Research Article, J Tourism Res Hospitality Vol: 10 Issue: 3

Airlines' Pricing Strategies and O-D Markets: Theoretical and Practical Pricing Strategies

Mohamed Ramadan R Abdelhady*, Mostafa Mahmoud H AbouHamad

Associate Lecturer at The Faculty of Tourism and Hotels, Fayoum University, Fayoum, Egypt

- *Corresponding Author:

- Mohamed Ramadan R Abdelhady

Associate Lecturer at The Faculty of Tourism and Hotels, Fayoum University, Fayoum, Egypt

Tel: 201027721739

E-mail: mrr11@fayoum.edu.eg

Received Date: October 12, 2020; Accepted Date: March 08, 2021; Published Date: March 15, 2021

Citation: Abdelhady MRR, AbouHamad MMH (2021) Airlines’ Pricing Strategies and O-D Markets: Theoretical and Practical Pricing Strategies. J Tourism Res Hospitality 10:3.

Copyright: © All articles published in Dental Health: Current Research are the property of SciTechnol, and is protected by copyright laws. “Copyright © 2021, SciTechnol, All Rights Reserved.

Abstract

Successful marketing strategies are just as substantial as the engineering for the airlines to survive. Part of the marketing mix is the pricing policies of the aviation industry. This is specifically paramount for airlines to increase the market share in the aviation industry and to generate the revenue desired. Although it is conclusive for the airlines to offer competitive fares, academic studies are rare in such a field. If there are airlines-related academic studies or literatures available, they usually concentrate on the whole marketing mix elements (4Ps) but not on pricing itself. The study aims at highlighting onpricing strategies and O-D marketsofFSCs and LCCsbased on monitoring of air ticket prices in different markets and in different time periods. Furthermore the authorswould like to find out how airlines set their pricing strategies to compete in a fast- growing and highly competitive market.The findings indicated that the airlines’ fares increase monotonically over time, peaking a few days before the departure. The results also revealed that the volatility of fares increase in the last four weeks before departure, which is the period when the airlines can formulate a better prediction for a flight’s load factor (LFs). Airlines attempt to segment the demand in each origin-destination (O-D) market by offering different combinations of price levels and restriction bundles, or fare products, designed to appeal to different groups of potential travelers with different levels of willingness to pay. In an effort to achieve this segmentation of demand, airlines impose purchase and travel restrictions on lower fares designed to act as ‘fences’ to prevent passengers with higher values of willingness to pay (WTP) for air travel from buying at a discount.

Keywords: The Aviation Industry, Pricing Strategies, RPKs, LFs, ASKs, LCCs FSCs, O-D Markets, GDSs

Introduction

The early 20th century witnessed myriad aviation developments as new planes and technologies entered service. During the First World War, the airplane also proved its effectiveness as a military tool and, with the advent of early airmail service, showed a great promise for commercial applications [1] The air transport industry first appeared in the middle of the 1920s (Rapp, 2000) when first scheduled commercial airline took to flight in 1914 [2], and after the Second World War, in the 1940s, it has experienced tremendous growth [3,4]. Nowadays, air aviation sector has faced critical stages of expansion; the gap among travelers’ expectations and perceptions is one of the most significant elements of the air services industry [5]. In addition, interaction between purchasers and vendors is facilitated by one or more Mediators [6] As organizations stick to pursue more international strategies, the need to be able to understand customers in faraway places is increasing [7]. The differences in passenger’s profiles and expectations are valuable proof to airlines in understanding their passengers and designing their marketing strategies [8] whereas marketing is more than advertising or selling [9]. Sensitivity to price is the most important major factor affecting purchasing decision [10- 11]. According to [12], the top 3 factors that impact airline loyalty are ticket prices (37%), flight schedule (17%) and onboard comfort (16%).

According to recent circumstances, the price became the only element of the marketing mix, which is exposed to change constantly, more than any other element [13] as well as producing revenues [14]. Others, however, are related to expenses that are also the most flexible element of marketing strategy [15]. Thus, Pricing is one of the main problems facing the administration and it has been an age-old management issue [16]. Although LCCs were able to attract passengers on the basis of value for money [17-19] they discovered awkwardness in retaining and building loyal passenger base [20]. Thus, In order to struggle the rivalry and to be sustainable, airlines have to take in consideration the cornerstones of air transport industry, apply a convenient strategy, and improve continuously 21. The highly air transport competition has grown extremely [22-28] since air transport deregulation in the US in 1978 [29-32] thereafter, intra- EU in the 1990s [33-39] and since then the cost of air travel in the US and Europe has fallen and the size of the airline industry has grown rapidly [40].

Theoretical Pricing Strategies

Cost-Based Pricing

Microeconomics textbooks make reference to the practice of marginal cost pricing‖ in which the producer sets prices equal to the marginal cost of producing an incremental unit of output. This practice is one of the theoretically optimal conditions of perfectly competitive‖ markets, which do not exist in the real world. In the short run, the costs to an airline of operating a schedule of flights are effectively fixed. The commitment to operate a scheduled service irrespective of the number of passengers on board means that not only aircraft ownership costs, but crew costs and even fuel costs, can be considered as fixed for a planned set of flights. The marginal costs of carrying an incremental passenger are therefore very low- essentially the cost of an additional meal and a very small amount of incremental fuel. Therefore, airlines could not possibly cover their total operating costs under a strict marginal pricing scheme in which marginal costs are attributed to an incremental passenger carried on a flight. An alternative approach to cost-based pricing is that of average-cost pricing. Under this pricing principle, an airline would set its prices in all O-D markets based on system-wide operating cost averages per flight or per available seat kilometer (ASK).This is, in fact, the pricing principle used under regulated airline regimes, as described above, so its use is feasible in airline markets, but its shortcomings are what led to the deregulation of airline pricing in the first place. Averagecost pricing ignores airline cost differences in providing services to different O-D markets. It allows smaller markets to benefit (with artificially low prices) at the expense of higher-density markets that airlines can serve more efficiently (e.g., with larger aircraft). Some have argued that average-cost pricing ensures equity;if we believe that air travel at equal prices per kilometer traveled represents a form of air transportation equity [41,42].

Demand-Based Pricing

The principle of demand-based pricing is based on consumers’ willingness to pay, as defined by the price– demand curve in each O-D market. The underlying assumption is that there are some consumers who are willing to pay a very high price for the convenience of air travel while others will only fly at substantially lower prices. Under this approach, airlines charge different prices to different consumers with different price sensitivity. The price elasticity’s of different demand segments and different O-D markets reflect their sensitivity to the prices of air travel, and the airline sets different prices for each segment in an attempt to maximize its total revenues. Demand-based pricing results in different prices for different O-D markets even for different demand segments within the same market. These price differences are not related to cost differences experienced by the airline in providing services to the different demand segments, only to the differences in price sensitivity, demand elasticity and willingness to paythis practice is referred to as strict price discrimination by economists [41].

Service-Based Pricing

The third theoretical pricing principle uses differences in the quality of services (and, in turn, in the cost of providing these services) as a basis for pricing. Even under US regulation of airline prices, some service distinctions were allowed in airline pricing structures (i.e., first class vs. economy class) due to the different costs to the airlines of providing them. In theory (and in practice), the notion of fare product differentiation can be extended beyond this simple first- vs. economy-class distinction. Unlike demand-based pricing, servicebased pricing has a differential cost basis for the airline. Because higher-quality services generally cost the airline more to produce, this approach cannot be considered price discrimination. Even if the onboard product (i.e., economy seat and meal service) are the same, lower fares with advance purchase requirements actually represent an opportunity cost savings to the airline, as the airline is better able to reduce uncertainty about loads on future departures and reduce the risk of lost revenue potential from empty seats [41].

Airlines Pricing Policies

Airline companies and retail chains are good examples of industries where dynamic pricing policies are becoming key drivers of the companies’ performance [43]. Price represents the most powerful marketing factor for airlines, especially for Low-cost carriers, while being a long-term factor for customer loyalty. For pricing LCCs use a mixed calculation, i.e. the average ticket price determined by cost accounting procedures serves as a basis for the offered prices. The air flights are sold at different prices with some of the tickets undercutting traditional airlines significantly and being distributed at a loss, which in turn is compensated for by high-priced tickets, often exceeding the fares of full service carriers. In contrast to traditional pricing policy, time-related price discrimination is implemented through penetration pricing. At first, low base prices (initial prices) corresponding to the strategic pricing policy aims are determined, i.e. market-orientated pricing based on competition and demand is undertaken [30]. These base prices are communicated to the passengers in order to make them book early [44]. Airline pricing strategies is a crucial factor of the air services marketing and a complicated issue [44,45]. In the past, air transport market was traditionally characterized by intensive usage of traditional carriers, with higher fares and different services and qualities. The penetration of LCCs on the market and their consequent consolidation are contributing to changes in air travel demand, making price perhaps the most important factor in choice of carrier. As well as often offering much lower prices than legacy airlines, LCCs offer some trip attributes which are positively valued by business passengers [46]. Currently, price wars are the fact of air transport industry [47]. Airline companies attempt to segment the demand in each origin-destination (O-D) market by offering different combinations of price levels and restriction bundles, or fare products, designed to appeal to different groups of potential passengers [48] with different levels of willingness to pay [49]. The success of LCCs business model was supported by the fact that the relationship between the passenger and FSCs was impacted by lack of trust. Pricing structures that were difficult to understand by the customer combined with a long list of complicated fare rules, resulted in the perception that all this was only designed for the purpose of confusing the customer and taking advantage of them by charging too high prices [38]. Subsequently, pricing is considered an important strategic factor that represents one of the core functions of an airline, pricing policies that may be applied in the air transport sector could be the matching or penetration strategy (match or even offer prices below those offered by other airlines) with the goal of gaining or preserving market shares or a skimming strategy (keeping prices higher than competitors) aiming at skimming the market of wellpaying passengers [50].

Pricing Strategies of FSCs

Air transport industry went through a long growth. The process of globalization, internationalization and many other factors greatly increased the amount of passengers. Trade agreements, expansion of cargo transportation caused greater mobility of business travelers. The behavior of leisure passengers also changed. All these factors have had a notable impact on creating of the airline pricing strategies [51,52] and it is well-known that air carriers use a variety of mechanisms to price discriminate between customers with different willingness to pay for travel [53]. In different industries, firms use a great number of approaches so as to understand the customers’ behavior and sell their services or products with the highest profit margin. One of them is revenue management (RM) [54]. Revenue management is a set of special pricing strategies developed by airlines [55] which has a long history starting with the air transport deregulation in the late 1970s [56]. RM let airlines survive without government support [57]. For the last few decades, the airlines all over the world have started to use this strategy. FSCs offer a wide range of class of service (first class, business class and economy class) with various sale conditions [58] and restrictions within each reservation booking designator (RBD) and each cabin so as to have the possibility to charge different types of passengers with different prices. Discriminant pricing or price differentiation is the underpinning of RM. Unbundling takes this to a new level and dimension [59], and thus RM is to maximize revenues by adjusting fares dynamically and controlling capacity Likewise, many FSCs offer last-minute deals, either directly or via mediators. The current prevailing practice is to control demand via seat allocation to various classes rather than by offering a single class and letting price be the sole variable that controls demand [60]. Last-minute prices, which are perceived by passengers as being fuel field as time goes on thus increasing the risk of booked out flights, conveys to the passenger the idea of a price guarantee, so there will be no cheaper prices for a certain flight at a later point in time. As booking goes on, pricing becomes more cost-orientated. FSCs prices increase as thedeparture date draws closer [61-63] and this period is characterized by a lower price elasticity of demand.

Pricing Strategies of LCCs

The practice of dynamic pricing typical of LCCs is generally regarded as a form of price discrimination between business passengers and leisure passengers on a single trip. Price is the weapon of many LCCs in the competition for market share [64] which has become a major competitor in the air transport industry all over the world [65]. LCCs, such as Easy Jet and Ryanair in Europe and Southwest and JetBlue in the U.S. are forcing major changes in pricing schemes [66-67], as LCCs caused a reduction in airfares offered by FSCs [68- 69]. Airlines are improving their revenue through ancillary services. At the same time, the European Union and other governments are regulating the industry in order to protect the consumer from inappropriate commercial practices. This regulation has resulted in some airlines finding innovative ways to ensure the consumer will at least consider purchasing some of these ancillary services while still remaining compliant with the legislation [70]. LCCs generally unbundled most, if not all, services offered to passengers including in-flight services, booking and check-in, with the objective of offering a basic service with all additional services provided for a fee. The success of this approach to pricing is evidenced by the growing popularity of LCC style operations [71]. Few of LCCs segment market on the basis of willingness to pay for the air ticket with different conditions and restrictions. On the contrary, most of LCCs offer a single price, at any time, for secondary of service at each departure. This fare is mostly growing with approaching departure. As offered air tickets are one-way tickets, these tickets are nonrefundable [72- 73] and ticket changes are either completely prohibited or subject to any administrative change fee LCCs business model targeted precisely that market, through very low fares. As a result, a significant share of the market was suddenly able to travel. This explains the success of the LCCs concept which was able to offer low fares and, with it, conquer the market that was previously economically excluded from flying.A precondition for success was that low fares could only be sustainable if there was a low-cost operation. So, in fact, the low-cost is a condition for the strategy followed and not the strategy itself. In this way, the most correct designation for these services should be low fare airlines (LFAs), instead of LCCs [74].

Factors Affecting Airline Pricing Strategies

The deregulation of the aviation industry in the US in the 1970s provided airlines control over most essential marketing variables such as pricing, capacity, market entry and exit [75]. Although, under regulation, network carriers not allowed to set their airfare prices, rather all airfares had to approve by government authorities, the air transport deregulation in 1978 permitted airlines to set their airfare price. It brought a new focus to every aspect of the way airlines side travelers. After years of rival on anything price, network carriers were given free rein to determine what service they wanted to promote, at what price, and in what quantity. Network carriers could have continued to offer a single service with discounts for special groups but airline veterans had long been aware that there are two very different types of travelers: business and leisure. Firstly, business travelers are far less price sensitive. Making meetings and minimizing time on the road are as important as price especially if someone else is paying the bill. Secondly, on the other hand, leisure travelers are price sensitive, willing to adjust their schedules to save a few dollars. Thus, if there’s a single factor that has shaped airline pricing and airfares throughout the years more than any other, it is the distinction between these two types of travelers [75]. The aviation market has three sources of competition. The first is intramural competition, which means airlines compete with other airlines for the same route. The second is intermodal competition which means airlines compete with other modes of transport as trains, especially high speed trains, and cars, which give the advantage to travel at any time. The last source is intertemporal price discrimination, which means airlines compete with themselves by setting different fares in different periods of time prior to departure. Therefore, airline pricing behavior is jointly affected by all these competitive forces. Price is the most important driver of profits [76]. It is known by economists and managers to be an important tool for increasing revenue and thereby ensuring the success of the company [77]. Pricing of airfares is a rather complicated process, where air carriers not only have to consider their operational costs but also demand-side characteristics and the competitive landscape including multiple rivals [78]. Although pricing fundamentally depends on the decisions of the air carrier and the revenue management, there are three main external factors that have a significant influence on the air ticket pricing. They are as follows.

Market Structure

The air transport market structure is meant as the whole external environment, in which the airlines operate their air fleets. This environment is influenced by various governmental regulations, environmental economics, air transport rivalry, and international relations.

Operational Factors

Price is not only important from a financial point of view but also from an operational standpoint. Operational factors are wide range of factors such as online booking and fuel price, which creates a significant pressure on airlines. When airlines have higher fuel costs, they tries to shift costs to customers in the form of fuel surcharges, but prices cannot rise to a level that will not be accepted by the market or over the level of competitors, aircraft handling, and flight schedule. In general, maintaining a low number of employees per available seat kilometers (ASMs), a low salary per employee [78], and a low fuel cost allows air companies to lower their operating expense. Therefore, this achieves a cost advantage. Maintaining high revenue per revenue passenger miles (RPMs), a high load factor (LF), and a longer flight stage allows them to grow their sales and therefore achieve a revenue advantage.

Demand

Demand has a great influence on pricing strategy, especially in the air transport sector. When the demand is greater than flights shown, prices are growing. However, when the demand for air flights is less than what is offered, travelers are expected to receive discounts on ticket prices. So, if an airline wants to increase revenue, it must shift some demand from high demanded flights to flights with low demand. For instance, implementation of advance purchase rule can be a strategy for maximizing revenue for airline, which has to face capacity constraints in periods with high demand. Carriers should predict carefully the peak seasons and offer discounted tickets for flights out of this period. The result will be that passengers with low time costs who originally wanted to fly in the peak season will move to low demanded flight. Thus, modelling rivalry is especially significant in the air transport market where frequently there are one or more network carriers serving the same route. Currently, the penetration of LCCs into the European aviation industry market have led to even greater rivalry, and the shift to the internet as a means of sale airfares has resulted in up-to-date ticket prices being available at the click of a mouse, making customers much better informed [79]. Although the internet provides benefits for information searching and service buying, there are perceived fences that passengers may encounter while using the internet for airfares buying, which impeded the growth of online airfares sales [80].

Airlines’ Prices and O-D Markets

As was the case with air travel demand, airline fares are defined for an O-D market, not for an airline flight leg. That is, airline prices are established for travel between origination point A and destination point C, where AC (or CA) is the relevant market. Given the “dichotomy of supply and demand”, it is possible for travelers in the AC market to choose from many itineraries (or paths) options that can involve non-stop, one-stop or connecting flights. At the same time, a single flight leg serves many different O-D markets, each with its own set of prices. The fact that airline prices are defined only for an O-D market gives rise to the following additional observations about airline pricing. Airline prices for travel A–C depend primarily on the volume and characteristics of the O-D market demand for travel between A and C (e.g., trip purpose and price elasticity of demand) as well as the nature of airline supply between A and C (frequency and path quality of flights) and the competitive characteristics in that market (number and type of airline competitors). There is, therefore, no inherent theoretical reason for prices in market AC to be related to prices in another distinct and separate market AD, based strictly on distance traveled (even though this was more likely to be the case under previously regulated airline pricing regimes). The distance to be traveled is certainly an important element in determining the cost of providing airline service and is thus reflected in price differences between markets in many cases. However, because the other market characteristics mentioned (demand elasticity, airline supply, and nature of competition) all affect airline prices; it could well be the case that prices for travel A–C are actually lower than prices for A–D, even though A–C involves a greater travel distance. These are distinct and separate markets with different demand characteristics, which might just happen to share the joint supply of seats on a flight leg [80].

Regulated vs. Liberalized Pricing

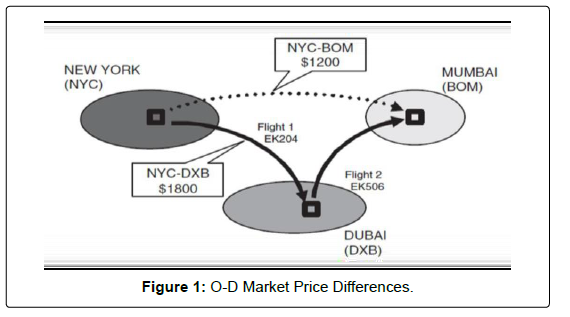

Under historical conditions of airline regulation, prices were subject to controls by the government agency. In the USA, the Civil Aeronautics Board (CAB) used a mileage-based formula to ensure equal prices for equal distances. A passenger wishing to fly on a nonstop flight from Boston to Seattle (approximately 4000 km or 2500 miles) would pay the same price as a passenger traveling on a doubleconnection service from Boise, Idaho, to Miami, Florida, covering the same distance. Airlines were required to charge the same price for either passenger, despite the fact that the Boise–Miami O-D market is substantially smaller, and the costs to the airline of providing doubleconnection service on smaller aircraft are substantially higher on a per passenger basis. In terms of different price levels, airlines were allowed to offer only first-class and unrestricted economy fare (coach or tourist class) products, both of which were tied to the mileage-based fare formula. With deregulated or liberalized airline pricing in the USA and in many countries throughout the world, this strict relationship between airline fares and distance traveled has become less apparent. Different O-D markets can have prices not related to distance traveled, or even the airline’s operating costs, as airlines match low-fare competitors to maintain market presence and share of traffic. It is also possible that low volume O-D markets that are more costly to serve on a per passenger basis will see higher prices than high-density O-D markets, even if similar distances are involved. The relationship between O-D markets and airline prices is illustrated in (Figure 1).

There are two distinct and separate O-D markets shown: New York (NYC) to Dubai (DXB) and NYC to Mumbai (BOM). Distinct and separate markets have different demand volumes, different travelers with different price and time elasticities, and perhaps even different trip purposes and currency valuations. The one-way unrestricted economy-class prices shown in Figure were in effect in November 2007 for travel in each O-D market: $1800 one way for travel on Emirates Airlines from NYC to DXB, and $1200 one way for travel on the same airline from NYC to BOM (with a connection in DXB). The comparable fare for NYC to BOM was substantially lower than for NYC to DXB, despite the substantially greater distance between NYC and BOM. This type of apparent inconsistency in airline prices occurs because the two markets are distinct and separate, with different demand characteristics, as mentioned. Moreover, competition can also explain many such inconsistencies–if a non-stop competitor offers a $1200 fare NYC–BOM, then Emirates is likely to match that fare to retain its market share of the NYC–BOM demand, even if the fare is lower than what the airline charges for the shorter-distance market NYC–DXB. In economic terms, such pricing is entirely reasonable– different markets with different demand characteristics and competitive environments are priced differently. For passengers, however, it can be perplexing, given that the NYC–BOM passenger makes use of the same NYC–DXB flight and can sit next to a passenger who paid much more in the shorter O-D market [81].

Research Methodology

The study aims to have a closer look at pricing strategies and O-D markets;The study has used ticket restrictions to estimate the effect of market concentration on price discrimination. Specifically, there were selected routes such as: (CDG-FCO-CDG// FCO-CDGFCO)– (LHR-MAD-LHR// MAD-LHR-MAD) – (FRA-IST-FRA// IST-FRA-IST))– (CAI-SHJ-CAI// SHJ-CAI-SHJ), which are served by Air France, Alitalia, British Airways, Iberia, Lufthansa, Turkish Airlines, Egypt Air, and Air Arabia. Passenger booking data were obtained from Galileo, one of the four major GDSs used by travel agents and airlines to book tickets and handle ticketing activities. These airlines are governmentally owned and now face competition in the open market, especially after the airline deregulation act of 1978 and increasing complexity of selecting airlines by passengers.In this example, each of the fares lower than the full economy (“Y”) fare has restrictions requiring advance purchase, a Saturday night minimum stay for the traveler, as well as various change fee and/or non-refund ability conditions. The restrictions become more severe as the level of discount from the full economy fare increases.

Practical Pricing Strategies

Airfares pricing have always been a source of embarrassment for travelers. What is the best time to purchase airfares? Why might travelers taking the same trip pay significantly different prices for the same seat? Why does a round trip become cheaper than the one-way flight? Is it fair to purchase an airfare for an itinerary cheaper than a ticket for just a part of it? These observations make passengers wonder why they pay higher prices for shorter flights [82,83]. Therefore, the study pursues to highlight on pricing strategies of FSCs and LCCs based on monitoring of air ticket prices in different markets and in different time periods, as follows:

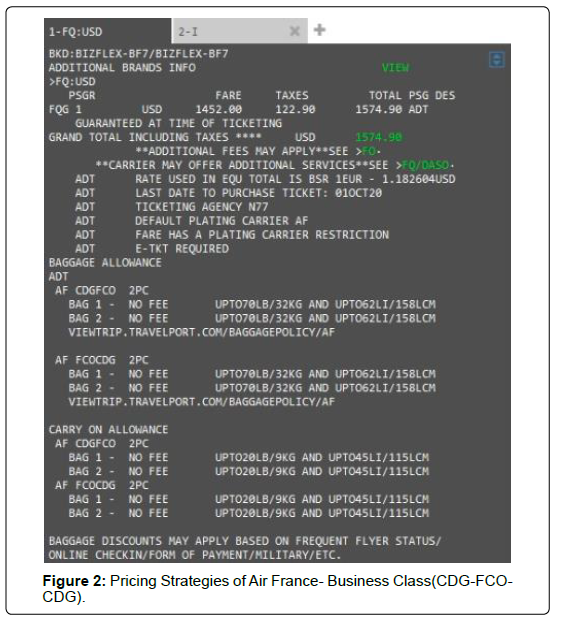

Pricing Strategies of Air France- Business Class

(Figure 2) elucidates pricing strategies of Air France, a round tripbusiness class (Paris-Roma -Paris). It turns out from the figure that the total fare of the ticket on-board of Air France (CDG-FCO-CDG)is 1574.90 USDollars (USD). The free pieces ofbaggage allowancearetwo pieces of baggage per business class passenger;the weight of one piece should not exceed 32KG per business class passenger.It is also remarkable from the figure that thepieces of carry-on baggage permitted are 2PCs of cabin baggage per business class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed9KG.

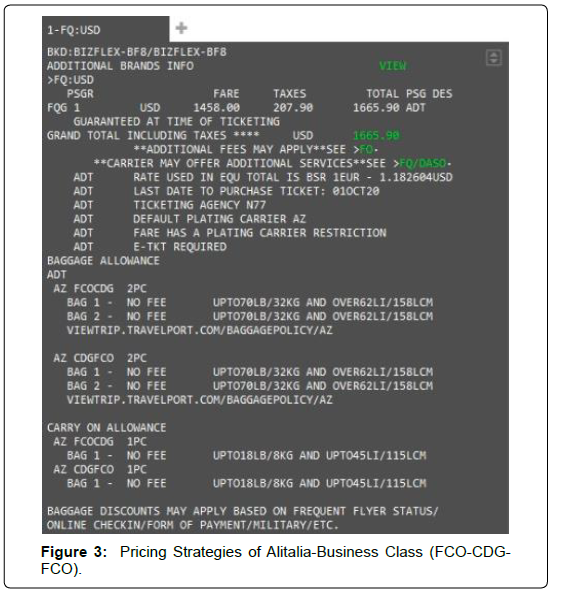

Pricing Strategies of Alitalia- Business Class

(Figure 3) clarifies pricing strategies of Alitalia, a round tripbusiness class (Roma-Paris -Roma). According to Figure 3, the total fare of the ticket on-board of Alitalia (FCO-CDG-FCO) is 1665.90 US Dollars (USD). The free pieces of baggage allowance are two pieces of baggage per business class passenger; the weight of one piece should not exceed 32KG per business class passenger. It is also remarkable from the figure that the pieces of carry-on baggage permitted is 1PC of cabin baggage per business class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 8KG.

Pricing Strategies of Air France and Alitalia- Business Class (Sky Team Alliance-FSCs)

(Table 1) demonstrates pricing strategies of Air France and Alitalia (Sky Team Alliance-FSCs), a round trip- business class (Paris- Roma–Paris// Roma–Paris- Roma). It is obvious from the table that the total fare of the ticket on-board of Air France (CDG-FCO-CDG) is 1574.90 USDollar (USD) compared to1665.90 US Dollar (USD) on-board of Alitalia (FCO-CDG-FCO). The free pieces of baggage allowance on board of Air France and Alitalia are two pieces of baggage per business class passenger; the weight of one piece should not exceed 32KG per business class passenger. It is also remarkable from the table that the pieces of carry-on baggage permitted on-board of Air France are 2PC of cabin baggage per business class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 9KG,compared to 1PC on each flight; the weight of one piece should not exceed 8KGon-board of Alitalia. Furthermore, Cancellation and Changes are permitted to Re-issue / Re-route/ Re-validation on board of Air France and Alitalia without charging reissue /rerouting penalty fees (penalty fee only).Refundable Tickets are permitted to Re-issue /Re-route without charging reissue /rerouting penalty fees.As Aircraft Cabin Classes on board of Air France and Alitalia (CDG-FCO-CDG// FCO-CDG-FCO) are economy and business classes.

| ELEMENTS OF COMPARISON |  |

|

|---|---|---|

| ➢AIRLINE ALLIANCE | ➢SKY TEAM ALLIANCE | |

| ➢TOTAL FARES | ➢1574.90 USD | ➢1665.90 USD |

| ➢BOOKING CLASSES | ➢BUSINESS CLASS | ➢BUSINESS CLASS |

| ➢ORIGIN-DESTINATION (O-D) | ➢CDG-FCO-CDG | ➢FCO-CDG-FCO |

| ➢FREE BAGGAGE ALLOWANCE | ➢ 2pcs (64 KG) | ➢ 2pcs (64 KG) |

| ➢FREE CARRY-ON BAGGAGEALLOWANCE | ➢2pcs (18 KG) | ➢ 1PC (9 KG) |

| ➢CANCELLATION CHARGES | ➢CANCELLATIONS ARE PERMITTED FOR CANCEL/NO-SHOW. | ➢CANCELLATIONS ARE PERMITTED FOR CANCEL/NO-SHOW. |

| ➢NO- SHOW CHARGES | ➢REFUND IS PERMITTED FOR CANCEL/NO-SHOW. | ➢REFUND IS PERMITTED FOR CANCEL/NO-SHOW. |

| ➢CHANGES CHARGES | ➢CHANGES ARE PERMITTED FOR REISSUE/ REVALIDATION. | ➢CHANGES ARE PERMITTED FOR REISSUE/ REVALIDATION. |

| ➢MINIMUM STAY | ➢ + | ➢ + |

| ➢MAXIMUM STAY | ➢ + | ➢ + |

| ➢AIRCRAFT CABIN CLASSES | ➢ECONOMY-BUSINESS CLASSES | ➢ECONOMY -BUSINESS CLASSES |

| ➢AIRCRAFT MODEL | ➢EQP 333/ 36(C) - 265(Y) | ➢EQP 343/ 21(C) - 227(Y) |

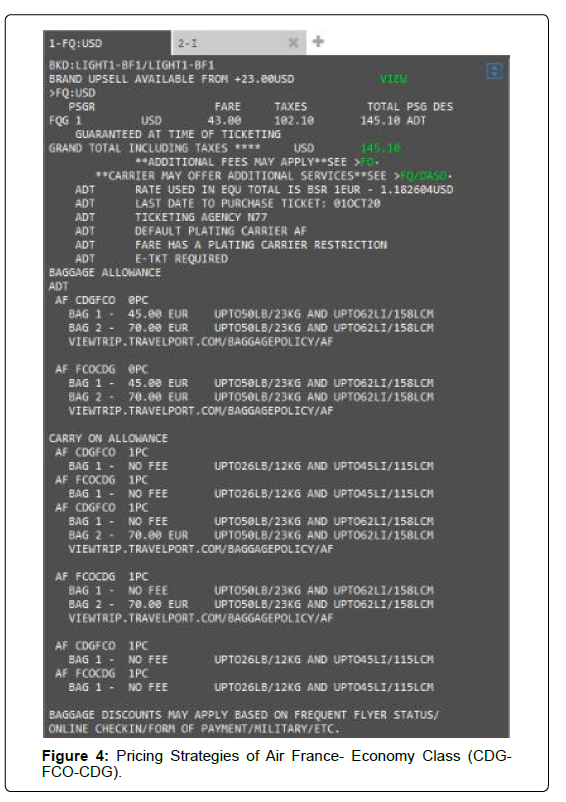

Pricing Strategies of Air France- Economy Class

(Figure 4) illuminates pricing strategies of Air France, a round trip- economy class (Paris-Roma -Paris). It turns out from the figure that the total fare of the ticket on-board of Air France (CDG-FCOCDG) is 145.10 US Dollars (USD). The pieces of baggage allowance are two pieces of baggage per economy class passenger; the weight of one piece should not exceed 23KG per economy class passenger. Air France fees are 45 Euros for the first and 70 Euros for the second checked baggage.It is also remarkable from the figure that the pieces of carry-on baggage permitted is 1PC of cabin baggage per economy class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 12KG.

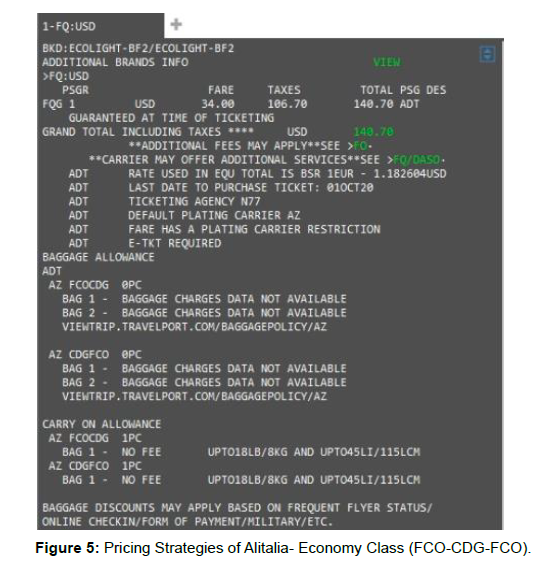

Pricing Strategies of Alitalia- Economy Class

(Figure 5) exemplifies pricing strategies of Alitalia, a round tripeconomy class (Roma–Paris- Roma). According to figure,the total fare of the ticket on-board of Alitalia (FCO-CDG-FCO) is 140.70 US Dollars (USD). The pieces of baggage allowance are two pieces of baggage per economy class passenger; the weight of one piece should not exceed 23KG per economy class passenger. Alitalia fees are 55 Euros for the first and 75 Euros for the second checked baggage. It is also remarkable from the figure that the pieces of carry-on baggage permitted is 1PC of cabin baggage per economy class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 8KG.

Pricing Strategies of Air France and Alitalia-Economy Class (Sky Team Alliance-FSCs)

(Table 2) delineates pricing strategies of Air France and Alitalia (Sky Team Alliance-FSCs), a round trip- Economy class (Paris- Roma–Paris// Roma–Paris- Roma). It seems that table assures that the total fare of the ticket on-board of Air France (CDG-FCO-CDG) is 145.10 USDollar (USD) compared to 140.70 US Dollar (USD) onboard of Alitalia (FCO-CDG-FCO). The pieces of baggage allowance are two pieces of baggage per economy class passenger; the weight of one piece should not exceed 23KG per economy class passenger.

| ELEMENTS OF COMPARISON |  |

|

|---|---|---|

| ➢ AIRLINE ALLIANCE | ➢ SKY TEAM ALLIANCE | |

| ➢ TOTAL FARES | ➢ 145.10 USD | ➢ 140.70 USD |

| ➢ BOOKING CLASSES | ➢ ECONOMY CLASS | ➢ ECONOMY CLASS |

| ➢ ORIGIN-DESTINATION (O-D) | ➢ CDG-FCO-CDG | ➢ FCO-CDG-FCO |

| ➢ FREE BAGGAGE ALLOWANCE | ➢ 0 PC(0 KG) | ➢ 0 PC(0 KG) |

| ➢FREE CARRY-ON BAGGAGE ALLOWANCE | ➢ 1PC (12KG) ` | ➢ 1PC (8KG) |

| ➢CANCELLATION CHARGES | ➢ TICKET IS NON-REFUNDABLE IN CASE OF CANCEL/ NO-SHOW. | ➢ TICKET IS NON-REFUNDABLE IN CASE OF CANCEL/ NO-SHOW. |

| ➢ NO- SHOW CHARGES | ➢ CHANGES ARE NOT PERMITTED IN CASE OF NO-SHOW. ➢ CANCELLATIONSARE NON-REFUNDABLE IN CASE OF NO-SHOW. | ➢ CHANGES ARE NOT PERMITTED IN CASE OF NO-SHOW. ➢ CANCELLATIONSARE NON-REFUNDABLE IN CASE OF NO-SHOW. |

| ➢ CHANGES CHARGES | ➢ CHANGES ARE PERMITTED FOR REISSUE/ REVALIDATION. | ➢ CHANGES ARE PERMITTED FOR REISSUE/ REVALIDATION. |

| ➢ MINIMUM STAY | ➢ 3D | ➢ 3D |

| ➢ MAXIMUM STAY | ➢ 12M | ➢ 12M |

| ➢ AIRCRAFT CABIN CLASSES | ➢ ECONOMY-BUSINESS | ➢ ECONOMY- BUSINESS |

| ➢ AIRCRAFT MODEL | ➢ EQP 333/ 36(C) - 265(Y) | ➢ EQP 343/ 21(C) - 227(Y) |

Air France fees are 45 Euros for the first and 70 Euros for the second checked baggage. It also turns out from the table that the pieces of carry-on baggage permitted is 1PC of cabin baggage per economy class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 12KG. On the other hand, the pieces of baggage allowance on board of Alitalia are two pieces of baggage per economy class passenger; the weight of one piece should not exceed 23KG per economy class passenger. Alitalia fees are 55 Euros for the first and 75 Euros for the second checked baggage. It is also obvious from the table that the pieces of carryon baggage permitted is 1PC of cabin baggage per economy class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 8KG.Non-refundable Tickets are permitted to Re-issue /Re-route without charging reissue /rerouting penalty fees on board of Air France. On the other hand, Non-refundable Tickets are not permitted to Re-issue /Re-route without charging reissue /rerouting penalty fees on board of Alitalia. Furthermore, Cancellations and Changes are not permitted to Reissue /Re-route/ Re-validation on board of Air France and Alitalia in case of no-show.These fares can carry substantial restrictions, such as an advance purchase requirement, a minimum and/or maximum stay requirement “at least one Saturday night” , penalties linked to changes, non-refundable status and non-eligibility for infant and child discounts. As Aircraft Cabin Classes on board of Air France and Alitalia (CDG-FCO-CDG// FCO-CDG-FCO) are economy and business classes.

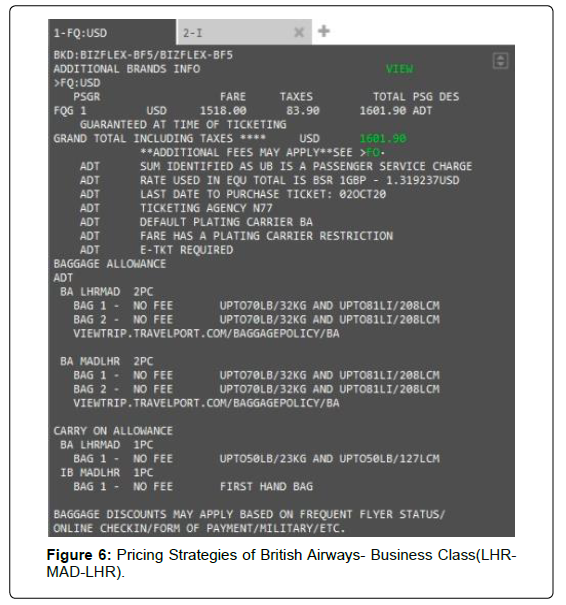

Pricing Strategies of British Airways-Business Class

(Figure 6) illustrates pricing strategies of British Airways, a round trip- business class (London-Madrid- London). It turns out from the figure that the total fare of the ticket on-board of British Airways (LHR-MAD-LHR) is 1601.90 USDollars (USD). The free pieces of baggage allowance are two pieces of baggage per business class passenger; the weight of one piece should not exceed 32KG per business class passenger. It is also remarkable from the figure that the pieces of carry-on baggage permitted is 1PC of cabin baggage per business class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 23KG.

Pricing Strategies of Iberia- Business Class(MAD-LHRMAD)

(Figure 7) illuminates pricing strategies of Iberia, a round tripbusiness class (Madrid-London- Madrid). According to fig.(7), the total fare of the ticket on-board of Iberia (MAD-LHR-MAD) is 1320.90 US Dollars (USD). The free pieces of baggage allowance are two pieces of baggage per business class passenger; the weight of one piece should not exceed 23KG per business class passenger. It is also remarkable from the figure that the pieces of carry-on baggage permitted is 1PC of cabin baggage per business class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 23KG.

Pricing Strategies of British Airways and Iberia-Business Class (Oneworld Alliance-FSCs)

(Table 3) elucidates pricing strategies of British Airways and Iberia (Oneworld Alliance-FSCs), a round trip- business class (London-Madrid- London // (Madrid-London- Madrid). According to table, the total fare of the ticket on-board of British Airways (LHRMAD- LHR) is 1601.90 USDollar (USD) compared to 1320.90 US Dollar (USD) on-board of Iberia (MAD-LHR-MAD). The free pieces of baggage allowance on-board of British Airways are two pieces of baggage per business class passenger; the weight of one piece should not exceed 32KG per business class passenger. It is remarkable from the table that the pieces of carry-on baggage permitted is 1PC of cabin baggage per business class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 23KG. On the other hand, the free pieces of baggage allowance are two pieces of baggage per business class passenger; the weight of one piece should not exceed 23KG per business class passenger. It is also obvious from the table that the pieces of carry-on baggage permitted is 1PC of cabin baggage per business class passenger will becarried in the cargo compartment free of charge; the weight of one piece should not exceed 23KG.Furthermore, Cancellation and Changes are permitted to Re-issue /Re-route/ Re-validation on board of British Airways and Iberia without charging reissue /rerouting penalty fees (penalty fee only). Cancellation and Changes are not permitted to Re-issue /Re-route/ Re-validation on board of British Airways in case of no-show.As Aircraft Cabin Classes on board of British Airways and Iberia ((LHR-MAD-LHR// LHR-MAD-LHR) are economy and business classes.

| Elements Of Comparison |  |

|

|---|---|---|

| ➢ AIRLINE ALLIANCE | ➢SKY TEAM ALLIANCE | |

| ➢ TOTAL FARES | ➢ 1601.90 USD | ➢ 1320.90 USD |

| ➢ BOOKING CLASSES | ➢ Business Class | ➢ ➢ Business Class |

| ➢ ORIGIN-DESTINATION (O-D) | ➢ LHR-MAD-LHR | ➢ MAD-LHR-MAD |

| ➢ FREE BAGGAGE ALLOWANCE | ➢ 2pcs (64 KG) | ➢ 2pcs (64 KG) |

| FREE CARRY-ON BAGGAGE ALLOWANCE | ➢ 1PC(23KG) | ➢ 1PC (23KG) |

| CANCELLATION CHARGES | ➢ CANCELLATIONS ARE PERMITTED. | ➢ CANCELLATIONS ARE PERMITTED. |

| ➢ NO- SHOW CHARGES | ➢ CHANGES ARE NOT PERMITTED IN CASE OF NO-SHOW. ➢ CANCELLATIONS ARE NON-REFUNDABLE IN CASE OF NO-SHOW. | ➢ REFUND IS PERMITTED FOR CANCEL/NO-SHOW. |

| ➢ CHANGES CHARGES | ➢ CHANGES ARE PERMITTED. | ➢ CHANGES ARE PERMITTED. |

| ➢ MINIMUM STAY | + | + |

| ➢ MAXIMUM STAY | + | + |

| ➢ AIRCRAFT CABIN CLASSES | ➢ Economy-Business | ➢ EconomyBusiness |

| ➢ AIRCRAFT MODEL | ➢ EQP 738/ 24(C) - 120(Y) | ➢ EQP 321/ 16(C) - 158(Y) |

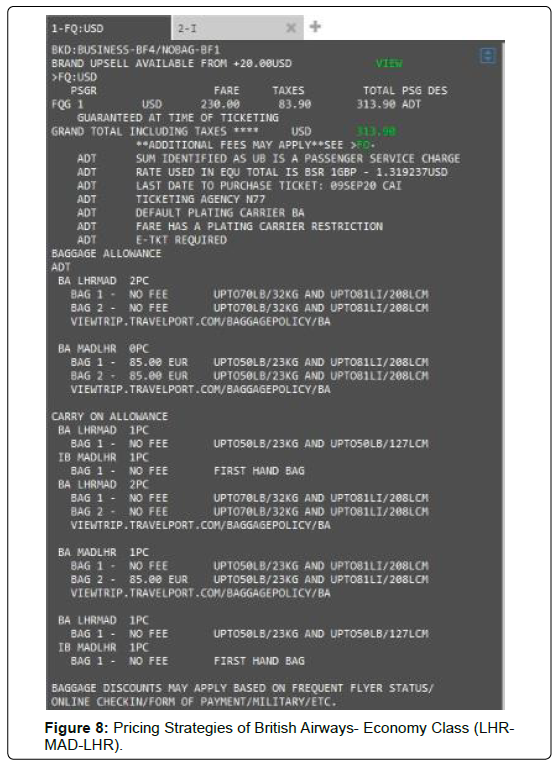

Pricing Strategies of British Airways- Economy Class (LHRMAD- LHR)

(Figure 8) clarifies pricing strategies of British Airways, a round trip- economy class (London - Madrid- London). It turns out from the figure that the total fare of the ticket on-board of British Airways (LHR-MAD-LHR)is 313.90 US Dollars (USD). The free pieces of baggage allowance are two pieces of baggage per economy class passenger (LHR-MAD); the weight of one piece should not exceed 32KG per economy class passenger. Alitalia fees are 85 Euros for the first and 85 Euros for the second checked baggage (MAD-LHR). It is also remarkable from the figure that the pieces of carry-on baggage permitted is 1PC of cabin baggage per economy class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 23KG.

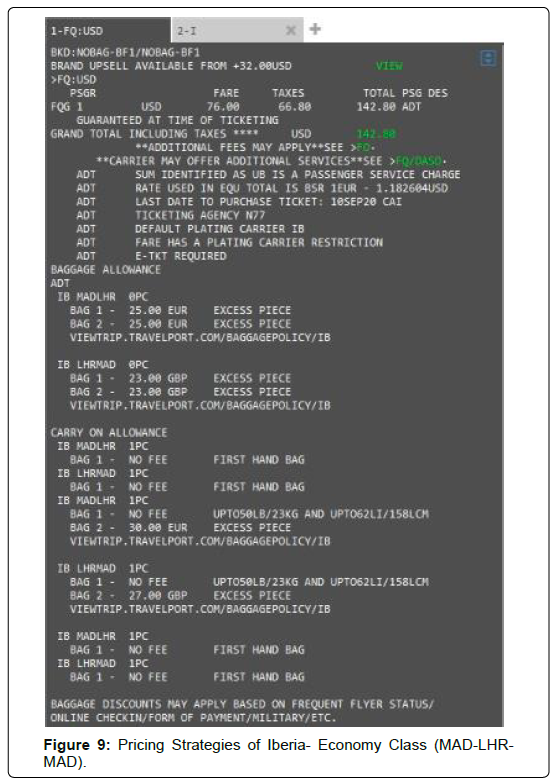

Pricing Strategies of Iberia- Economy Class (MAD-LHR-MAD)

(Figure 9) demonstrates pricing strategies of Iberia, a round tripeconomy class (Madrid-London-Madrid). According to Figure 9, the total fare of the ticket on-board of Iberia (MAD-LHR-MAD) is 142.80 US Dollars (USD). The pieces of baggage allowance are two pieces of baggage per economy class passenger; the weight of one piece should not exceed 32KG per economy class passenger. Iberia fees are 25 Euros for the first and 25 Euros for the second checked baggage (MAD-LHR)and 23 Euros for the first and 23 Euros for the second checked baggage (LHR-MAD).It is also remarkable from the table that the pieces of carry-on baggage permitted is 1PC of cabin baggage per economy class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 23KG.

Pricing Strategies of British Airways and Iberia- Economy Class (One world Alliance-FSCs)

(Table 4) exemplifies pricing strategies of British Airways and Iberia (One world Alliance -FSCs), a round trip- Economy Class (London-Madrid-London// Madrid-London-Madrid). The table confirms that the total fare of the ticket on-board of British Airways (LHR-MAD-LHR) is 313.90 US Dollars (USD), compared to 142.80 US Dollar (USD) on-board of Iberia (MAD-LHR-MAD). The free pieces of baggage allowance are two pieces of baggage per economy class passenger (LHR-MAD); the weight of one piece should not exceed 32KG per economy class passenger. Alitalia fees are 85 Euros for the first and 85 Euros for the second checked baggage (MADLHR). It seems that table assures that the pieces of carry-on baggage permitted is 1PC of cabin baggage per economy class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 23KG. On the other hand, the pieces of baggage allowance are two pieces of baggage per economy class passenger; the weight of one piece should not exceed 32KG per economy class passenger. Iberia fees are 25 Euros for the first and 25 Euros for the second checked baggage (MAD-LHR)and 23 Euros for the first and 23 Euros for the second checked baggage (LHR-MAD). It is also remarkable from the table that the pieces of carry-on baggage permitted is 1PC of cabin baggage per economy class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 23KG.Non-refundable Tickets are permitted to Re-issue /Re-route/ Re-Validation charging 130 USD on board of British Airways, Compared to 80 USD on board of Iberia. These fares can carry substantial restrictions, such as an advance purchase requirement, a minimum and/or maximum stay requirement “at least one Saturday night”, penalties linked to changes, non-refundable status and non-eligibility for infant and child discounts. As Aircraft Cabin Classes on board of British Airways and Iberia (LHR-MADLHR// MAD-LHR-MAD) are economy and business classes.

| ELEMENTS OF COMPARISON |  |

|

|---|---|---|

| ➢ AIRLINE ALLIANCE | ➢ONEWORLD ALLIANCE | |

| ➢ TOTAL FARES | ➢ 313.90 USD | ➢ 142.80 USD |

| ➢ BOOKING CLASSES | ➢ ECONOMY CLASS | ➢ ECONOMY CLASS |

| ➢ ORIGIN-DESTINATION (O-D) | ➢ LHR-MAD-LHR | ➢ MAD-LHR-MAD |

| ➢ FREE BAGGAGE ALLOWANCE | ➢ 2pcs (64KG-HR-MAD) | ➢ 0 PC (0 KG) |

| FREE CARRY-ON BAGGAGE ALLOWANCE | ➢ 1PC(23KG) | ➢ 1PC(23KG) |

| CANCELLATION CHARGES | ➢ TICKET IS NON-REFUNDABLE IN CASE OF CANCEL. | ➢ TICKET IS NON-REFUNDABLE IN CASE OF CANCEL. |

| ➢ NO- SHOW CHARGES | ➢ CANCELLATIONS ARE TICKET IS NON-REFUNDABLE IN CASE OF NO-SHOW. | ➢ CANCELLATIONS ARE NON-REFUNDABLE IN CASE OF NO-SHOW. |

| ➢ CHANGES CHARGES | ➢ CHARGE 130.00 USD FOR REISSUE/ REVALIDATION. | ➢ CHARGE 80.00 USD FOR REISSUE/ REVALIDATION. |

| ➢ MINIMUM STAY | ➢ 3D | ➢ 3D |

| ➢ MAXIMUM STAY | ➢ ➢ 3M | ➢ 12M |

| ➢ AIRCRAFT CABIN CLASSES | ➢ ECONOMY-BUSINESS | ➢ ECONOMY -BUSINESS |

| ➢ AIRCRAFT MODEL | ➢ EQP 738/ 24(C) - 120(Y) | ➢ EQP 321/ 16(C) - 158(Y) |

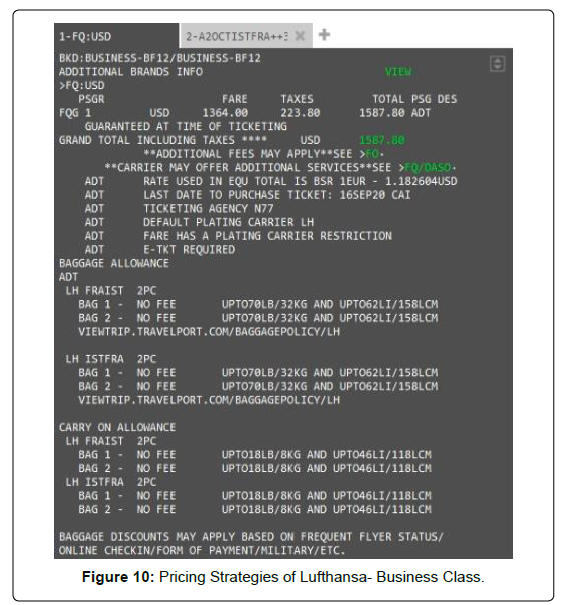

Pricing Strategies of Lufthansa- Business Class (FRA-ISTFRA)

(Figure 10) delineates pricing strategies of Lufthansa, a round trip- business class (Frankfurt-Istanbul- Frankfurt). It turns out from the figure that the total fare of the ticket on-board of Lufthansa (FRAIST- FRA) is 1587.80 US Dollars (USD). The free pieces of baggage allowance are two pieces of baggage per business class passenger; the weight of one piece should not exceed 32KG per business class passenger. It is also remarkable from the figure that the pieces of carry-on baggage permitted are 2PCs of cabin baggage per business class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 8KG.

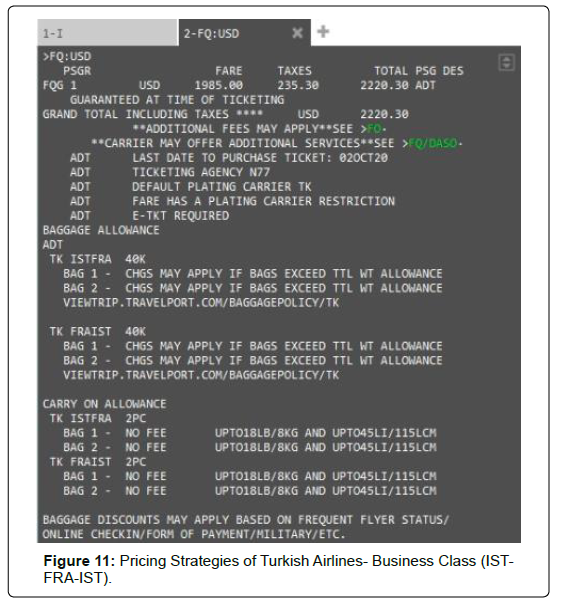

Pricing Strategies of Turkish Airlines- Business Class (ISTFRA- IST)

(Figure 11) illustrates pricing strategies of Turkish Airlines, a round trip- business class (Istanbul-Frankfurt-Istanbul). According to figure the total fare of the ticket on-board of Turkish Airlines (ISTFRA- IST) is 2220.30 US Dollars (USD). The free pieces of baggage allowance are two pieces of baggage per business class passenger; the weight of one piece should not exceed 20KG per business class passenger. It is also remarkable from the figure that the pieces of carry-on baggage permitted are 2PCs of cabin baggage per business class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 8KG.

Pricing Strategies of Lufthansa and Turkish Airlines- Business Class (Star Alliance- FSCs)

(Table 5) illuminates pricing strategies of Lufthansa and Turkish Airlines (Star Alliance-FSCs), a round trip- business class (Frankfurt- Istanbul-Frankfurt // Istanbul- Frankfurt- Istanbul). It turns out from the table that the total fare of the ticket on-board of Lufthansa (FRAIST- FRA) is 1587.80 US Dollars (USD), compared to 2220.30 US Dollar (USD) on-board of Turkish Airlines (IST-FRA-IST). The free pieces of baggage allowance on board of Lufthansa are two pieces of baggage per business class passenger; the weight of one piece should not exceed 32KG per business class passenger, compared to 40KG on-board of Turkish Airlines.According to table, the pieces of carry-on baggage permitted on-board of Lufthansa and Turkish Airlines are 2PC of cabin baggage per business class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 8KG. Furthermore, Cancellation and Changes are permitted to Re-issue /Re-route/ Re-validation on board of Lufthansa and Turkish Airlines without charging reissue /rerouting penalty fees (penalty fee only).Refundable Tickets are permitted to Re-issue /Reroute without charging reissue /rerouting penalty fees. As Aircraft Cabin Classes on board of Lufthansa and Turkish Airlines (FRA-ISTFRA // IST-FRA-IST) are economy and business classes.

| ELEMENTS OF COMPARISON |  |

|

|---|---|---|

| AIRLINE ALLIANCE | ➢STAR ALLIANCE | |

| ➢ TOTAL FARES | ➢ 1587.80 USD | ➢ 2220.30 USD |

| ➢ BOOKING CLASSES | ➢ BUSINESS CLASS | ➢ BUSINESS CLASS |

| ➢ ORIGIN-DESTINATION (O-D) | ➢ FRA-IST-FRA | ➢ IST-FRA-IST |

| ➢ FREE BAGGAGE ALLOWANCE | ➢ 2pcs (64KG) | ➢ 40KG |

| FREE CARRY-ON BAGGAGE ALLOWANCE | ➢ 2pcs (16KG) | ➢ 2pcs (16KG) |

| CANCELLATION CHARGES | ➢ CANCELLATIONS ARE PERMITTED FOR CANCEL/NO-SHOW. | ➢ CANCELLATIONS ARE PERMITTED FOR CANCEL/NO-SHOW. |

| ➢ NO- SHOW CHARGES | ➢ REFUND IS PERMITTED FOR CANCEL/NO-SHOW. | ➢ REFUND IS PERMITTED FOR CANCEL/NO-SHOW. |

| ➢ CHANGES CHARGES | ➢ CHANGES ARE PERMITTED FOR REISSUE/ REVALIDATION. | ➢ CHANGES ARE PERMITTED FOR REISSUE/ REVALIDATION. |

| ➢ MINIMUM STAY | + | + |

| ➢ MAXIMUM STAY | + | + |

| ➢ AIRCRAFT CABIN CLASSES | ➢ ECONOMY-BUSINESS | ➢ ECONOMY -BUSINESS |

| ➢ AIRCRAFT MODEL | ➢ EQP 738/ 16(C) - 138(Y) | ➢ EQP 321/ 38(C) - 147(Y) |

TablePricing Strategies of Lufthansa and Turkish Airlines, a round-trip- Business Class (FRA-IST-FRA// IST-FRA-IST)

Pricing Strategies of Lufthansa- Economy Class (FRA-ISTFRA)

(Figure 12) elucidates pricing strategies of Lufthansa, a round tripeconomy class (Frankfurt-Istanbul- Frankfurt). It turns out from the figure that the total fare of the ticket on-board of Lufthansa (FRA-ISTFRA) is 375.10 US Dollars (USD). The free piece of baggage allowance isone piece of baggage per economy class passenger; the weight of one piece should not exceed 23KG per economy class passenger. Alitalia fees80 Euros for the second checked baggage (FRA-IST), and fees 705 TRY for the second checked baggage (IST-FRA). It is also remarkable from the figure that the pieces of carry-on baggage permitted is 1PC of cabin baggage per economy class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 8KG.

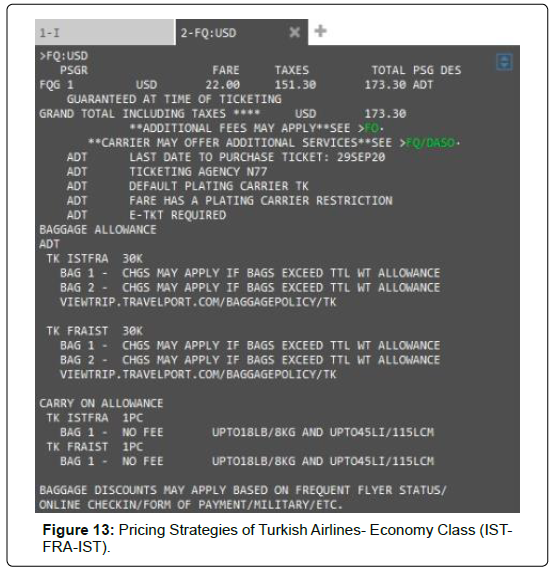

Pricing Strategies of Turkish Airlines- Economy Class(ISTFRA- IST)

(Figure 13) demonstrates pricing strategies of Turkish Airlines, a round trip- economy class (Istanbul-Frankfurt-Istanbul). According to figure, the total fare of the ticket on-board of Turkish Airlines (IST-FRA-IST) is 173.30 US Dollars (USD). The free piece of baggage allowance is one piece of baggage per economy class passenger; the weight of one piece should not exceed 30KG per economy class passenger. It is also remarkable from the figure that the pieces of carry-on baggage permitted is 1PC of cabin baggage per economy class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 8KG.

Pricing Strategies of Lufthansa and Turkish Airlines- Economy Class (Star Alliance- FSCs)

(Table 6) exemplifies pricing strategies of Lufthansa and Turkish Airlines (Star Alliance-FSCs), a round trip- Economy class (Frankfurt- Istanbul- Frankfurt // Istanbul- Frankfurt- Istanbul).It seems that table assures that the total fare of the ticket on-board of Lufthansa (FRA-IST-FRA) is 375.10 USDollar (USD), compared to 173.30 US Dollar (USD) on-board of Turkish Airlines (IST-FRA-IST).The free piece of baggage allowance on-board of Lufthansa is one piece of baggage per economy class passenger; the weight of one piece should not exceed 23KG per economy class passenger. Alitalia fees 80 Euros for the second checked baggage (FRA-IST), and fees 705 TRY for the second checked baggage (IST-FRA). It turns out from the table that the pieces of carry-on baggage permitted is 1PC of cabin baggage per economy class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 8KG. On the other hand, the free piece of baggage allowance is one piece of baggage per economy class passenger; the weight of one piece should not exceed 30KG per economy class passenger. It is also remarkable from the table that the pieces of carry-on baggage permitted is 1PC of cabin baggage per economy class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 8KG. Non-refundable Tickets are permitted to Re-issue / Re-route without charging reissue /rerouting penalty fees on board of Lufthansa and Turkish Airlines. Furthermore, Cancellations and Changes are not permitted to Re-issue /Re-route/ Re-validation on board of Lufthansa and Turkish Airlines in case of no-show. These fares can carry substantial restrictions, such as an advance purchase requirement, a minimum and/or maximum stay requirement “at least one Saturday night”, penalties linked to changes, non-refundable status and non-eligibility for infant and child discounts. As Aircraft Cabin Classes on board of Lufthansa and Turkish Airlines (FRA-ISTFRA // IST-FRA-IST) are economy and business classes.

| ELEMENTS OF COMPARISON |  |

|

|---|---|---|

| ➢ AIRLINE ALLIANCE | ➢STAR ALLIANCE | |

| ➢ TOTAL FARES | ➢ 375.10 USD | ➢ 173.30 USD |

| ➢ BOOKING CLASSES | ➢ ECONOMY CLASS | ➢ ECONOMY CLASS |

| ➢ ORIGIN-DESTINATION (O-D) | ➢ FRA-IST-FRA | ➢ IST-FRA-IST |

| ➢ FREE BAGGAGE ALLOWANCE | ➢ 1PC (23KG) | ➢ 30KG |

| FREE CARRY-ON BAGGAGE ALLOWANCE | ➢ 1PC (8KG) | ➢ 1PC (8KG) |

| CANCELLATION CHARGES | ➢ TICKET IS NON-REFUNDABLE IN CASE OF CANCEL/NO-SHOW. | ➢ TICKET IS NON-REFUNDABLE IN CASE OF CANCEL/NO-SHOW. |

| ➢ NO- SHOW CHARGES | ➢ CANCELLATIONS ARE NON-REFUNDABLE IN CASE OF NO-SHOW. | ➢ CANCELLATIONS ARE NON-REFUNDABLE IN CASE OF NO-SHOW. ➢ CHANGES ARE NOT PERMITTED IN CASE OF NO-SHOW FOR REISSUE/ REVALIDATION. |

| ➢ CHANGES CHARGES | ➢ CHANGES ARE PERMITTED FOR REISSUE/ REVALIDATION. | ➢ CHANGES ARE PERMITTED FOR REISSUE/ REVALIDATION. |

| ➢ MINIMUM STAY | ➢ 7D | ➢ 3D |

| ➢ MAXIMUM STAY | ➢ 12M | ➢ 12M |

| ➢ AIRCRAFT CABIN CLASSES | ➢ ECONOMY-BUSINESS | ➢ ECONOMY -BUSINESS |

| ➢ AIRCRAFT MODEL | ➢ EQP 738/ 16(C) - 138(Y) | ➢ EQP 321/ 38(C) - 147(Y) |

Table Pricing Strategies of Lufthansa and Turkish Airlines, a round-trip- Economy Class (FRA-IST-FRA// IST-FRA-IST)

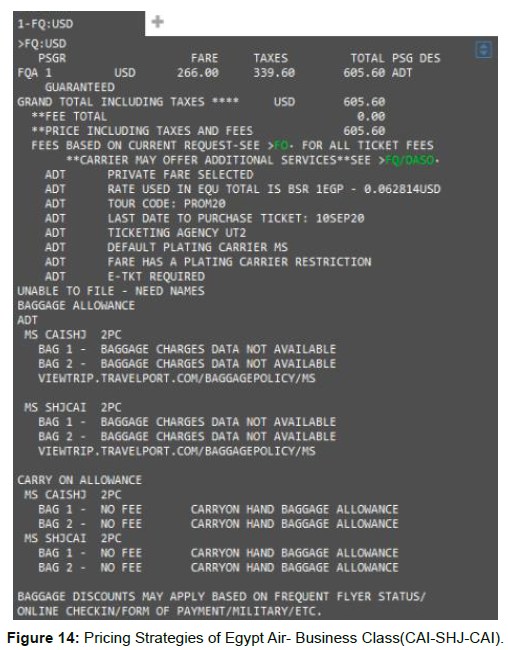

Pricing Strategies of Egypt Air- Business Class (CAI-SHJCAI)

(Figure 14) delineates pricing strategies of Egypt Air, a round tripbusiness class (Cairo- Sharjah -Cairo). It turns out from the figure that the total fare of the ticket on-board of Egypt Air (CAI-SHJ-CAI) is 605.60 US Dollars (USD). The free pieces of baggage allowance are two pieces of baggage per business class passenger; the weight of one piece should not exceed 32KG per business class passenger. It is also remarkable from the figure that the pieces of carry-on baggage permitted are 2PCs of cabin baggage per business class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 8KG.

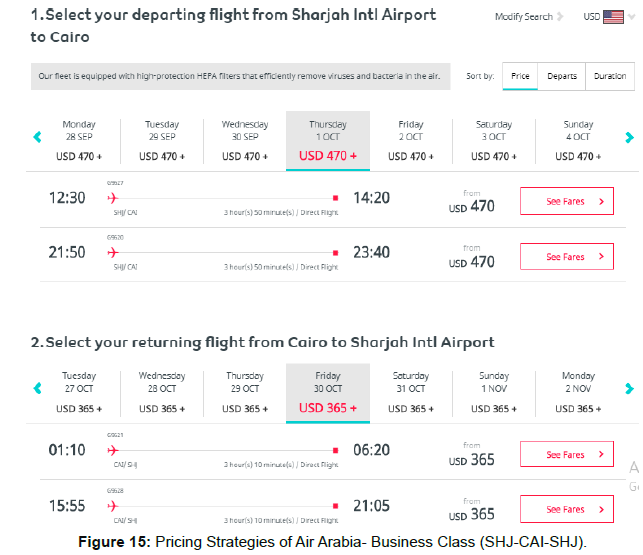

Pricing Strategies of Air Arabia- Business Class (SHJ-CAISHJ)

(Figure 15) illustrates pricing strategies of Air Arabia, a round trip- business class (Sharjah -Cairo- Sharjah). According to figure, the total fare of the ticket on-board of Air Arabia (SHJ-CAI-SHJ) is 835.00 US Dollars (USD). The free pieces of baggage allowance are two pieces of baggage per business class passenger; the weight of one piece should not exceed 32KG per business class passenger. It is also remarkable from the figure that the pieces of carry-on baggage permitted are 2PCs of cabin baggage per business class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 10KG.

Pricing Strategies of Egypt Air and Air Arabia- Business Class (FSCs vs. LCCs)

(Table 7) illuminates pricing strategies of Egypt Air and Air Arabia (FSCs vs. LCCs), a round trip- business class (Cairo- Sharjah -Cairo // Sharjah –Cairo- Sharjah). It is obvious from the table that the total fare of the ticket on-board of Egypt Air (CAI-SHJ-CAI) is 605.60 US Dollars (USD), compared to 835.00 US Dollar (USD) on-board of Air Arabia (SHJ–CAI-SHJ). The free pieces of baggage allowance on-board of Egypt Air and Air Arabia are two pieces of baggage per business class passenger; the weight of one piece should not exceed 32KG per business class passenger. It seems that table assures that the pieces of carry-on baggage permitted on-board of Egypt Air are 2PCs of cabin baggage per business class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 8KG, compared to 2PCs of cabin baggage per business class passenger; the weight of one piece should not exceed 10KG.Furthermore, Cancellation and Changes are permitted to Reissue /Re-route/ Re-validation on board of Egypt air without charging reissue /rerouting penalty fees (penalty fee only) except for no-show. Refundable Tickets are permitted to Re-issue /Re-route without charging reissue /rerouting penalty fees.It turns out from table that the restrictions of LCCs are more stringent compared to FSCs. As Aircraft Cabin Classes on board of Egypt Air and Air Arabia (CAISHJ- CAI// SHJ–CAI-SHJ) are economy and business classes.

| Elements Of Comparison |  |

|

|---|---|---|

| ➢ TYPES OF AIRLINES | ➢ Fscs | ➢ Lccs |

| ➢ TOTAL FARES | ➢ 605.60 USD | ➢ 835.00 USD |

| ➢ BOOKING CLASSES | ➢ BUSINESS CLASS | ➢ BUSINESS CLASS |

| ➢ ORIGIN-DESTINATION (O-D) | ➢ CAI-SHJ-CAI | ➢ SHJ–CAI-SHJ |

| ➢ FREE BAGGAGE ALLOWANCE | ➢ 2pcs (64KG) | ➢ 2pcs (64KG) |

| FREE CARRY-ON BAGGAGE ALLOWANCE | ➢ 2pcs (16KG) | ➢ 2pcs (20KG) |

| CANCELLATION CHARGES | ➢ CANCELLATIONS ARE PERMITTED IN CASE OF CANCEL/NO-SHOW. | ➢ 72 HOURS BEFORE DEPARTURE: 30% OF THE FARE AND SURCHARGE OR A MINIMUM OF 150 AED PER PASSENGER EACH WAY. ➢ 72 TO 24 HOURS BEFORE DEPARTURE: 30% OF THE FARE AND SURCHARGE OR A MINIMUM OF 200 AED PER PASSENGER EACH WAY. ➢ AIR ARABIA DOES NOT HAVE A REFUND POLICY ONCE THE BOOKING IS PAID FOR (EXCEPT FLIGHTS TO/FROM CAIRO). ON CANCELLATION, AIR ARABIA WILL RETAIN THE REMAINING AMOUNT AS A CREDIT TOWARDS A FUTURE FLIGHT WHICH CAN BE USED FOR TRAVEL WITHIN ONE YEAR FROM THE DATE OF PAYMENT BY THE SAME PASSENGER ONLY. |

| ➢ NO- SHOW CHARGES | ➢ CHARGE 95.00 USD | ➢ WITHIN 24 HOURS BEFORE DEPARTURE – NO CHANGES ARE PERMITTED. |

| ➢ CHANGES CHARGES | ➢ CHANGES ARE PERMITTED | ➢ 72 HOURS BEFORE DEPARTURE: 25% OF THE FARE AND SURCHARGE OR A MINIMUM OF 150 AED PER PASSENGER EACH WAY. ➢ 72 TO 24 HOURS BEFORE DEPARTURE: 25% OF THE FARE AND SURCHARGE OR A MINIMUM OF AED 200 PER PASSENGER EACH WAY. ➢ BUSINESS CLASS PASSENGERS ON CAIRO FLIGHTS, ARE ELIGIBLE FOR FREE MODIFICATION (FARE DIFFERENCE WILL APPLY) UP TO 8 HRS PRIOR TO SCHEDULED DEPARTURE TIME. |

| ➢ MINIMUM STAY | + | + |

| ➢ MAXIMUM STAY | + | + |

| ➢ AIRCRAFT CABIN CLASSES | ➢ ECONOMY-BUSINESS | ➢ ECONOMY -BUSINESS |

| ➢ AIRCRAFT MODEL | ➢ EQP 738/ 24(C) - 120(Y) | ➢ EQP 321/ 38(C) - 147(Y) |

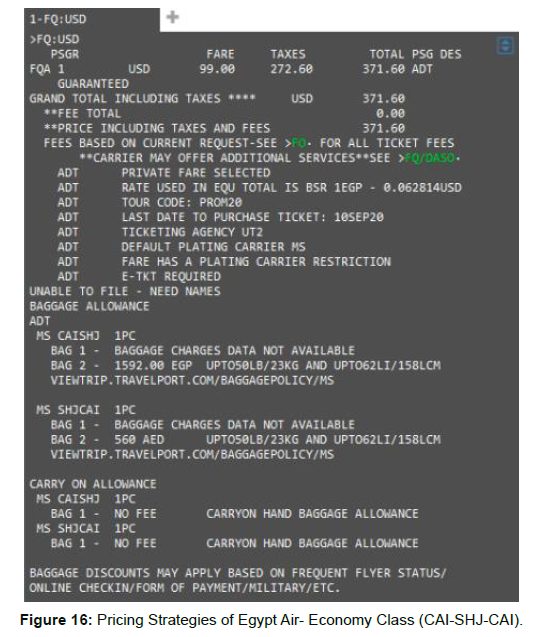

Pricing Strategies of Egypt Air- Economy(CAI-SHJ-CAI)

(Figure 16) elucidates pricing strategies of Egypt Air, a round tripeconomy class (Cairo- Sharjah -Cairo). It turns out from the figure that the total fare of the ticket on-board of Egypt Air (CAI-SHJ-CAI) is 371.60 US Dollars (USD).The free piece of baggage allowance is one piece of baggage per economy class passenger; the weight of one piece should not exceed 23KG per economy class passenger. Egypt Air fees 1592 EGP(CAI- SHJ)and 560 AED (SHJ-CAI) for the second checked baggage. It is also remarkable from the figure that the pieces of carryon baggage permitted is 1PC of cabin baggage per economy class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 8KG.

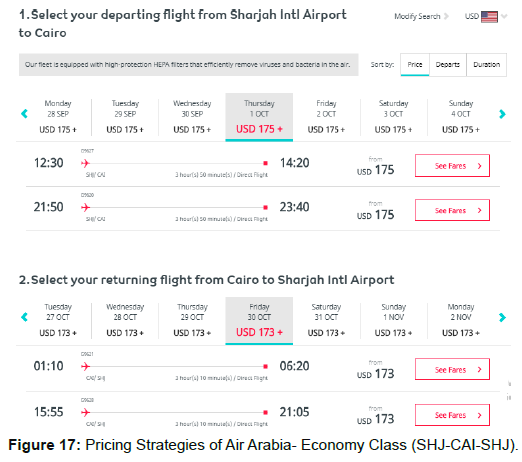

Pricing Strategies of Air Arabia- Economy Class

(Figure 17) demonstrates pricing strategies of Air Arabia, a round trip- economy class (Sharjah -Cairo- Sharjah). It turns out from the figure that the total fare of the ticket on-board of Air Arabia (SHJCAI- SHJ)is 348.00 US Dollars (USD).Passengers will be charged for baggage. The only baggage allowance available for purchase at the airport is 20 KG; additional weight will be subject to excess baggage rates. It is also remarkable from the figure that the pieces of carryon baggage permitted is 1PC of cabin baggage per economy class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 10KG.

Pricing Strategies of Egypt Air and Air Arabia- Economy Class(FSCs vs. LCCs)

(Table 8) illuminates pricing strategies of Egypt Air and Air Arabia (FSCs vs. LCCs), a round trip- Economy class (Cairo- Sharjah -Cairo // Sharjah –Cairo- Sharjah). According to table, the total fare of the ticket on-board of Egypt Air (CAI-SHJ-CAI) is 371.60 US Dollars (USD), compared to 348.00 US Dollar (USD) on-board of Air Arabia (SHJ–CAI-SHJ). The free piece of baggage allowance on-board of Egypt Air is one piece of baggage per economy class passenger; the weight of one piece should not exceed 23KG per economy class passenger. Egypt Air fees 1592 EGP (CAI- SHJ) and 560 AED (SHJCAI) for the second checked baggage. It is remarkable from the table that the pieces of carry-on baggage permitted is 1PC of cabin baggage per economy class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 8KG. On the other side, the only baggage allowance available for purchase at the airport is 20 KG on-board of Air Arabia; additional weight will be subject to excess baggage rates. It is also obvious from the table that the pieces of carry-on baggage permitted is 1PC of cabin baggage per economy class passenger will be carried in the cargo compartment free of charge; the weight of one piece should not exceed 10KG. Refundable Tickets are permitted to Cancel/ Re-issue /Re-route with charging reissue /rerouting penalty fees. These fares can carry substantial restrictions, such as an advance purchase requirement, a minimum and/or maximum stay requirement“at least one Saturday night”, penalties linked to changes, non-refundable status and noneligibility for infant and child discounts.It turns out from table that the restrictions of LCCs are more stringent compared to FSCs. As Aircraft Cabin Classes on board of Egypt Air and Air Arabia (CAISHJ- CAI// SHJ–CAI-SHJ) are economy and business classes.

| ELEMENTS OF COMPARISON |  |

|

|---|---|---|

| ➢ TOTAL FARES | ➢ 371.60 USD | ➢ 348.00 USD |

| ➢ BOOKING CLASSES | ➢ ECONOMY CLASS | ➢ ECONOMY CLASS |

| ➢ ORIGIN-DESTINATION (O-D) | ➢ CAI-SHJ-CAI | ➢ SHJ-CAI-SHJ |

| ➢ FREE BAGGAGE ALLOWANCE | ➢ 1PC(23KG) | ➢ 0 PC(0 KG) |

| FREE CARRY-ON BAGGAGE ALLOWANCE | ➢ 1PC (8 KG) | ➢ 1PC(10 KG) |

| CANCELLATION CHARGES | ➢ CHARGE 65 .00USD. | ➢ 72 HOURS BEFORE DEPARTURE: 30% OF THE FARE AND SURCHARGE OR A MINIMUM OF 150 AED PER PASSENGER EACH WAY. ➢ 72 TO 24 HOURS BEFORE DEPARTURE: 30% OF THE FARE AND SURCHARGE OR A MINIMUM OF AED 200 PER PASSENGER EACH WAY. ➢ AIR ARABIA DOES NOT HAVE A REFUND POLICY ONCE THE BOOKING IS PAID FOR (EXCEPT FLIGHTS TO/FROM CAIRO). ON CANCELLATION, AIR ARABIA WILL RETAIN THE REMAINING AMOUNT AS A CREDIT TOWARDS A FUTURE FLIGHT WHICH CAN BE USED FOR TRAVEL WITHIN ONE YEAR FROM THE DATE OF PAYMENT BY THE SAME PASSENGER ONLY. |

| ➢ NO- SHOW CHARGES | ➢ CHARGE 95.00 USD. | ➢ CHANGES ARE NOT PERMITTED IN CASE OF NO-SHOW. |

| ➢ CHANGES CHARGES | ➢ CHANGES ARE PERMITTED. | ➢ 72 HOURS BEFORE DEPARTURE: 25% OF THE FARE AND SURCHARGE OR A MINIMUM OF 150 AED PER PASSENGER EACH WAY. 72 TO 24 HOURS BEFORE DEPARTURE: 25% OF THE FARE AND SURCHARGE OR A MINIMUM OF AED 200 PER PASSENGER EACH WAY. |

| ➢ MINIMUM STAY | ➢ 7D | ➢ 3D |

| ➢ MAXIMUM STAY | ➢ 12M | ➢ 6M |

| ➢ AIRCRAFT CABIN CLASSES | ➢ ECONOMY-BUSINESS | ➢ ECONOMY- BUSINESS |

| ➢ AIRCRAFT MODEL | ➢ EQP 738/ 24(C) - 120(Y) | ➢ EQP 321/ 38(C) - 147(Y) |

Results and Discussions

Airlines’ pricing strategies and fare product restrictions are designed to make low fares less attractive to those with a higher willingness to pay (WTP), while still offering those with lower willingness to pay (WTP) a viable travel option. As a result, a Saturday night (or longer) minimum stay has historically been associated with most discount fares. Ticket purchase and advance booking requirements for discount fares range from 7 to 30 days in most O-D markets. In addition, the lower-priced fare products carry non-refundability conditions and cancellation feesand/or change. The restrictions become more severe as the level of discount from the full economy fare increases. In fact, any business traveler who is not able to or does not wish to stay over Saturday night on his/her business trip has little choice but to purchase the highest “Y” fare. Even if a business traveler is willing to stay over Saturday night, the lower fares are not an option if the trip cannot be booked more than 7 days in advance or if the traveler wants to retain the flexibility to make changes and/or obtain a refund should the trip have to be cancelled. The highest unrestricted economy fare (Y) is almost five times that of the lowest discount fare with restrictions, although this ratio can be as great as eight times the lowest fare in some similar markets. Most noteworthy is the fact that all fares with any meaningful discount from the unrestricted fare require both an advance purchase and a Saturday night minimum stay.Furthermore, the lowest fares are limited to specific flights, days of the week and/or have a limited “seat sale” duration for booking and ticketing.These practices led to higher load factors (LFs) and increased unit revenues (passenger revenues/ASKs), as airlines embraced the notion of pricing based on their perception of passengers’ WTP.As far as the identity of the lowprice firm is concerned, the evidence confirms the notion that a LCC offers the lowest price in a competitive route.However, considerable differences are observed across LCCs, especially in conjunction to the distinction between early and late booking fares. Indeed, the same airline may offer the cheapest early booking fares but the dearest late booking fares. Furthermore, the authors show that a few days before departure it is not unlikely that a FSC may offer the cheapest fare. A first interesting result is that LCCs do not always post the cheapest price: this is even more surprising when we consider that FSCs operate in major airports that are often considered to be able to enhance the quality of a journey’s experience. This may be explained by the results in the previous section, where we show that FSCs’ fares are more stable than those by LCCs and exhibit smaller changes between consecutive booking periods.Both the fare product structure and nested seat allocation mechanism imply a hierarchy of fare products, in which the lowest-priced products have the most severe restrictions and the lowest seat availability while the highest- priced products have few or no restrictions and the greatest level of seat availability.

Conclusion

For the time being at least, aviation industry is not exemplary, and therefore there will always be some barriers, which the airlines must be aware of. These barriers can completely discourage the airlines from entry on the market or affect their pricing strategy. At all O-D markets, the airlines have several strategies of how to formulate pricing strategies in the aviation industry.The most remarkable strategy iscost-based pricing to make prices dependent on costs which have to be incurred in order to provide the air service. Under this pricing principle, an airline would set its prices in all O-D markets based on system-wide operating cost averages per flight or per available seat kilometers (ASKs). Average-cost pricing ignores airline cost differences in providing services to different O-D markets. Following this strategy when setting the price for particular O-D markets, airlines would have to determine their costs of providing that service, and subsequently add a profit, thus arriving at the price which would be needed to be charged. This paper focuses on pricing strategies and O-D markets for FSCs and LCCs based on monitoring of air ticket prices in different markets and in different time periods to match the supply with demand and accomplish market equilibrium. The aim of study is to find a pattern of how pricing takes place, if and how airlines implement market segmentation and take demandrelated elasticities into account. The conventional wisdom on the temporal profile of airlines’ prices holds that carriers facing uncertain demand can enhance their profits by assigning a monotonically increasing price to different batches of seats. Interestingly, prices tend to remain more stable when departure is further away in the future, while volatility increases as the date of departure approaches. Unexpectedly, FSCs tend to change their fares more frequently than LCCs. As far as the identity of the low-price firm is concerned, the evidence confirms the notion that a LCC offers the lowest price in a competitive route. There are many factors affecting airlines’ pricing strategies, and O-D market. Type of market is an important factor that must be taken into consideration by new air carrier.On the market with larger segment of business travelers, LCCs have to offer a better service with higher prices. Peak and seasonality period are other factors that must be taken into consideration. The carrier cannot apply the same pricing strategy in summer and winter. For example, in winter when the demand for travel within the Middle East is low, the air carrier should expect lower revenue and offer more discount tickets in order to increase the load factor. Therefore, the new entrant airline should set in advance reasonable prices in peak periods to avoid selling out the capacity with lower yields. With increased prices airlines should shift price-sensitive passengers to low-demanded flights and raise revenue from tickets sold to timesensitive passengers.

References

- Truxal S (2013) Competition and regulation in the airline industry: Puppets in chaos. Routledge.

- Rapp R (2000) Customer relationship marketing in the airline industry (1 Edn). Berlin: Springer.

- Mamo H (2015) Key factors that determine return on loyalty: Evidence from Ethiopian airlines loyal customer base. Master's thesis, Addis Ababa University.

- Rafati D, Shokrollahi P (2011) The impact of expectation & perception on customer satisfaction in airline industry (A Case Study of Mahan Air). Master's thesis, Sharif University of Technology International Campus.

- Bilotkach V, Rupp NG (2014) Buyer subsidies in two-sided markets: evidence from online travel agents. The Economics of International Airline Transport.

- Young RB, Javalgi RG (2007). International marketing research: A global project management perspective. Business Horizons 50: 113-122.

- Aksoy S, Atilgan E, Akinci S (2003) Airline services marketing by domestic and foreign firms: differences from the customers’ viewpoint. J Air Transp Manag 9: 343-351.

- Pride W, Ferrell OC (2008) Marketing (4th Edn). Boston.

- Astuti R, Silalahi RLR, Wijaya GDP (2015) Marketing strategy based on marketing mix influence on purchasing decisions of Malang apples consumers at giant Olympic garden mall (MOG), Malang city, East Java province, Indonesia. Agriculture and Agricultural Science Procedia 3: 67-71.

- Abdelhady MRR, Fayed HAK, Fawzy NM (2019) The influence of airlines’ marketing mix on passengers' purchasing decision-making: The case of FSCs and LCCs. Int J Hosp Tour Syst. 12: 2.

- IATA Economics. (2016). Airline loyalty – what matters most? Retrieved March 24, 2018, from: http://www.iata.org/publications/economics/Reports/chart-of-the-week/chart-of-the-week-21-oct-2016.pdf.

- Gábor D. (2010) Low-cost airlines in Europe: Network Structures after the enlargement of the European Union. Geographica Pannonica 14: 49-58.

- Lee K, Carter S (2012) Global marketing management: Changes, new challenges, and strategies (3rd edn). Oxford: Oxford University Press.

- Avlonitis GI (2005) Pricing objectives and pricing methods in the services sector. J Serv Mark 19: 47-57.

- Cho M, Fan M, Zhou YP (2009) Strategic consumer response to dynamic pricing of perishable products. Consumer-Driven Demand and Operations Management Models Springer, Boston, MA.

- Pels E, Rietveld P (2004) Airline pricing behaviour in the London-Paris market. J Air Transp Manag 10: 279-283.

- Sai BT, Ekiz EH, Kamarulzaman Y (2012) Factors determining choice of full service airlines and low cost carriers: the case of Malaysia. Asia- Pacific J Innov Hospit Tour 1: 179-194.

- Rajaguru R (2016) Role of value for money and service quality on behavioural intention: A study of full service and low cost airlines. J Air Transp Manag 53: 114-122.

- Chacon J, Mason KJ (2011) An analysis of the relationship between passenger loyalty and consumer buying behavior for network and low-cost carriers. Transp J 50: 271-290.

- Fedosova A. Comparison between Low-cost and traditional airlines. Case study: Easy Jet and British Airways.

- Banerjee M, Kanathia S (2006) Indian low cost airlines: Present model & strategy for an increased profitability. Indian Institute of Management, Bangalore.

- Vidović A, Steiner S, Babić R (2006) Impact of low-cost airlines on the European air transport market. 10th International Conference on Traffic Science ICTS 2006: Globalization and Transportation.

- Button K, Ison S (2008) The economics of low-cost airlines: Introduction. Res Transp Econ 24: 1-4.

- Fageda X, Luis J, Perdiguero J (2011) Price rivalry in airline markets: A study of a successful strategy of a network carrier against a low-cost carrier. J Transp Geogr 19: 658-669.

- Hamidi N, Niareki FR, Madrekian H (2013) Study of the effective factors influencing the decision-making process of Iranian air travelers in their choice of airline for domestic flights. Tech J Engineer Applied Sci 3: 3792-3798.

- Acar AZ, Karabulak S (2015) Competition between full service network carriers and low cost carriers in Turkish airline market. Procedia-Social and Behavioral Sciences 207: 642-651.

- Bergantino AS, Capozza C (2015) Airline pricing behavior under limited inter‐modal competition. Economic Inquiry 53: 700-713.

- Driver J (2001) Airline marketing in regulatory context. Marketing Intelligence & Planning 19: 125-135.

- Gross S, Lück M (2011) Flying for a buck or two: Low-cost carrier in Australia and New Zealand. EJTIR 11: 297-319.

- Detzen D, Jain PK, Likitapiwat T, Rubin RM (2012) The impact of low cost airline entry on competition, network expansion, and stock valuations. J Air Transp Manag 18: 59-63.

- Sarilgan AE (2016) Impact of low cost carriers on Turkish tourism industry. Int J Acad Res Busi Social Sci 6: 176:188.

- Schnell MC (2003) Does the effectiveness of airline strategies change? A survey of European full service airlines. Int J Transp Manag, 1: 217-224.

- Knorr A, Žigová S (2004) Competitive advantage through innovative pricing strategies: The case of the airline industry. Bremen: Institute for World Economics and International Management.

- Civil Aviation Authority. (2006). No-frills Carriers: Revolution or Evolution?. Retrieved March 23, 2018, from:https://publicapps.caa.co.uk/docs/33/CAP770.pdf.

- Graham B, Shaw J (2008) Low-cost airlines in Europe: Reconciling liberalization and sustainability. Geoforum, 39: 1439-1451.

- Diaconu L (2012) The evolution of the European low-cost airlines business models. Ryanair Case Study. Procedia-Social and Behavioral Sciences 62:342-346.

- Westermann D (2012) The impact of low cost carrier on the future. J Revenue Pricing Manag11: 481-484.

- Vidović A, Štimac I, Vince D (2013) Development of business models of low-cost airlines. Int J Traffic Transport Engineering 3: 69-81.

- Karivate S (2004) Low-cost carriers and low fares. Bangkok University Acadamic Review.

- Wensveen JG (2012) Air transportation: A management perspective (7th Edn). Farnham: Ashgate Publishing Company.