Research Article, Res Rep Math Vol: 2 Issue: 2

Sensitivity Analysis on Regime-Switching Models by Wiener-Malliavin Calculus

Yue Liu1,2*, Yongsheng Hang2, Hongxing Yao2 and Yan Chen2

1School of Physical and Mathematical Sciences, Nanyang Technological University, China

2School of Finance and Economics Jiangsu University, China

*Corresponding Author : Yue Liu

School of Physical and Mathematical Sciences, Nanyang Technological University, Finance and Economics Jiangsu University, China

Tel: +86 15905288730

E-mail: h.zheng@imperial.ac.uk

Received: July 27, 2017 Accepted: March 01, 2018 Published: March 08, 2018

Citation: Liu Y, Hang Y, Yao H, Chen Y (2018) Sensitivity Analysis on Regime-Switching Models by Wiener-Malliavin Calculus. Res Rep Math 2:2.

Abstract

In this paper we present the sensitivity analysis on regime switching models applying the techniques of Malliavin calculus. As is well known, risk management in portfolio pricing and hedging is often achieved by estimating the Greeks, which are price sensitivities relative to variations in the model parameters. By developing this method for sensitivity analysis, we have multiple versions of Greeks expression, optimization by minimizing the variance of weight is available among those alternatives. Although the classical Malliavin calculus approach requires the differentiability of the payoff function, we extend the results for models with non-differentiable payoff function.

Keywords: Wiener-Malliavin calculus; Sensitivity analysis; Regime-switching models

Introduction

Emerging interests focus on sensitivity analysis with its wide application in risk management, especially for hedging strategy. In particular, Greeks are the sensitivities with respect to parameters in the generalized Black-Scholes’ models. Starting from Fournié et al. [1], Malliavin calculus is applied for computation of Greeks such like Delta (Δ), Rho (ρ),respectively representing the sensitivities of option value to spot price, risk-free rate. Via this approaches, fast algorithms for Greeks computations are designed. Following the method initiated on the Wiener space in Fournié and El-Khatib et al. [1,2] calculates the Greeks in a model of jump process driven by Poisson jump times. By Debelley et al. [3], sensitivities in a jump diffusion model are computed by using the Malliavin calculus. By Davis et al. [4], Malliavin calculus is applied for Levy processes and integration by parts formula is developed for Greeks calculation, where the computational effciency is assessed by comparison through Monte Carlo simulation. Using the Malliavin calculus on Poisson space, [5] computes the sensitivities for European and Asian options simulated by jump type diffusion. Applying the Malliavin calculus in time inhomogeneous jump-diffusion models, Denis et al. [6] obtains an expression for the sensitivity Theta of an option price as the expectation of the option payoff multiplied by a stochastic weight. Also, Bayazit et al. [7] presents sensitivities for options when the underlying dynamic follows an exponential Levy process. For other recent works on computation of Greeks in asset price models, c.f. also Denis and Liu [8,9].

On the other hand, Regime-switching models have been introduced by Hamilton et al. [10] in discrete time and are among the most popular and effective risky asset models. The regime switching property is reflected in the changes of states of a Markov chain, which stands for the influence of external market factors. Intensive researches about asset pricing and trading are modelled with Markovian regimeswitching, such as Yao et al. [11], Kim et al. [12], Liu and privault [13,14]. In this paper we compute the Greeks by Malliavin calculus in a generalized Black-Scholes model with regime switching that reflects the underlying changes in the state of the economy and extend the results for models with non-differentiable payoff function.

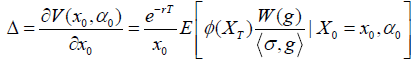

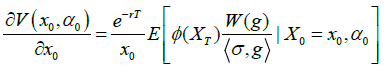

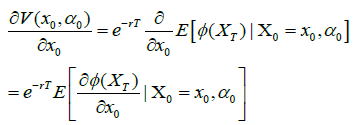

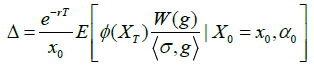

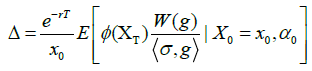

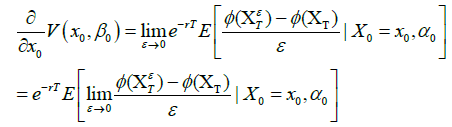

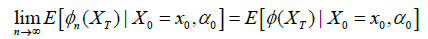

Applying the Wiener-Malliavin calculus, we compute the sensitivities in the framework of the regime switching model (2) below. For any payoff function  with bounded derivative, value function V given by (3) below, and any

with bounded derivative, value function V given by (3) below, and any  we show by Proposition 3.1 that

we show by Proposition 3.1 that

(1)

(1)

Where  note that optimal choice of g for efficient Monte Carlo simulation is achievable, by Section 4, the choice of g such that g(i)=σ(i) for all i∈{1,…, m} minimizes the variance of the weight of Δ. Other Greeks like Γ, vega, ∧ are similarly computed in Subsection 3.2-3.4. Moreover we note that,

note that optimal choice of g for efficient Monte Carlo simulation is achievable, by Section 4, the choice of g such that g(i)=σ(i) for all i∈{1,…, m} minimizes the variance of the weight of Δ. Other Greeks like Γ, vega, ∧ are similarly computed in Subsection 3.2-3.4. Moreover we note that,

i) Given  differentiating the payoff function φ inside expectation tends to be easier than our approach applying Malliavin calculus.

differentiating the payoff function φ inside expectation tends to be easier than our approach applying Malliavin calculus.

ii) In the right-hand of the expression (1), no derivative of the payoff function φ appears any more.

Based on these observations, it is tempted and necessary to relax the restriction of φ. Therefore, by Section 5, we extend the results to a class of non-differentiable payoff functions.

Formulation

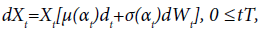

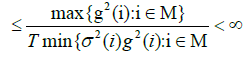

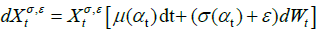

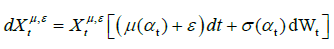

Consider a standard Brownian motion (Wt)t∈R+ and a Markov chain (αt) t∈R+, assume that they are independent and the Markov chain αt has a state space M={1,…, m}.Consider the stochastic process (Xt)t∈R+ given by the following SDE:

(2)

(2)

with  and

and  and σ: M→(0, ∞), are deterministic functions. Denote the filtration generated by (Bt)t∈R+ and (αt)t∈R+ as (Ft)t∈R+. Given a payoff function φ on

and σ: M→(0, ∞), are deterministic functions. Denote the filtration generated by (Bt)t∈R+ and (αt)t∈R+ as (Ft)t∈R+. Given a payoff function φ on  consider t

consider t

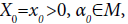

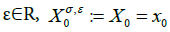

he value function V(x0, α0) defined as follows:

(3)

(3)

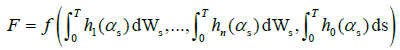

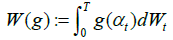

Where (Xt)t∈[0,T] follows SDE (2), r>0 denotes the risk-free rate. Then we proceed to compute the sensitivities of V(x0, 0) to the changes of coefficients in this model, such like X0=x0, μ, σ and even Q-matrix. To begin with, we recall some Malliavin operators. For any random variable F∈L2(Ω,P) of the form:

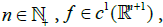

For  and deterministic functions hi: M→R, i∈{0,1,…,n}. Given F∈L2(Ω,P) in the form of (3), the gradient of F is defined by

and deterministic functions hi: M→R, i∈{0,1,…,n}. Given F∈L2(Ω,P) in the form of (3), the gradient of F is defined by

(4)

(4)

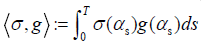

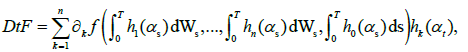

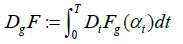

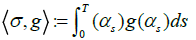

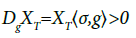

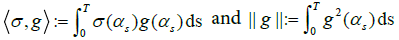

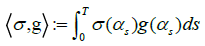

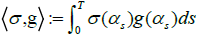

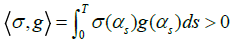

For t∈[0,T]. For any deterministic function g : MR we define

(5)

(5)

(6)

(6)

for any random variable F∈L2(Ω,P) in form of (3).

Computation of the Greeks based on the Partial Malliavin Calculus

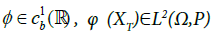

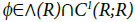

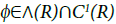

In this section, we proceed the computation of the sensitivities of V(x0, 0) to the changes of coefficients in this model, such like X0, μ, . First in this section, we assume that  and has bounded derivative, extension to non-differentiable payoff function will be shown in Section 5.

and has bounded derivative, extension to non-differentiable payoff function will be shown in Section 5.

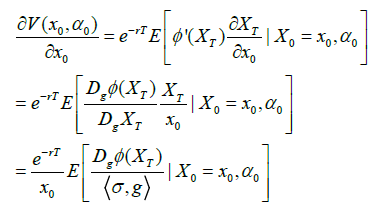

Variations in the initial price

The sensitivity of value function (2) to the initial price X0 is given by the following proposition:

Proposition 3.1 For any payoff function  with bounded derivative (Xt)t∈[0,T], defined in (2) and any g: M→(0,∞), we have

with bounded derivative (Xt)t∈[0,T], defined in (2) and any g: M→(0,∞), we have

(7)

(7)

Where

Proof

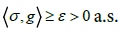

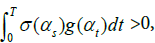

First we check that the right-hand side of (7) is well defined by the following points,

i)  for some ε>0, since σ(i)>0 and g(i) > 0 for all iM

for some ε>0, since σ(i)>0 and g(i) > 0 for all iM

ii) We show that  is integrable. Since

is integrable. Since

and Eφ(XT)2]<∞ for φ is a bounded function, we claim the integrability of

For the left-hand side, we need to show that V(x0,α0) is differentiable with respect to x0. Since φ has bounded derivative, there exists a K0>0 that  for any x∈R. We have the solution to the SDE (2)

for any x∈R. We have the solution to the SDE (2)

(8)

(8)

it follows that

which is uniformly bounded by an integrable random variable XTK0/x0.

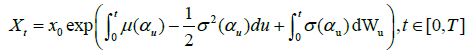

Therefore by V(x0,α0) is differentiable with respect to X0=x0 and

(9)

(9)

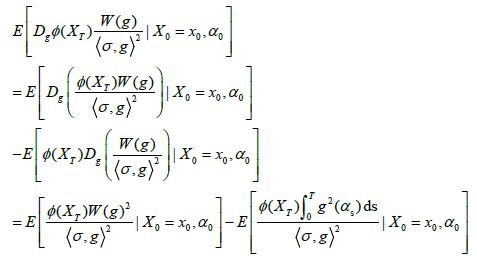

Then we continue to prove (7). It follows from (8) that XT∈L2(Ω,P) in form of (2), and we have

(10)

(10)

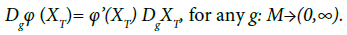

Since the payoff function  and is in form of (2), we have the following chain rule:

and is in form of (2), we have the following chain rule:

(11)

(11)

Hence by (8-10) we see that

(12)

(12)

Denote by Fα a filtration generated by {αt; t∈[0,T]}, it follows from the integration by parts formula by Lemma 1.2.1 in Nualart et al. [15] and the independence between (Wt) t∈[0,T] and (αt) t∈[0,T] that,

for any g: M→(0,∞). By (12,13), we obtain,

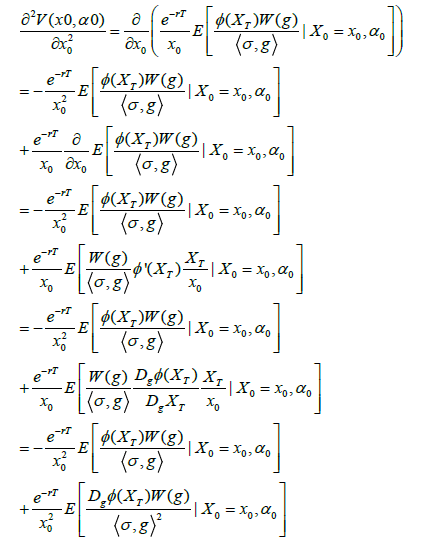

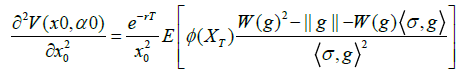

Variations in the initial price for second order

As in most context, the second derivative of the value function with respect to the initial price is denoted as . Similarly, we have,

Proposition 3.2 For any payoff function  with bounded derivative, g: M→(0,∞), and (Xt)t∈[0,T] defined in (2), we have

with bounded derivative, g: M→(0,∞), and (Xt)t∈[0,T] defined in (2), we have

Where

Proof.

(13)

(13)

Where  a.s. By the chain rule of derivative and the independence between (Wt) t∈[0,T] and (αt) t∈[0,T] we have

a.s. By the chain rule of derivative and the independence between (Wt) t∈[0,T] and (αt) t∈[0,T] we have

(14)

(14)

where in the last line we applied the integration by parts formula. Substituting (14) into (13), we see that

Where

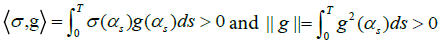

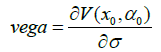

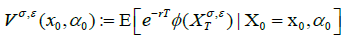

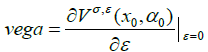

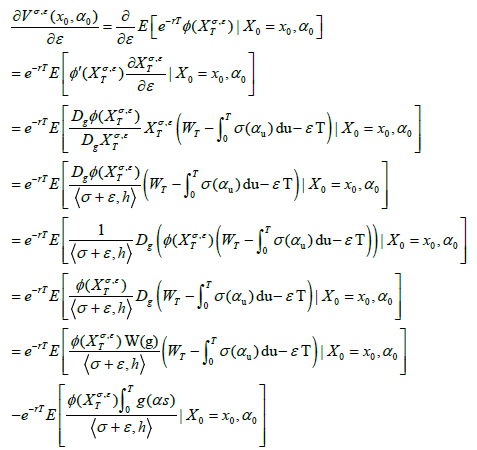

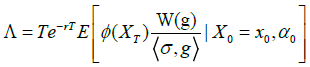

Variations in the diffusion coefficient

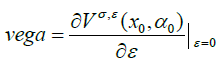

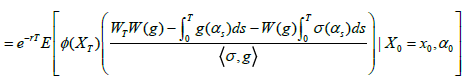

The variations in the diffusion coefficient is denoted as Vega, precisely,

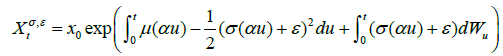

where σ is a constant parameter. In our model, σ(.) is a function on M, so there is no direct way of derivative. Instead, we introduce the perturbed process:

(15)

(15)

Where  Accordingly, we define

Accordingly, we define

(16)

(16)

Then the variation in the diffusion coefficient is given by

(17)

(17)

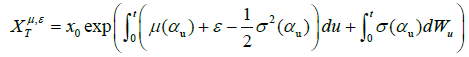

Note that the solution to (15) is

For t∈[0,T], we compute Vega by the following proposition.

Proposition 3.3 For any payoff function  with bounded derivative, g: M→(0,∞), and (Xt) t∈[0,T] defined in (2), we have

with bounded derivative, g: M→(0,∞), and (Xt) t∈[0,T] defined in (2), we have

(18)

(18)

Where

Proof. By the integration by parts formula and chain rule we have,

(19)

(19)

for any deterministic function g: M→R, ε∈R. Note by (18) that

the expression Vega in (18) is obtained by passing ε to 0 in (19).

Variations in the drift coefficient

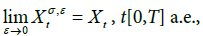

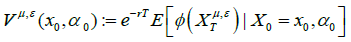

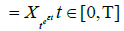

Similarly, we introduce the perturbed process for drift coefficient:

(20)

(20)

and the value function  driven by

driven by

(21)

(21)

Accordingly, we have the solution to (20) as follows,

(22)

(22)

Through a similar computation as that of Vage, we have the derivative of Vμ,ε(x0,α0) with respect to ε:

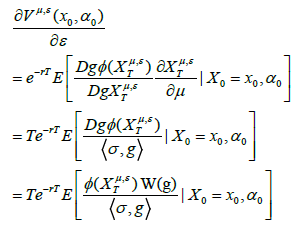

for any deterministic function g : M → R and ε∈R. Therefore, we have the following Proposition 3.4 for Lambda.

Proposition 3.4 For any payoff function  with bounded derivative, g: M→(0,∞), and (Xt) t∈[0,T] defined in (2), we have

with bounded derivative, g: M→(0,∞), and (Xt) t∈[0,T] defined in (2), we have

Where

Optimization of Convergence

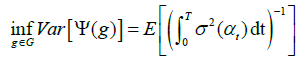

In this section, we aim at figuring out an optimal choice of g for efficient Monte Carlo simulation. Based on the computation of Theta in a jump diffusion model, Proposition 4.1 of Denis et al. [6] minimizes the variance of the weight of Theta. In our model, there exists such a problem too. We can minimize the weight by choosing a optimal g ∈ G. We gain a similar conclusion to that in Denis et al. [8].

Proposition 4.1 The weight of Delta in (7) is  then the infimum on {var[Ψ(g)]; g: M→R}is attained when

then the infimum on {var[Ψ(g)]; g: M→R}is attained when

g(i) = c(i) i ∈M;

with a constant c > 0, and is given by

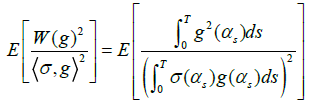

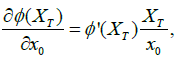

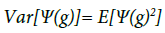

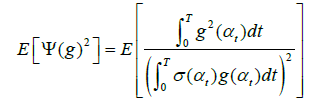

Proof. Since W(g) and  , are independent, we have E[Ψ(g)]=0 and

, are independent, we have E[Ψ(g)]=0 and

(23)

(23)

For any g : M → R, we see that  with the isometry property of W(g), we have

with the isometry property of W(g), we have

(24)

(24)

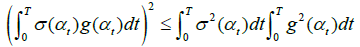

By Cauchy-Schwarz inequality,

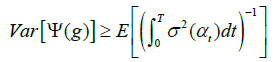

Therefore, by (4.1)-(4.3), we obtain that

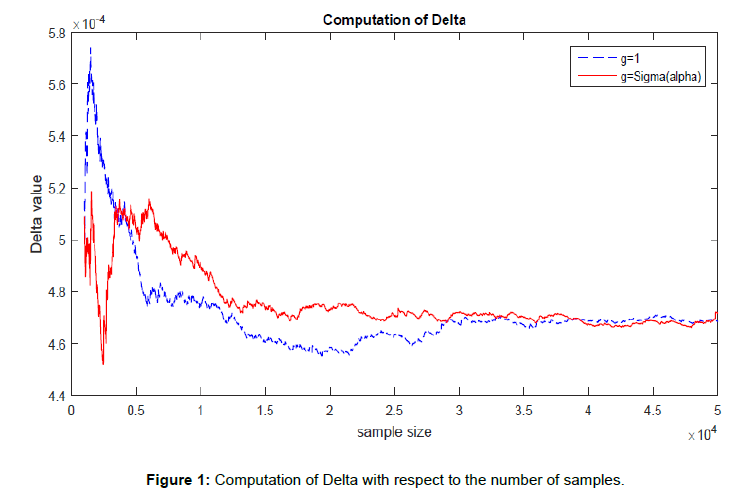

In the case of Denis et al. [8], it is proved that the best function chosen in the weight is the constant number. However, in our case, {g(i) = cσ(i) ; i ∈ M} obtains a faster convergence than {g(i) = 1; i ∈ M} does, as shown in the following (Figure 1).

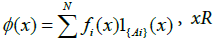

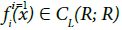

Extension to Non-Differentiable Payoff Function

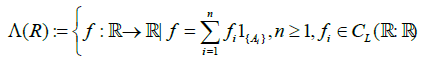

In this section, by a similar arguments as Kawai et al. [16], we show by Proposition 5.1 that the conclusion in Proposition 3.1 below is able to be extended for non-differentiable payoff function in the class ∧(R) defined as in Kawai et al. [16],

Ai are intervals of R},

Where

Proposition 3.4 For any payoff function  with bounded derivative, g: M→(0,∞), and (Xt) t∈[0,T] defined in (2), we have

with bounded derivative, g: M→(0,∞), and (Xt) t∈[0,T] defined in (2), we have

(25)

(25)

Where

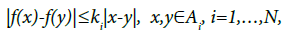

Proof. For any φ∈∧(R), there exists N≥1 and a sequence {ki∈R+; i=1,…,N}and a list of disjoint sets (A1,…,AN) such that

(26)

(26)

where  with

with

(27)

(27)

And Ai=(ai-1, ai], i=1,…,N,

With a0= -∞ and aN=∞

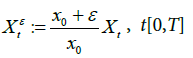

(i) First, we prove that (25) holds for  Recalling the definition (2.1) of (Xt) t∈[0,T], we let X0=x0>0, and for any ε∈R we define

Recalling the definition (2.1) of (Xt) t∈[0,T], we let X0=x0>0, and for any ε∈R we define  by

by

(28)

(28)

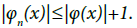

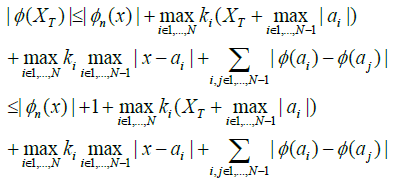

Without letting φ bounded, we can also show that φ(XT) is integrable. Since φ is continuous, by (27) we see that

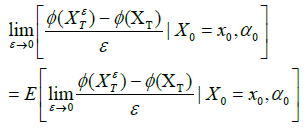

which is integrable, hence the integrability of φ(XT) is proved. On the other hand, without the bounded derivative of φ, we also show that (10) holds, namely,

(29)

(29)

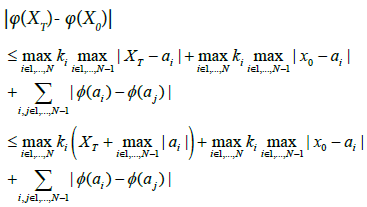

By (27) and definition (28) of XTε we see that

which is uniformly bounded. Therefore, (29) is proved by Lebesgue’s dominated convergence theorem and we have

Relation (26) follows from (31) in the case  by repeating the arguments from (10) until the end of Subsection 3.1.

by repeating the arguments from (10) until the end of Subsection 3.1.

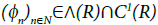

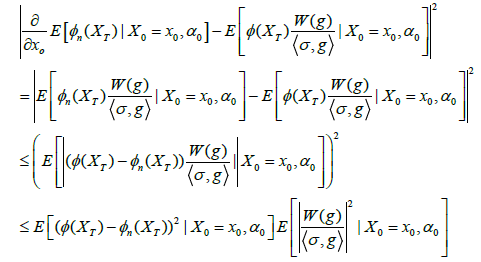

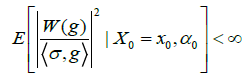

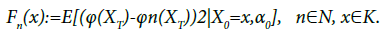

(ii) Finally, we extend from  to the class ∧(R). We will structure a sequence

to the class ∧(R). We will structure a sequence  approaching to

approaching to  By e.g. Theorem 7.17 of Rudin et al. [17] or (3:6)-(3:7) in Kawai et al. [16], it suffices to show that for all compact set K (0,∞) we have

By e.g. Theorem 7.17 of Rudin et al. [17] or (3:6)-(3:7) in Kawai et al. [16], it suffices to show that for all compact set K (0,∞) we have

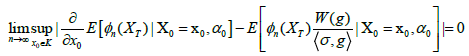

(31)

(31)

for any x0 ∈ K and

(32)

(32)

Since  is continuous on every interval (ai-1, ai), i=1,…,N, there exists a point wise increasing sequence

is continuous on every interval (ai-1, ai), i=1,…,N, there exists a point wise increasing sequence  such that

such that

(33)

(33)

For any  there exist

there exist  such that for n≥Nx we have

such that for n≥Nx we have  Since

Since  we see that, for any n≥Nx

we see that, for any n≥Nx

which is integrable, hence we can apply the Lebesgue’s dominated convergence theorem and by (34) we obtain (32). Regarding (33), it follows from (i) that (25) holds for any (n)∧(R)∩C1(R), therefore

(34)

(34)

where by (8) we have

Define a decreasing sequence (fn)n∈N of continuous functions:

zy Dini’s theorem, fn(x) pointwise decreases to 0 on K. Therefore, by (34), we complete the proof for (32).

References

- Fournié E, Lasry JM, Lebuchoux J, Lions PL, Touzi N (1999) Applications of Malliavin calculus to Monte Carlo methods in finance. Fin Stochastics 3: 391-412.

- El-Khatib Y, Privault N (2004) Computations of Greeks in a market with jumps via the Malliavin calculus. Finance and Stochastics 8: 161-179.

- Debelley V, Privault N (Sensitivity analysis of European options in jump discussion models via the Malliavin calculus on the Wiener space Preprint) Sensitivity analysis of European options in jump discussion models via the Malliavin calculus on the Wiener space. Preprint.

- Davis MH, Johansson MP (2006) Malliavin Monte Carlo greeks for jump diffusions. Stoch Process Appl 116: 101-129.

- Bavouzet MP, Messaoud M (2006) Computation of Greeks using Malliavin's calculus in jump type market models. Electron J Probab 11: 276-300.

- Denis L, Nguyen TM (2016) Malliavin calculus for Markov chains using perturbations of time. Stochastics 88: 813-840.

- Bayazit D, Nolder CA (2013) Sensitivities of options via Malliavin calculus: applications to markets of exponential Variance Gamma and Normal Inverse Gaussian processes. Quant Fin 13: 1257-1287.

- Denis L, Nguyen TM (2016) Sensitivities of options via Malliavin calculus: applications to markets of exponential variance Gamma and normal inverse Gaussion processes. Stochastics 88: 813840.

- Liu Y, Privault N (2017) An integration by parts formula in a Markovian regime switching model and application to sensitivity analysis. Stoch Anal Appl 35: 919-940.

- Hamilton JD (1989) A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica 1: 357-384.

- Yao DD, Zhang Q, Zhou XY (2006) A regime-switching model for European options. In: Stochastic processes, optimization, and control theory: applications in financial engineering, queueing networks, and manufacturing systems. Springer, Boston, USA.

- Kim J, Jeong D, Shin DH (2014) A regime-switching model with the volatility smile for two-asset European options. Automatica 50: 747-755.

- Liu Y, Privault N (2017) A recursive algorithm for optimal selling in regime switching models. Methodol Comput Appl 1702: 1-16.

- Liu Y, Privault N (2017) Selling at the ultimate maximum in a regime-switching model. Int J Theoretical Appl Finance 20: 1750018.

- Nualart D (1995) The Malliavin Calculus and Related Topics. Probability and its Application. Springer, Verlag, USA.

- Kawai R, Takeuchi A (2011) Greeks formulas for an asset price model with Gamma processes. Mathematic Fin 21: 723-742.

- Rudin W (1964) Principles of mathematical analysis. McGraw-hill, New York, USA.

Spanish

Spanish  Chinese

Chinese  Russian

Russian  German

German  French

French  Japanese

Japanese  Portuguese

Portuguese  Hindi

Hindi