Research Article, Res J Econ Vol: 2 Issue: 2

The Singapore Model of Managing Healthcare Cost

Phang Xue Ni Sendy1 and Ameen Talib2*

1Business School, Coventry University, Singapore

2Business School, Singapore University of Social Science, Singapore

*Corresponding Author : Ameen Talib

Head Applied Projects, Business School, Singapore University of Social Science, 463 Clementi Road, Singapore 599491

E-mail: ameentalib@suss.edu.sg

Received: March 01, 2018 Accepted: March 14, 2018 Published: March 20, 2018

Citation: Phang XNS, Talib A (2018) The Singapore Model of Managing Healthcare Cost. Res J Econ 2:2.

Abstract

The Singapore healthcare system can be considered a successful system in relation to its efficiency and provision of world class services to Singaporean residents. One of the major factors that have contributed to the success of the Singapore Healthcare system has been how healthcare cost is managed. This paper seeks to evaluate how Singapore manages its healthcare cost. We compare how health cost is managed in Singapore, with that of the United States and Germany. The study found out that Singapore manages its healthcare cost through multiple protection schemes that are supplemented with private health insurance to cater for individual health cost. Individuals are the major contributors of the healthcare cost in Singapore. There are government subsidies to supplement these contributions. The needy and poor are able to be afforded various healthcare services, but only after allowing those who are capable of paying to do so. However, the major problem facing the Singapore healthcare system is the increase in the number of insurance claims.

Keywords: Singapore healthcare system; Healthcare cost; Protection schemes; Government subsidies; IP claims

Background

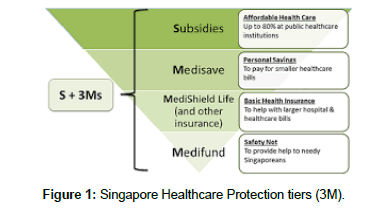

There are different approaches to healthcare that countries can emulate in their quest of improving the efficiency and lowering the cost of healthcare among its citizens [1]. There is France healthcare multi-payer system that is high-performing and is ranked among the best healthcare system on the rankings provided by the World Health Organization (WHO). There is also the single-payer system that is successful in Canada, a reflection of simplicity, or the hybrid approach that works well in Germany [2]. Moreover, the Scandinavian countries healthcare systems that have been excellent over the years. There is the National Health Services (NHS) of the United Kingdom and the similar social security system in Thailand. The Singapore model differs from these models or approaches. In 2014, Singapore healthcare system was ranked in position one in relation to efficiency globally by Bloomberg [2]. Singapore is even ranked above some of the most developed countries in the world in terms of excellent healthcare systems including the United States of America. In fact, in the US, the government has been urged to dispose the Obama Care and instead copy the Singapore healthcare system, referring it as a “Miracle” [3]. The Singapore government does not spend a lot on healthcare. The government using funds from the state taxes is responsible for funding one-fourth of the total health cost in Singapore. This is only 4% of the Singapore Gross Domestic Production (GDP) that caters for the healthcare expenditure, which is relatively low in relation to many developing countries [1]. In most developing countries, there is an emerging demographic problem in relation to healthcare in relation to the aging population. The elderly population is on the rise rapidly, whereas that young population who ought to take care of them is shrinking significantly. The majority of the cost in Singapore is paid by the citizens and their particular employer [4]. There is a universal healthcare coverage system for their citizens, which is based on the two philosophies: affordable healthcare to all citizens and individual responsibility. The Singapore government has secured excellent healthcare system to its population through utilization of market-based mechanisms to facilitate transparency and competition, a mixed financing scheme and acquisition and extensive use of technology to facilitate excellent delivery of healthcare services. There is universal coverage and various protection layers to ensure good healthcare including government subsidies and schemes such as Medisave, Medishield life and the Medifund [4]. Additionally, there are various private insurances for individuals who can afford private healthcare services.

Literature Review

The unique approach that Singapore approaches its healthcare system is a model that has drawn attention from a number of health analysts, academician and other researchers from different countries. Data from the World Health Organization (2017), Singapore has a total population of 0ver 5.6 million people [5]. The life expectancy in Singapore at birth is 80 years for males, while 86 years for females. Moreover, World Health Organization (2017) also indicates that the probability of any individual to die between the age of 15 years and 60 years in males is 71 per 1000 population while 39 per 1000 for females. The total expenditure on health per capital in 2014 was 4,047 (Intl $), while the total health expenditure as the percentage of GDP was 4.9% (World Health Organization, 2017). One of the major qualities and features that the Singapore Healthcare system has been praised for is that it is able to provide quality world-class services at a relatively low cost to the nation. This is mainly because the cost is borne by the users from compulsory saving in the shape of Medisave. Singapore also believes in preventive health care where the citizens are continuously encouraged to lead a healthy lifestyle. The government linked community centers has various exercise based activities. Health screening is made available for elders at the clinics at virtually no cost. Singapore has been able to produce World-class outcomes similar to most-developed countries globally [6], but the most amazing thing is that it has been able to achieve that with a fraction of the total cost of offering such high-quality care. Singapore has been able to attain noteworthy quality in the provision of healthcare services in every healthcare department, putting into consideration common measures used in evaluating healthcare systems [6]. The country has been able to increase the life expectancy levels of its residents and also significantly increased the survival rates of infants as well as attained under-five mortality rates, which is one of the lowest in the world. The cancer survival rates in Singapore are similar to those in Europe and the cardiovascular disease has been nullified significantly. Currently, the cardiovascular death rate in Singapore is almost half that experienced in other nations located in the Asia Pacific region. Despite the ever rising healthcare cost globally as a result of changing disease patterns, demographic trends, expensive and new technologies, Singapore has been able to keep the healthcare cost relatively low with the country spending not more that 4% of it GDP [6].

The Health Insurance Task Force (HITF) (2016) further identifies that the Ministry of Health (MOH) in Singapore has come up with various ways that have enabled them to excellently manage the healthcare needs of the country in an affordable manner. The identified ways include the development and implementation of policies to increase drugs and outpatient services subsidies, improve the benefits associated with Medishield Life and also expand the coverage for permanent residents and Singapore Citizens for life. Another step that has been taken has been an extension of how the Medisave funds. The Health Insurance Task Force (2016) also notes that in order to improve transparency in relation to local healthcare, MOH has been publishing the sizes of various hospital bills. These actions have all been aimed at ensuring that healthcare cost is managed properly. On the other hand, the Health Insurance Task Force (2016) notes that the insurance sector has been critical in aiding the public sector to finance their healthcare expenditure. This has been through the consistent introduction of health insurance schemes and their extensive coverage. For instance, the Integrated Shield Plan (IPs) that offers almost two-thirds of the Singapore population with extra insurance coverage apart from the Medishield that offers life insurance coverage.

Health insurance schemes

The public healthcare financing in the country is composed of the Medisave, MediShield, and medifund, which are generally referred to as the ‘S+3M’. Additionally, there is the Eldershield which was initiated recently. Medisave is a second tier protection coverage that is mandatory for all individuals. Medisave is a saving account that is dedicated to medical expenses that enable Singapore residents to comfortably pay for their medical treatments gradually with less difficulty. Any Singaporean, who is employed, contributes to the Medisave with the help of their employer by saving a certain fraction of their salary for future medical expenses. Medisave is portable from job to job and even after retirement. One is allowed to use Medisave to pay various medical bills including Private Medical Insurance (PMIS) and Shield Premiums. Medisave is compulsory personal savings dedicated to healthcare. Of-course those with no Medisave could become a burden on society. However these are very low numbers as anyone who had ever worked for a salary would have Medisave. Furthermore, those doing their own business also need to contribute to their Medisave accounts before they are issued renewal of their business license. The skeptics will even argue that for the elders who have no Medisave, there is a law allowing the suing of their children to foot the bills.

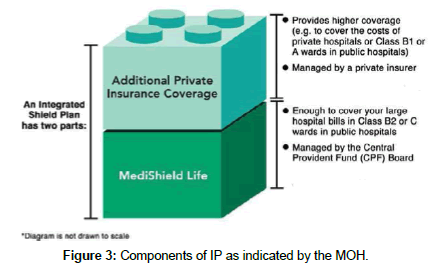

The MediShield Life, which is a third tier protection that replaced MediShield since 2015. The MediShield Life is a health insurance plan that is basic and its major use is to pay some selected outpatient treatments that are costly and huge hospital bills including cancer chemotherapy and dialysis among others. This insurance plan is mainly for treatments that are subsidized in public hospitals. All Singapore Residents and Citizens are covered for life by MediShield Life even in cases where there is a fatal pre-existing sickness or condition. Through MediShield Life co-payment features, personal responsibilities for healthcare needs of Singaporeans are promoted. The government also adds affordable subsidies to keep MediShield Life premiums at an affordable range. There is also an option for Singaporeans to supplement the protection and coverage offered by Medishield Life with IPs. IPs is composed of two vital components that include MediShield Life and extra private insurance coverage that offer additional coverage and advantages. For instance, to cover healthcare cost in private hospitals. It is also important to note that as they offer extra advantages and coverage, the premiums in such cases are also higher compare to MediShield Life. The fourth tier protection and coverage is the Medifund, which include various medical endowment funds that are set up by the Singapore government to offer safety and cover for Singapore residents who may be subjected to various difficulties in paying their medical bills after utilizing other modes of payment such as Medisave, MediShield Life and IPs as well as the received Government subsidies.

When it comes to the recently set up ElderShield, is an insurance plan that is aimed for various severe disabilities. ElderShield is usually offered to individuals that to the individual over 40 years that have Central Provident Fund Board accounts. Its aim is to risk-pool these individuals against the financial difficulties that are associated with severe sicknesses or disabilities.

Private financing

On the other hand, there is the private financing present in facilitating the coverage of healthcare cost in Singapore. Hsiao [7] indicated that despite the fact that there are resources that come from public financing, there are also some private insurers. These insurance companies and organizations provide private health insurance schemes for both groups and individuals. The benefits that are present in this insurances coverage are similar to out-patient and in-patient critical sickness treatments, long-term care, surgical costs, disability care, and medical expenses. Under the private insurers, two categories of plans are usually outlined that include the Non- PMIS Private Medical Insurance and the Private Medical Insurance Scheme (PMIS). The CPF are allowed to enroll for the PMIS in order to purchase Medisave-approved Integrated Shield Plans (MISP) using Medisave savings to finance medical bills for themselves and also intermediate families when the need may arise. It is a medical insurance scheme in the case where catastrophe may arise, offering more benefits on the basis of the MediShield, which is jointly insured by the CPF Board and the private carriers. Furthermore, the private insurer may also offer non-PMIS including the individual plans and group plans.

Singapore health philosophy

Singapore healthcare system operates under various principles that guide every step and policies that are developed and implemented to facilitate effective healthcare cost management. As offers a summary of the Singapore healthcare philosophy by indicating that the Singapore Government disregards egalitarian welfarism to advocate a relatively free market since it views it as the most capable way of achieving efficiency in allocating scarce resources [8]. However, since it is aware of the various defaults that may be prevalent in the healthcare market, the government comes in where necessary via incentives to facilitate demand-side responsibilities and at the same time discouraging supply-side waste. As a result of various government subsidies, Singapore citizens are able to afford basic health care [8]. Through state-funded schemes, the needy and poor are able to be afforded various healthcare services, but only after allowing those who are capable of paying to do so. This is achieved through various public healthcare financing plans that are encouraged by the MOH, which was reviewed above (Medisave, MediShield Life, EldersShield, and Medifund). It is through these protection coverage plans and insurance that the private sector is encouraged and granting the public institutions greater autonomy that results into reduced state-funded health undertakings [8]. Consequently, it frees up various tax-based resources in order to meet health preventive and promotional activities that are advantages to the general public and other national priorities.

Nevertheless, the Singapore approach is not perfect. As Lim pointed out the Singapore healthcare system is not as perfect as it may look from the outside, but the Government has made sure that its choices are conscious in ensuring that the allocation of various healthcare resources is done right and also to tailor the circumstances and needs of its population to the healthcare system [8]. In the 1993 MOH [9] White Paper, it is outlined that, regardless of the way that is chosen to finance the healthcare cost, it is important to put into consideration that the final burden will be rested on the shoulders of the country’s residents and citizens. This is because the insurances are all paid by the people and in the cases of money from the government; it is paid by the people in form of taxes. Therefore, as the 1993 MOH white paper indicated, the question that is prevalent is on the tradeoffs that should be made in relation to competing goals including equitable access, affordability, freedom to set various prices, freedom to organize and control production and the patient freedom to choose.

Issues facing Singapore healthcare

Blümel [10] also noted that despite the fact that the Singapore healthcare system might be considered way more efficient and effective than many other nations, there are still some prevalent problems. The identified problems by these authors are those highlighted by the CPF Board that illustrated that post-retirement healthcare cost was not sufficiently covered. In particular Singapore residents who were over the 85 years, who were not sufficiently covered by Medishield. BIA [11] noted that after these individuals have fully utilized the savings, they have limited sources of healthcare financing especially if they are in severe conditions. Moreover, these authors also noted that the Singapore healthcare model was set up with no or limited social riskpooling. In any health care system, social risk-pooling is believed to offer a platform to improve its equity and efficiency in offering quality healthcare services. In cases where there is a scheme that lacks risk pooling, the individual costs belong to individuals. The non-existence of resource transfer among individuals might lead to less reasonable allocation of treatment services and products in a healthcare system. Smith and Witter [12] are also in agreement with BIA et al. [11] assertion and they also noted that the society may be burden by the healthcare cost due to the inefficiency of the citizens to finance their healthcare expenses without risk pooling.

Through evaluation of the information provided on the MOH official website, it was found that the cost and financing of the healthcare cost in Singapore is offered universally to all the citizens. There are two philosophies that are utilized which include the provision of healthcare to all individuals at an affordable rate and individual responsibility for every citizen in the country. Additionally, there is a universal coverage and different levels of protection that is a mixed way of financing. As a result, these different layers of protection make sure that everyone is covered and no one is denied basic healthcare services. Additionally, the healthcare services are affordable to everyone, since these protection tiers ensure that healthcare cost is managed effectively. Figure 1 below is an illustration of these protection tiers including government subsidies, Medisave, Medishield Life and Medifund, which are usually referred to as ‘S+3Ms’.

Additionally, in the MOH website, there indicate the presence of the Community Health Assist Scheme (CHAS), which is a plan that facilitates the Singaporean Citizens in the lower and middle-class or income households to be able to receive dental care as well as various medical care through participation in the General Practitioners as well as dental clinics that are near their home. It is through the S+3Ms and the CHAS that the Singaporean is able to offer affordable healthcare services to its residents and citizens, aiding them in managing their healthcare costs. These findings are consistent with Haseltine [6] indication that Singapore has been able to attain noteworthy quality in provision of healthcare services in every healthcare department, putting into consideration common measures used in evaluating healthcare systems.

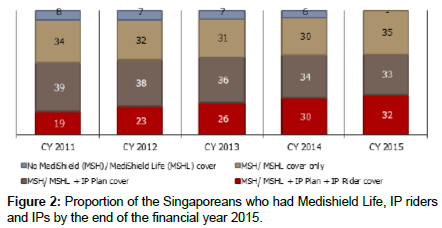

The Ministry of Health (MOH) has taken various steps over the years to ensure that they manage the healthcare cost to ensure that the Singapore public can assess affordable healthcare. These steps are inclusive of the recent shifts regarding policies to increase subsidies into a significant amount in order to cover some of the cost attributed to drugs, outpatient services, improve the benefits of MediShield life and widen its coverage for all citizens and permanent Singapore Residents. The coverage is for life. Moreover, there has also been an extension to how one can use the Medisave funds. Another noticeable step that has been undertaken in relation to effective management of healthcare cost by the MOH is the publication of hospital bills on a regular basis. This step has been taken mainly to increase the level of transparency among the Singapore healthcare institutions and improve healthcare cost at different public hospitals. The impact of these steps has been provision of quality healthcare services to the Singapore residents at an affordable rate. On the other hand, according to data collected by the MOH (2013), all Singapore residents were all covered through the MediShield Life. Two individuals out of three Singaporean had an IP. Since 2013 to 2015 the number of Singapore residents with an IP rider increased significantly to 32% in the year 2015. By 2015, one in three Singaporean had an IP rider and IP, as indicated in Figure 2 [13], which offers a breakdown on the proportion of the Singaporeans who had MediShield Life, IP riders and IPs by the end of the financial year 2015 according to the MOH statistics.

Table 1 offers the healthcare financing in Singapore from 2014 to 2016, which include the MediShield Life, Medifund, Medisave, and ElderShield. It is important to note that after 2105, Medishield was replaced by MediShield Life. Therefore all the Singapore Residents converted to the MediShield Life automatically. Moreover, the Intermediate and Long-Term Care (ILTC) were classified in the same category over the past years. FY12, Medifund application in relation to ILTC services are differentiated into three distinct categories or types including Intermediate Term Residential Services through admission, Non-Residential Services through attendance and the Long Term Residential Services through bed-months. This was done to offer a better reflection of the varying nature of the services offered. FY12 number of the ILTC Medifund Silver and Medifund applications is a summary of the various services offered in their different units. From Table 1, it is evident that in each scheme or plan, there is a significant increase from the previous 2014 to 2016 in the number of Singaporean residents that have their application approved. This is also the same case in relation to the number of finances available in each case. This is an illustration that the Singapore healthcare system through the provision of multiple protection schemes such is able to manage it healthcare cost effectively by meeting the healthcare financial needs of its citizens. These findings are consistent with Lim [8] findings that as a result of various government subsidies, Singapore citizens are able to afford basic health care. Through state-funded schemes, the needy and poor are able to be afforded various healthcare services, but only after allowing those who are capable of paying to do so.

| Medisave | 2014 | 2015 | 2016 |

|---|---|---|---|

| No. of individual Accounts (m) | 3.2 | 3.3 | 3.4 |

| The Total Medisave Balance ($b) | 70.5 | 75.9 | 82.1 |

| The Average Balance per Account ($) | 21,800 | 22,700 | 24,200 |

| Withdrawn Amount for Direct Medical Expenses ($m) | 852 | 905 | 971 |

| MediShield Life & Integrated Shield Plans | 2014 | 2015 | 2016 |

| No. of Medi Shield Life Policyholders ('000) | 3,656 | All SC/PR | All SC/PR |

| No. of Policyholders with Private Integrated Shield plans ('000) |

2,485 | 2,548 | 2,619 |

| ElderShield | 2014 | 2015 | 2016 |

| No. of ElderShield Policyholders ('000) | 1,167 | 1,220 | 1,279 |

| No. of ElderShield Policyholders with Supplements ('000) | 357 | 398 | 437 |

| Medifund | 2014 | 2015 | 2016 |

| No. of Applications Approved2 ('000) | 1,006 | 1,097 | Na |

| Grants Disbursed to Institutions ($m) | 157.5 | 162.6 | na |

Table 1: Healthcare Financing in Singapore.

Numerous Singaporeans have chosen to extend their coverage with the Integrated Shield Plans (IPs). As illustrated in Figure 3 the IPs are composed by two major components that include the MediShield Life and the Additional private Insurance Coverage. The Additional Private Insurance Coverage offers extra benefits to individuals such as covering for increased hospital charges especially when it comes to private hospitals or in other cases covering for higher cost in Class A/ B1 wards when it comes to public hospitals. MOH data indicate that over two-thirds of the Singapore residents were covered by the IP as of the year 2015. IPs has become better and widely used since they were introduced in 2005 as part of the reforms made to the MediShield. As a result of this wide and better coverage by the IPs as well as the incorporation of the IP riders, which were mainly introduced to facilitate that the needs of the policymakers are met have resulted into a general increase of the IP premiums. Consequently, the increase in the IP premium levels, there has been increased in IP claims. As of 2014, IP insurers are reported to have paid a staggering $488 million to claims. This has been a major problem to the Singapore healthcare system and it is moving to unsustainable levels.

Comparing Singapore with the United State and Germany

In the US, there is a much complicated format compared to the mixed system practiced in Singapore. Unlike in Singapore where everyone is under the MediShield Life coverage, not every US citizen or resident is covered by a health insurance. The health insurance present in the US such as the Children Insurance Program, Medicaid for the disabled and low incomes and Medicare for elders, which are all sponsored by the government, only offers protection to a certain portion of the US population. On the other hand, the private health insurers present in the US are business oriented, which is facilitated by the economic structure of the US Economy that is ‘marketoriented’. In most cases, employers in the US pay certain health insurance schemes to private sources, who also offer them healthcare services. This is unlike Singapore, where employers contribute to the MediShield Life.

Furthermore, according to latest data provided by WHO (2017), the life expectancy in the United State is relatively low compared to that of Singapore, which is associated with the efficiency of the two healthcare system. The life expectancy of males in the US at birth is 77, while that of the females is at 82. The probability of a male dying between 15 and 65 years in the US is 128 per 1000 individuals, while that of females is 77 per 1000 population. The total expenditure on health per capita in the US is 9,403 (Intl$), while the total expenditure on health in relation to the GDP percentage is 17.1%. In relations to Singapore, the life expectancy in Singapore at birth is 80 years for males, while 86 years for females. Moreover, World Health Organization (2017) also indicates that the probability of any individual to die between the age of 15 years and 60 years in males is 71 per 1000 population while 39% per 1000 for females. The total expenditure on health per capital in 2014 was 4,047 (Intl $), while the total health expenditure as the percentage of GDP was 4.9% (World Health Organization, 2017).

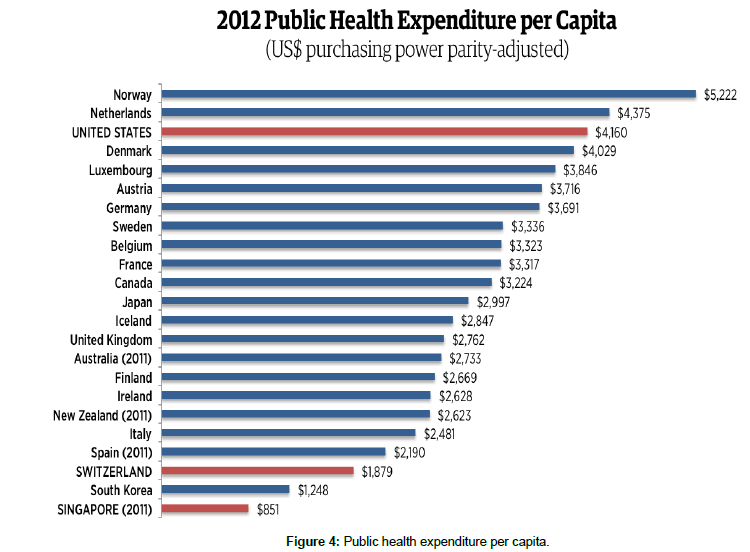

The mixed system utilized by Singapore means that the healthcare cost is shared among the citizens and the government. In the US, most of the healthcare cost is from the government. As indicated in Figure 4, in 2012, the US public health expenditure per capita was $5,222 compared to that of Singapore at $851. The Singapore healthcare system remains efficient in managing healthcare cost as opposed, which is a reflection of the outline in the 1993 MOH White Paper, where it is outlined that, regardless of the way that is chosen to finance the healthcare cost, it is important to put into consideration that the final burden will be rested on the shoulders of the country’s residents and citizens. This is because the insurances are all paid by the people and in the cases of money from the government; it is paid by the people in form of taxes.

In the case of Germany, according to the World Health Organization (2017), Germany has a total population of 0ver 80 million people. The life expectancy in Germany at birth is 79 years for males, while 83 years for females. Moreover, World Health Organization (2017) also indicates that the probability of any individual to die between the age of 15 years and 60 years in males is 87 per 1000 population while 47 per 1000 for females. The total expenditure on health per capital in 2014 was 5,182 (Intl $), while the total health expenditure as the percentage of GDP was 11.3% (World Health Organization, 2017).As indicated in Figure 4, in 2012, the Germany public health expenditure per capita was $ 3, 691, which was less than that of the US ($5,222) more than that of Singapore ($851). According to the latest OECD data [14], on Germany’s health spending, over 80% of their total spending is from the public.

Germany similar to Singapore has an effective healthcare cost management systems in place. The healthcare system in Germany operates on the basis of the Bismarck model that is composed of the public and private mix of providers and also the Statutory Health Insurance (SHI) funding. SHIs forms also part of the social insurance system, accident insurance, unemployment insurance, nursing care insurance and the pension insurance, all which are under the regulation of the Social Code Book (SGB).Germany is the sole member nation of the European Union (EU) that has SHI in coexistence with other private health insurance; offering complementary, substitutive and supplementary insurance. However, the private health insurance is separate to the pooling and funding arrangements of the SHIs but the service providers are similar. Just like Singapore, it is mandatory for all the German residents to have health insurance, a policy initiated in 2009. Over 85% of the German population was covered by the SHI in 2009, whereas 10.8% were under the private health insurance coverage. The free government medical care covered another 4% that incorporates soldiers, policemen, asylum seekers, welfare recipients’ and civil servants. Only 0.25% was not under any health insurance such as rich and poor, self-employed and individuals under voluntary insurance but did not make their payments [15-22].

Concluding Remarks

Singapore manages its healthcare cost with multiple protection schemes that are supplemented with private health insurance to cater for individual health cost. These schemes include Medisave, Medishield Life, EldersShield, Medifund and Integrated Shield Plan (IPs). As a result, these different layers of protection make sure that everyone is covered and no one is denied basic healthcare services. Additionally, the healthcare services are affordable to everyone, since these protection tiers ensure that healthcare cost is managed effectively. Government subsidies are only utilized to supplement individual medical saving and ensure that the poor and disabled are not disadvantaged.

All the Singapore residents are covered by the MediShield Life, which is mandatory in the country. The Singapore Government has been spending not more than 4% of its GDP on healthcare since most of the healthcare costs are covered by individuals. Additionally, via state-funded schemes, the needy and poor are able to be afforded various healthcare services, but only after allowing those who are capable of paying to do so. However, the Singapore healthcare system is facing one major problem, which is an increase in the number of IP claims that is moving towards unsustainable level. The increase in IP claims is facilitated by the increase in the IP premium levels.

The Singapore healthcare system is facing a crisis in relation to the rise of claims among the IP and IP Riders. Various Insurers have indicated that there the premiums levels are growing to unsustainable state. There is fear that the rise in IP claims might surpass the savings set up by the Medi Shield life, which will put more pressure on the private insurers in the long run. Therefore, for the Singapore healthcare system to be able to manage their finances well, they ought to be able to solve this challenge. To address this problem, the Singapore Ministry of Health can introduce medical fee guidelines in relation to all medical procedures, products, and services. As a result of these medical fee guidelines, all stakeholders will be aware of the professional fees to be charged and also ensure that appropriate charge are prevalent in the healthcare institutions whether public or private. This will nullify overcharging providers and help Singaporean to approximate their charges and consequently be able to manage their healthcare funds. Moreover, these guidelines will ensure that transparency is enhanced within Singapore healthcare system, improving trust and doctor-patient relationships. IP insurers can also be able to determine the sizes of the presented claims and also solve inflated claims.

Moreover, despite the presence of various protection schemes for all Singapore residents, the healthcare cost still poses a challenge especially when all the insurance coverage are exhausted Therefore, it is recommendable that Consumer education is enhanced so as to inform Singapore residents on the available options in relation to seeking medical services including the hospital, corresponding cost for various services and wards among others. Therefore consumers will be able to make healthcare decisions that are more informed and use their finances appropriately.

This paper can be useful to individuals in the health sectors in other nations, to help them comprehend how the Singapore Healthcare system manages it healthcare cost. Additionally, the recommendations can be useful to the Singapore Ministry of Health (MOH) to curb the increased IP claims. Future research studies can address areas related to the research questions how Singapore manages its healthcare questions by narrowing the question down to more specific areas. For instance, they can investigate how effective are the various protection schemes put in place in Singapore effective in helping Singapore manage its healthcare cost including Medisave, Medifund, MediShield Life and EldersShield. Additionally, future studies can evaluate the increase of IP claims and IP Premium levels in Singapore.

References

- Reisman D (2009) Social policy in an ageing society: age and health in Singapore. Cheltenham, UK.

- Lee CE, Satku K (2016) Singapore's health care system: what 50 years have achieved. Singapore.

- Henderson R (2012) Still broken: understanding the U.S. health care system. J Health Polit Policy Law 37: 559-562.

- Healthhub SG (2017) Community health assist scheme (CHAS).

- World Health Organization. (2017) Statistics. Singapore.

- Haseltine WA (2013) Affordable excellence: The singapore healthcare story. (1stedtn), Brookings Institution Press. Singapore.

- Hsiao W (1995) Medical savings accounts: lessons from Singapore. Health affairs 14: 260-266

- Lim M (1998) Health care systems in transaction II. Singapore, Part I. An overview of health care systems in Singapore. J Public Health Med.

- Ministry of Health (1993) Affordable health care: A white paper singapore. SNP Publishers, Singapore.

- Busse R, Blümel M (2014) Germany health system review. Health systems in transition 16.

- Bai Y, Shi C, Li X, Liu F (2012) Healthcare system in singapore. singapore.

- Smith PC, Witter SN (2004) Risk pooling in health care financing: the implications for health system performing. HNP Discussion Paper.

- Ministry of Health (2017) Government health expenditure and healthcare financing | ministry of health, Singapore.

- The OECD (2017) Health resources - health spending - OECD Data.

- Lim J (2013) Myth or magic: The singapore healthcare system. 1st edtn, Singapore.

- Ministry of Health (2011) Parliamentary QA: patient workload in public hospitals.

- Ministry of Health (2012) Drug subsidies. Home: Costs and Financing: Schemes and Subsidies.

- Monette DR, Sullivan TJ, DeJong CR (2005) Applied Social Research. A Tool for the Human Services.

- Privitera GJ, Forzano LAB (2013) Research methods for the behavioral sciences. (6th edtn), Cengage Learning, Massachusetts, USA.

- William N (2005) Your research project. (2nd edtn), Sage Publications, Oxford, UK.

- World Health Organization. (2017) Statistics. United States of America.

- Yin RK (2013) Case study research: design and methods. Sage Publications. London, UK.

Spanish

Spanish  Chinese

Chinese  Russian

Russian  German

German  French

French  Japanese

Japanese  Portuguese

Portuguese  Hindi

Hindi