in Tables 2a and 2b, where ce1 stands for the constant term, L1 for the first lag and LD for the lagged differences. Evidence is provided of a high statistically significant interconnectedness between financial markets and each macroeconomic variable under scrutiny in this paper.

| D_IBCF | [95% Conf. Interval] | D_GB15Y | [95% Conf. Interval] | ||

|---|---|---|---|---|---|

| _ce1 L1. | -.0302631 | (-.0556483, -.0048779) | _ce1 L1. | .1215029 | (.1057082, .1372976) |

| p-value | (0.019)** | p-value | (0.000)*** | ||

| IBCF LD. | -.3438319 | (-.4356486, -.2520151) | IBCF LD. | -.0038394 | (-.060968, .0532892) |

| p-value | (0.000)*** | p-value | (0.895) | ||

| GB15Y LD. | -.1453288 | (-.2990432, .0083857) | GB15Y LD. | .0722799 | (-.0233615, .1679214) |

| p-value | (0.064)* | p-value | (0.139) |

Table 2a: The outcomes from the VECM estimations about the 15-year bond yield.

| D_IBCF | [95% Conf. Interval] | D_GB20Y | [95% Conf. Interval] | ||

|---|---|---|---|---|---|

| _ce1 L1. | -.0478148 | ( -.0797007, -.0159288) | _ce1 L1. | .1540391 | ( .1339539, .1741244) |

| p-value | (0.003)*** | p-value | (0.000)*** | ||

| IBCF LD. | -.332968 | (-.4254104, -.2405256) | IBCF LD. | -.0008757 | ( -.059106, .0573545) |

| p-value | (0.000)*** | p-value | (0.976) | ||

| GB20Y LD. | -.1746486 | (-.3264528, -.0228445) | GB20Y LD. | .046482 | (-.0491407, .1421048) |

| p-value | ( 0.024)** | p-value | (0.341) |

Table 2b: The outcomes from the VECM estimations about the 20-year bond yield.

Results provide evidence for the existence of a unidirectional negative statistically significant causal relation between the Venezuelan IBCF index and the 15-year Venezuelan government bond yield, originated from the latter to the former, equal to approximately 14, 5%. On the other hand, although there is also a negative causal relation from the IBCF index towards the 15-year yield, this is very weak and far from statistically significant. This means that the capital market in Venezuela is getting better as government bond yields become lower, thereby indicating that a boost in the real economy by lower yields leads to ameliorated conditions in the capital market in Venezuela as reflected by stock prices. Nevertheless, this effect is not found to be cyclical, as better functioning financial markets and more specifically capital markets do not lead in lowering bond yields and do not spur economy growth in a statistically significant manner. Thereby, during the really stressful in terms of inflationary pressures period of May 2009- May 2017, the government rates have been found as being those leading economic growth also in financial markets and not the other way around.

By focusing on results about the relation of the Bursatil Financial Index with the longer-term government bond yield (20-year), it is seen that the negative effect of the latter on the former is larger (approximately 17.5%) than the impact of the 15-year yield, as well as statistically significant with a lower possibility of error, that is in a 5% possibility of error level, as the p-value indicates. This leads to the outcome that the effects of the government bond yields on capital markets in Venezuela are larger the longer is the maturity of the bond. Therefore, the higher is the price of a Venezuelan government bond in the long and the longer-term, the higher is the probability that financial markets in Venezuela will become more active. This indicates a strong interdependence between bond and capital markets in times of inflation-led crisis, providing evidence not for a substitution but for a complementarity effect between demands for financial assets during monetary abnormal eras. Thereby, tapering of demand-led inflation could come up easier for Venezuela if monetary authorities wished to, due to the interconnectedness of the real economy with capital markets.

Conclusions

The recent hyperinflationary episodes in Venezuela have been alarming for the modern monetary theory as well as for theories supporting money printing and credit provisions in general. The weakness of Venezuela’s export sector to replace oil exports by other commodities in case of large unexpected shocks as well as the lack of an implementable legal framework against currency speculation via US dollar –bolivar black markets has proven catastrophic so far. Once the gap between the nominal and real value of the bolivar has tremendously widened, price bubbling in tandem with menu costs and the opportunity cost of the shopping time in a lesser extent have led to continuous worsening of the purchasing power of Venezuelan consumers. Moreover, potential investors in Venezuela have become less in number due to the increasing instability in the monetary, labor and consequently political framework in the country.

The effort to stabilize the exchange rate by relating to the US dollar in steady ratios has led to empowering black economy to take advantage of speculative opportunities by US dollar and Venezuelan bolivar trades, which make the latter’s devaluation sprint in an even higher pace than the 2014 global oil price shock would impose. This paper examines whether in conditions of such negative terms of economic sanity, the rates of long-term and very long-term Venezuelan government debt have any effect on stock prices and the other way around. Empirical findings provide evidence that indeed the government bond market is related to the capital market and that a real economy boost could well lead to a spur in asset prices such as stocks. This is valid both when 15-year and 20-year bonds are taken into consideration. As regards the bi-directional character of this relation, this is also confirmed by the Vector Error Correction empirical estimation as regards the signs, but in a much lesser extent, and more importantly, with no statistical significance.

The purpose of this study is to arouse interest about the crucial example of Venezuela as regards monetary policy and phenomena of hyperinflation when liquidity and credit provision seems to be the only solution in a negative shock-hit economy. This could well be parallelized with the unconventional monetary policies such as overt money financing that a non-negligible portion of economists support that should be adopted by the European Central Bank after the recent sovereign debt crisis. Even though by no means it is implied that an inflation-led catastrophe could be in front of the gates of the Eurozone if ample liquidity provisions are adopted, the Venezuelan paradigm really could feed policy-makers with deep second thoughts or enlighten them in order to avoid mistakes and take a quantum leap forward in better understanding advanced fiat money matters.

Bibliography

- Bjørnland HC (2005) A stable demand for money despite financial crisis: the case of Venezuela. Applied Economics, 37: 375-385.

- Chortareas GE, Garzaâ€ÂÂÂÂGarcia JG, Girardone C (2011) Banking sector performance in Latin America: Market power versus efficiency. Rev Dev Econ 15: 307-325.

- Ruprah IJ, Luengas P (2011) Monetary policy and happiness: Preferences over inflation and unemployment in Latin America. J Socio-Econ 40: 59-66.

- Weisbrot M, Johnston J (2012) Venezuela’s Economic Recovery: Is it Sustainable?. Washington, DC: Center for Economic and Policy Research.

- Wilpert G (2003) The economics, culture, and politics of oil in Venezuela. Venezuela Analysis.

- Engle RF, Granger CW (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 1: 251-276.

Spanish

Spanish  Chinese

Chinese  Russian

Russian  German

German  French

French  Japanese

Japanese  Portuguese

Portuguese  Hindi

Hindi