Research Article, J Tourism Res Hospitality Vol: 8 Issue: 1

Fields of Tourism Innovation According to the Level of Investment

Josep-Francesc Valls Giménez* and Itziar Labairu Trenchs

Department of Marketing Management, ESADE Business and Law School, Av. Esplugues, 92-96, Barcelona, Spain

*Corresponding Author: Josep-Francesc Valls Giménez

Department of Marketing Management, ESADE Business and Law School, Av. Esplugues, 92-96, Barcelona, Spain

Tel: +34932806162 Extn: 2516

E-mail: josepf.valls@esade.edu

Received: February 26, 2019 Accepted: July 19, 2019 Published: July 24, 2019

Citation: Giménez JFV, Trenchs IL (2019) Fields of Tourism Innovation According to the Level of Investment. J Tourism Res Hospitality 8:1.

Abstract

The aim of our study is to learn about the innovation models currently used by Spanish tourism companies and determine if there is any relation between the level of innovation and the sub-industry, the firms’ billing volume, how they manage their innovation efforts, the general innovation fields and the companies’ ranking of specific innovation focuses. Our findings reveal that hotels and tourist activity companies invest the most in innovation, while intermediation and transport firms and restaurants invest the least. However, there is no direct correlation between innovation investment levels and the different tourism subindustries. Contrarily, our results indicate that, as companies increase their billing volume, they dedicate greater resources to innovation. Similarly, though despite no significant difference, creating new products attracts more investments than technology in order to achieve differentiation. Also, the most innovative tourism companies apply significant resources to client orientation efforts while very few to cost reduction initiatives.

Keywords: Tourism innovation; New products and services; Technology; Client orientation; Innovation management system; Co-creation

Keywords

Tourism innovation; New products and services; Technology; Client orientation; Innovation management system; Co-creation

Introduction

The relatively low level of innovation in the tourism industry is probably related to the high degree of firm fragmentation. In effect, there is a much higher number of SMEs in this industry than in others, implying that firms are managed by a single person or have a significant family component [1,2]. This international trend is even greater within the Spanish tourism industry (in terms of hotels, restaurants, transportation, intermediation, leisure, entertainment and culture-related firms and public bodies) due to the industry’s historic development. The Spanish coasts witnessed the birth of mass tourism (low-cost, massified and seasonal) in the 1960s. German, British and French tour operators created a new product for a new market: sun and beach destinations along the Mediterranean for tourists from northern and central Europe. These tour operators didn’t need large local companies, hotels, restaurants, transportation firms, shops and entertainment centres, etc., to create this new product. They also managed flights directly through the charters they organised. In fact, these companies preferred this fragmentation since it implied a better negotiating position for them when agreeing on prices. Consequently, the Spanish tourism industry originally consisted of small companies, some of which have grown over time until becoming medium and large firms. However, the concentration process was much less intense in this Spanish industry than in others.

As of the 1980s when Spanish public administrations began planning and managing Spanish tourism destinations, the term “mature” was added to the sun and beach model. But, there were no innovation movements in the private Spanish tourism industry prior to this period, from 1960 to 1980, or after public reforms, from 1980 to 1990. We can clearly see the five key innovation barriers to which Najda-Janoszka and Kopera [1] refer: low innovation and low culture of knowledge; high employee turnover: weak change management; small company size; and insufficient competencies and resources.

However, the war in the former Yugoslavia during the 1990s, the major attacks in urban centres during the first decade of the new millennium and the Arab Spring uprisings at the start of the current decade devastated many of Spain’s competing destinations along the Mediterranean, making the Spanish coast the ideal location to escape from the countries in conflict. As a result, Spain saw a huge increase in the number of tourists it welcomed over these decades, deepening the low-cost, commodity, tour-operated and seasonal tourism model which currently represents more than 12% of the country’s GDP. This low productivity model also had an additional weakness: it counted on 2.8 million workers facing ever-increasing seasonality (38.4% compared to 27% in the Spanish job market as a whole) in addition to job insecurity and the lowest wages in the market [3].

Despite the practically constant growth in the number of tourists, the strong drop in both national and international tourism as a result of the 2008 economic crisis represented a turning point. Though the business model hasn’t changed, in general, there is a nascent innovation process taking place within the industry. From 2008- 2013, Spanish tourism companies in every sub-industry were forced to define contingency plans, down-size, disinvest and, in the worst possible case, disappear. It was at this time, as tends to occur in these types of scenarios [4] that Spanish tourism industry professionals embraced innovation in order to reduce costs, produce at lower prices, become more international, gain economies of scale, adapt to the new demands from existing clients and new generations and join the digital revolution bandwagon. As Keller [5] argues innovation capacity is crucial not only to ensure the individual companies’ survival but also for the entire national economy: In terms of Spain, this affected the economy’s heavy dependence on tourism and, especially, the labour question.

All this serves as a backdrop for the strong growth in the amount that Spanish tourism companies have invested in innovation over the last five years: The number of companies that do invest and want to accelerate this process has gone from 34% to 44% [6].

Literature Review

According to Hjalager [2], innovation is the process of putting new ideas into practice in order to solve problems, all based on reorganising, reducing costs, introducing new budgetary systems, improving communications or assembling products in teams. Similarly, the OECD’s Oslo Manual [7] refers to the introduction of an element that provides something new or significantly improved, whether a product, a process, a method, a practice or an organisation. Rodríguez-Sánchez [8] refers to innovation as a “black box” whose complex internal workings are poorly understood, defining the major tasks in a four-phase innovation journey: idea generation; coalitionbuilding; idea realisation; and transfer or diffusion [8].

To trigger the process to which Hjalager [2] refers, Weiermaier [9] describes five components: the generation of new or improved products; the introduction of new production processes; the development of new sales markets; the development of new supply markets; and the company’s reorganisation and/or restructuring.

The innovation focus connects to Schumpeter’s [10] view of innovation as the driver of economic development insofar as it produces a dynamic process of creative destruction in which new technologies substitute previous ones. When referring to the tourism industry, we have to add another innovation factor to this technological focus, one that Schumpeter’s model doesn’t consider. We refer here to the human factor, a key issue in the service sector, in general. In other words, this includes employee contact with clients, opening up an enormous innovation field for firms to differentiate themselves from others in terms of products and services, experience, hospitality, satisfaction, sustainability, collaborative development and interactions between tourists and the local community [11-21].

Scholars have focused on different areas related to innovation within the tourism industry. Weiermaier [9] describes three large research blocks in this respect: supply or supply-related determinants; demand drivers; and the level and pace of competition depending on regular innovations, niche, architectural or revolutionary innovations. Hjalager [2] develops these across four levels: process; managerial; management; and institutional. Romero [22] expands the research field even further, distinguishing between the following areas: commercialisation; technological processes; internal organisation; the market; external organisation; and technological products. In line with Schumpeter, Camison and Monfort [10] argue that studies on tourism innovation encompass the following: the influence of market and enterprise characteristics on incremental and radical innovations; the decision to innovate in products or processes; certain technological aspects related to the diffusion of information technologies across the industry; marketing innovations; the internal structure of the innovative activity; and the identification and measurement of the internal capabilities which determine a company’s level of innovativeness and innovative performance.

Research Objectives, Hypotheses and Methodology

Objectives

A. Our aim is to learn about the innovation models currently applied by Spanish tourism companies and determine if there is any relation between the level of investment and:

B. The sub-industry (hotels, restaurants, transportation, intermediation, entertainment, leisure and culture-related firms and public bodies).

C. Billing volume (less than €100,000, between €100,000 and €500,000, between €500,000 and €3M, between €3M and €10M, between €10M and €50M, between €50M and €100M, over €100M).

D. The innovation management system (by internal departments; ad hoc projects; outsourcing; other systems; no management system used).

E. General innovation investment fields (new products and services; commercialisation and sales; branding; restructuring and new functions; training in new methodologies; technology; and cost reduction).

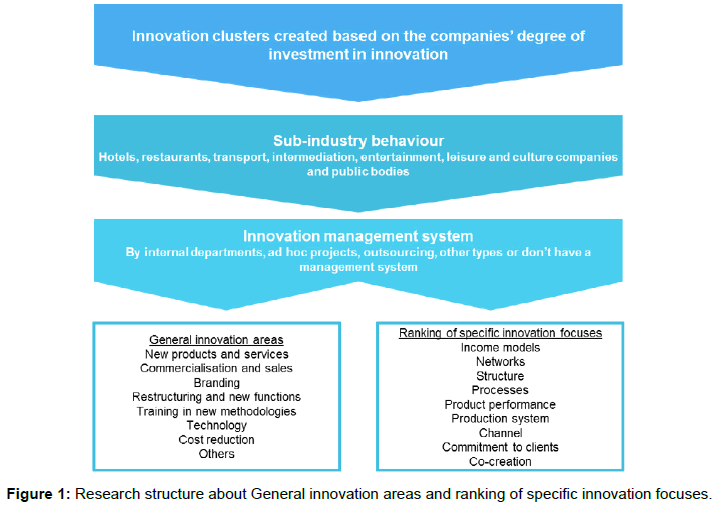

F. And company rankings of specific innovation focuses: income model; structure; processes; channel; brand; commitment to clients; co-creation; networks; product performance; and production system (Figure 1).

Hypothesis

To achieve these objectives, we consider the following hypotheses:

Companies with elevated income invest more in innovation.

H1: The greater the billing volume, the greater the investment in innovation.

Kotler [23] indicates that, due to the digital revolution, we can now go from producing sellable goods/services to managing clients. This seems especially true in the tourism industry in which personal contact is fundamental.

H2: The greater the investment in innovation, the greater the efforts tourism-industry companies dedicate to client-orientation initiatives.

The innovation concept in the tourism industry is habitually associated to technological innovation. Consequently, the most innovative companies will likely dedicate their greatest innovation efforts to this area.

H3: The greater the investment in innovation, the greater the innovation efforts tourism companies dedicate to technology.

The current scenario in which tourists demand low prices may force companies to focus all their efforts on cost reduction.

H4: Reducing costs is the key innovation objective among all tourism firms.

In companies’ initial lifecycle phases, defining a sustainable income model is one of the key innovation objectives. Once firms have consolidated and achieved a stable income model, their investments in innovation may increase, while the income model will no longer be a priority innovation area.

H5: Concern for the companies’ income models will decrease as firms increase their investments in innovating themselves.

Research Design

Based on previous scholarly work on innovation adapted to the tourism industry, we understand innovation as the reinvention of processes, routines, structures, technology and work methodologies that companies undertake to improve their profits and/or their position compared to competitors. For example, this includes reinventing in areas such as new products, technology, commercialisation and sales, restructuring, training, income models and cost reduction as well as new areas of action such as client orientation, the creation of new products or services and the internal organisation’s orientation [6].

To complete our definition of innovation and its application in tourism companies, in March 2017 we organised two focus groups to carry out exploratory research. Participants included experts and executives from the different tourism sub-industries. Our aim was, first, to gain insights on the innovations carried out within the firms and, second, understand the possible relation between their investment in innovation and the innovative behaviour in each sub-industry, the management systems used to manage those innovations and the general areas in which they invested and their ranking of specific focuses. In terms of these general investment fields and their specific focuses, we presented the focus groups with a long list of innovations and practices gathered from the literature. The aim was for the focus groups to choose which they felt were the most important. The following areas were selected: new products and services; commercialisation and sales; branding and brand image; restructuring and new functions; training in new methodologies; technology; and cost reduction. Participants also chose the following specific focuses to rank: income model; structure; processes; channel; brand; commitment to clients; co-creation; networks; product performance; and production systems. Based on the above results, we then designed our survey to test our hypotheses.

Our survey comprised sixteen questions designed to gather data on the companies’ billing volume, the percentage invested in innovation this year compared to the previous year; the investment areas and the most important investment focuses for them in 2016 and those foreseen for this year; the use of the ecosystem players; innovation management methods; and their position with respect to key innovation trends.

We took into account the following when preparing our survey:

A. Proportional geographic distribution by Spanish Autonomous Community: Catalonia, 21.4%; Andalusia, 14.6%; Madrid, 14.2%; Valencia, 11.4%; Canary Islands, 9.6%; Galicia, 5.0%; and Balearic Islands, 4.2%.

B. Distribution by sub-industry: hotels represented 36.1% of the sample; restaurants, 31.9% (and proportions between 3.6% and 1.2% in the remaining Autonomous Communities, the latter representing 5.4% of the universe); intermediation firms, 6.2%; entertainment, leisure and culture companies, 18%; and public bodies, 2.4%. We determined this distribution based on the data provided by Central Registry of Firms (Directorio Central de Empresas, DIRCE) pertaining to Spain’s National Statistics Institute (Instituto Nacional de Estadísticas, INE) and selected the areas that comprise our universe. We then grouped the different categories and sub-categories as follows:

Accommodation

A. Hotels and similar accommodations.

B. Tourist and other short-term accommodations.

C. Hotels, campgrounds and rural accommodations.

Restaurants

A. Restaurants and food stands.

B. Beverages and drinking establishments.

C. Restaurants and catering.

Transport

A. Inter-urban passenger transport by train.

B. Other overland passenger transport.

C. Maritime passenger transport.

D. Passenger transport via interior navigable waterways.

E. Passenger transport by air.

F. Transport.

Intermediation

A. Travel agencies, tour operators, reservation services and other activities related to the latter.

B. Intermediation.

Entertainment, leisure and culture

A. Museums, theatres, amusement parks and casinos.

Public bodies

We gathered data based on an ad hoc sample of tourist destinations (municipalities and Autonomous Communities) and national tourism services.

A. We also identified key decision-makers in tourism and entertainment companies. Survey respondents were distributed as follows: middle managers, 43.9%; senior managers, 19.6%; owners, 18.8%; and specialised posts, 17.8%.

B. Sample-size: We gathered 501 cases using the CAWI technique via a self-administered online interview carried out by the firm, Elogia.

C. We carried out our fieldwork from May 5th to 15th, 2017.

D. The maximum sampling error for our global dataset was approximately 4.4%, with a 95.5% confidence interval and p=q=0.5.

When defining clusters, we determined that using all the variables related to innovation did not generate robust groups. Consequently, we opted to group companies based on the key variable, that is, the percentage of billing that the firms dedicated to innovation. We later complemented this data with the other variables.

We thus determined that there were four clusters according to the percentage of billing the companies dedicated to innovation:

a) Low Innovation cluster (dedicating 0 or less than 1% of billing to innovation)

b) Moderate Innovation cluster (dedicating between 1% and 2% of billing to innovation)

c) Medium Innovation cluster (dedicating between 2% and 4%)

d) High Innovation cluster (dedicating more than 4%).

Result

Below details the innovation clusters’ distribution according to the amount invested in innovation (Table 1): We then analysed the composition of each of the innovation clusters identified, bearing in mind: the sub-industries; billing volume; innovation management systems; general investment areas; and each company’s ranking of specific innovation focuses.

| Frequency | Percentage | Valid Percentage | Accumulated Percentage | ||

|---|---|---|---|---|---|

| Valid | High Innovation | 126 | 25.1 | 25.1 | 25.1 |

| Medium Innovation | 120 | 24.0 | 24.0 | 49.1 | |

| Moderate Innovation | 142 | 28.3 | 28.3 | 77.4 | |

| Low Innovation | 113 | 22.6 | 22.6 | 100.0 | |

| Total | 501 | 100 | 100 | ||

Table 1: Clusters by innovation investment levels (as a percentage of billing).

To determine the relation between the clusters and the variables, we used the contingency table technique, analysing, on the one hand, cluster distribution by sub-industry and billing volume and, on the other, the distribution of general investment areas, company rankings of specific innovation focuses and innovation management systems in each cluster, comparing the latter to the general mean.

By sub-industries

If we examine companies by sub-industry, we can see that firms in the accommodation and tourist activity sub-industries represent the highest percentage of High Innovation companies compared to the sample mean (30.39% and 25.56%, respectively). Worth noting is that there is also a high percentage of Moderate Innovation companies within the tourist activity sub-industry (27.78%). By contrast, the restaurant and catering sub-industry stands out for concentrating the largest share of Low Innovation companies (30.63%, when the sample mean is 25.1%).

Nearly half of the transport sub-industry companies are within the Medium Innovation cluster (48.15%), while a significant portion of companies in the intermediation sub-industry fall within the Moderate Innovation cluster (38.71%).

Public bodies are included primarily in the Moderate Innovation cluster, representing 41.67% when the sample mean is 24% (Table 2).

| Accommodation | Restaurants and Catering | Passenger transport | Intermediation | Tourist activities | Public bodies | Total | |

|---|---|---|---|---|---|---|---|

| High Innovation | 30.39% | 15.00% | 14.81% | 19.35% | 25.56% | 8.33% | 22.60% |

| Medium Innovation | 25.41% | 31.88% | 48.15% | 19.35% | 25.56% | 25.00% | 28.30% |

| Moderate Innovation | 20.99% | 22.50% | 14.81% | 38.71% | 27.78% | 41.67% | 24.00% |

| Low Innovation | 23.20% | 30.63% | 22.22% | 22.58% | 21.11% | 25.00% | 25.10% |

| Total | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

Table 2: Innovation clusters by sub-industries.

By billing volume

Based on our data, we can see that more than half of the companies with the lowest billing volume belong to the Low Innovation cluster (52.2%), while companies billing between €50M and €100M are the most innovative (51.7% belonging to the High Innovation cluster compared to the sample mean of 22.6%), followed by companies that bill between €10M and €50M (30.1%).

Companies that bill the most (over €100M) are highly represented in the Medium Innovation cluster (38.8%) (Table 3).

| Less than €100,000 | Between €100,000 and €500,000 | Between €500,000 and € 3,000,000 | Between €3,000,000 and €10,000,000 | Between €10,000,000 and €50,000,000 | Between €50,000,000 and €100,000,000 | More than €100,000,000 | Total | |

|---|---|---|---|---|---|---|---|---|

| High Innovation | 11.5% | 15.2% | 28.7% | 25.8% | 30.19% | 51.72% | 27.8% | 22.55% |

| Medium Innovation | 13.3% | 35.2% | 30.7% | 22.6% | 39.62% | 34.5% | 38.89% | 28.34% |

| Moderate Innovation | 23.0% | 27.2% | 21.8% | 30.65% | 24.5% | 6.9% | 22.2% | 23.95% |

| Low Innovation | 52.21% | 22.4% | 18.8% | 21.0% | 5.7% | 6.9% | 11.1% | 25.15% |

| Total | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

Table 3: Clusters by billing volume.

By innovation management system

Worth noting is that 76.4% of the companies included in the Low Innovation cluster declare that they do not intend to formalise their innovation systems, compared to 34.3% among the general sample. The most innovative companies, those included in the High and Medium Innovation clusters, primarily innovate by creating a specific department (24.8% and 22.5%, respectively) or via ad hoc projects (49.6% and 35.9%, respectively) (Table 4).

| Yes by creating a specific department | Yes through ad hoc projects | Yes outsourcing external companies | Yes using other methods | We don’t intend to formalise innovation within my firm | Total | |

|---|---|---|---|---|---|---|

| High Innovation | 24.8% | 49.6% | 5.3% | 1.8% | 19.6% | 100.00% |

| Medium Innovation | 22.5% | 35.9% | 21.8% | 3.5% | 16.2% | 100.00% |

| Moderate Innovation | 20.8% | 39.2% | 9.2% | 2.5% | 28.3% | 100.00% |

| Low Innovation | 7.1% | 7.1% | 4.0% | 7.1% | 74.6% | 100.00% |

| Total | 18.8% | 32.5% | 10.6% | 3.8% | 34.3% | 100.00% |

Table 4: Clusters by innovation management methods.

By general investment area

Table 5 below details how each of the four innovation clusters targets its innovation investments, with the sample mean in the last row.

| New product/services | Commercialization and sales | Branding (improve brand) | Restructuring and new functions | Training in new methodologies | Technology | Cost reduction | Other | Total | |

|---|---|---|---|---|---|---|---|---|---|

| High Innovation | 23.72% | 17.1% | 8.9% | 8.7% | 9.9% | 20.05% | 9.3% | 2.3% | 100.00% |

| Medium Innovation | 21.1% | 16.1% | 10.2% | 11.0% | 9.3% | 18.4% | 9.5% | 4.3% | 100.00% |

| Moderate Innovation | 21.7% | 17.6% | 10.0% | 9.4% | 9.8% | 18.4% | 9.5% | 4.3% | 100.00% |

| Low Innovation | 24.46% | 13.6% | 4.5% | 6.6% | 5.2% | 27.68% | 7.9% | 10.2% | 100.00% |

| Total | 22.52% | 16.51% | 9.08% | 9.38% | 9.20% | 19.96% | 8.90% | 4.45% | 100.00% |

Table 5: Clusters by investment in general innovation areas.

We can see that the Low Innovation cluster directs a large share of its innovation efforts to certain areas more clearly than other clusters or the general sample, investing primarily in the technology area (27% compared to the sample mean of 18%) and new products (24.46%). By contrast, this cluster’s investment in the other areas is lower than that carried out by the other groups. Particularly noteworthy is its scant investment in branding compared to the other clusters and the general sample mean.

Also worth noting is the High Innovation cluster’s primary investment in products and services (23.72%), a slightly higher percentage than among the sample mean, followed by its investment in technology (20.1%). In general, the High Innovation cluster invests more than the sample mean in all the general innovation fields except in branding and restructuring (dedicating less than the sample mean to these areas).

Based on our data, we determined that the ratio between investments in the new product area compared to technology is as follows for the different clusters:

a) Low Innovation: 0.88.

b) Moderate Innovation: 1.17.

c) Medium Innovation: 1.14.

d) High Innovation: 1.17.

According to this data, we can determine that, excepting companies in the Low Innovation cluster, the above ratios are positively skewed towards new products, in particular, among the Moderate and High innovation clusters (Table 5).

By ranking of specific innovation focuses

This variable describes the importance that the surveyed companies attribute to specific innovation focuses. Companies were asked to rank a series of innovation focuses on a scale from 1 to 7, where 1 is highly important and 7 not at all important. To interpret this variable, we consider the means of these preferences in each cluster, the lowest values representing greater importance compared to the highest values which represent lesser importance.

We then grouped the specific innovation focuses according to their general nature, differentiating between three fundamental types of innovation:

a) Internal organisation: income model, structure, processes and channel.

b) Client orientation: brand, commitment to clients, cocreation and networks.

c) Product: product performance and product system.

Table 6 below details the importance that each focus area has for the different clusters by type of innovation.

| Internal Organization | Client Orientation | Product | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Income model (how the companies generate income) | Structure (aligning talent and assets) | Processes (work methods) | Channel (hoe the offering is delevered to clients | Branding (how the business and products are presented) | Commitment to clients (the types of interaction to strenghten) | Co-creation (that is havingclients participate in product/service desig or a of those product/service) | Networks (external connections) | Product performance (differentiating functionalities and traits) | Product system ( complementary product/service for the primary product/service) | |

| High Innovation | 5.13 | 6.13 | 5.21 | 5.70 | 4.63 | 4.82 | 6.73 | 5.88 | 4.81 | 5.96 |

| Medium Innovation | 5.42 | 6.11 | 5.65 | 5.7 | 4.56 | 4.73 | 6.42 | 6.04 | 4.51 | 5.80 |

| Moderate Innovation | 5.21 | 6.06 | 5.12 | 5.09 | 4.88 | 5.13 | 6.27 | 6.76 | 4.87 | 5.63 |

| Low Innovation | 5.14 | 6.15 | 5.03 | 5.33 | 5.03 | 4.74 | 7.02 | 6.16 | 4.91 | 5.48 |

| Total | 5.23 | 6.11 | 5.27 | 5.48 | 4.77 | 4.86 | 6.60 | 6.20 | 4.77 | 5.71 |

Table 6: Clusters by ranking of specific innovation focuses.

The specific focuses that the general sample values the most are product performance (4.77 out of 7), the brand (4.77) and commitment to clients (4.85). As can be seen in the above table, all the innovation clusters consider the brand (client orientation) and product performance (product) to be very important.

The two most innovative clusters (High and Medium Innovation) clearly favour clients and products, both valuing the brand, commitment to clients and product performance the most. The clusters investing the least in innovation (Moderate and Low Innovation) also feel that the client orientation and product areas are important; however, they also value the internal organisation focus. Worth noting is the importance both of these last two clusters give to processes.

Discussion

Based on our results, we can observe that accommodation and tourist activity firms have the broadest innovative profile compared to the other sub-industries. This stems from the historic consolidation of their business models. If we combine the High and Medium Innovation clusters, public bodies and intermediation companies are the ones that invest the least in innovation. Transportation companies play an important role within the Medium Innovation cluster, while restaurants and catering companies represent the largest share of firms in the Low Innovation cluster.

In terms of billing, the lower the companies’ billing volume, the less they invest in innovation. More than 75% of companies in our sample that bill less than 500,000 euros are in the Low Innovation cluster, while more than 65% of those that bill over 100 million are in the High and Medium Innovation clusters.

The innovation management category encompasses three different vectors. In the first, more than a third of the companies has not formalised innovation processes internally (34.3%), and 37.1% doesn’t intend to do so over the mid-term. Restaurants (44.4%) and tourist activity companies (33.3%) represent the bulk of these companies. In the second vector, another third of the companies manages innovation via ad hoc projects (32.5%), while 20.4% plans to continue doing so in the future. In this group we find hotels in particular (40.3% of the total that manages innovation this way) and intermediation companies (35.5%). Last, the third vector comprises companies that manage innovation via a specific department (18.8%), 21.9% of which continues to want to do so. Transportation companies stand out within this group (40.7%). Less relevant are outsourcing methods (10.6%), 16.2% of these firms preferring to continue to use this system.

In terms of managing innovation through a stable department or ad hoc projects, we can observe that restaurants, transportation companies and public bodies favour the former, while hotels and intermediation firms prefer the latter. In general, tourist activity companies opt to outsource this function. By contrast, we cannot determine that billing volume or the intensity of innovation efforts drive companies towards one management model or another. Companies that opt for an internal department argue that the latter helps to ensure that their innovation policies are maintained over time. Those adopting ad hoc projects argue that the latter make the innovation function within their firms more dynamic.

In terms of general innovation focuses, new products and services and technology predominate, so much so, in fact, that High and Low Innovation clusters represent the majority of investments in these areas (23.7% and 24.4% and 20.0% and 27.6%, respectively). This year, the battle between new products and technologies has favoured the former, while in previous years the opposite was true. As companies’ innovation efforts deepen and they consolidate the required technology, the firms begin to focus their efforts on their products. Among the other general innovation areas, we find commercialisation and sales (16.5% of total investments), followed at some distance by restructuring and new functions, training in new methodologies and branding (all three above 9%). Worth noting is the companies’ little interest in cost reduction (8.9%), reflecting that the effects of the economic crisis on the industry have diminished.

In terms of how the companies rank specific investment focuses, there is a clear interest in client-orientation efforts as expressed by the co-creation, use of networks and commitment to client categories and brand versus internal organisation (structure, channel, processes and income models) and products (product systems and performance through differentiation).

These data help us to better understand the four innovation clusters within the Spanish tourism industry: The Low Innovation cluster represents 25.1% of firms; the Moderate Innovation cluster, 24%; the Medium Innovation cluster, 28.3%; and the High Innovation cluster, 22.6%. We can broadly describe these groups as follows.

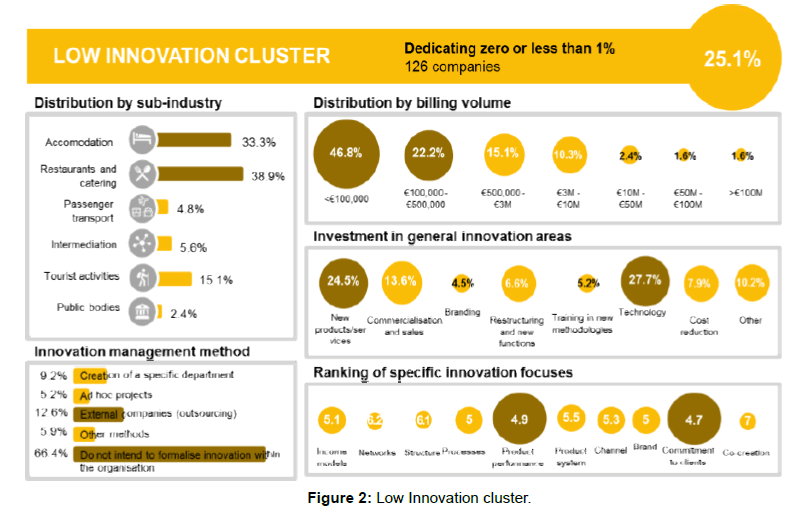

Low Innovation cluster

The Low Innovation cluster (25.1%) is characterised by the billing volume of the included companies and how they manage their innovation efforts. The least innovative cluster comprises companies that bill the least (46.8% of the companies included in this group bill less than €100,000, compared to 22.6% of general sample). In terms of innovation management, more than half of the firms in this cluster declare that they do not intend to manage innovation within their firms (66.4% compared to 37% among the general sample).

Also worth noting is the elevated presence of companies from the restaurant and catering sub-industry (38.9%, while the general sample mean is 36.1%). In addition, this cluster dedicates the largest share of its innovation budget to technology (27.7% versus 19.96% of the general sample) and to new products and services (24.5% compared to 22.5% among the general sample).

In terms of general investment areas, the least innovative cluster gives special importance to products and client orientation, with product performance (4.91 out of 7) and commitment to clients (4.74) seen as the most important followed by processes (5.03) and brand (5.03) (Figure 2).

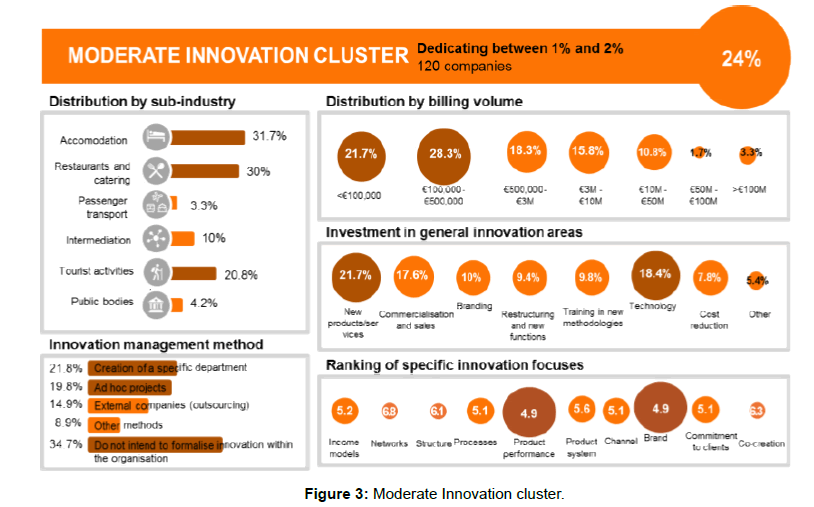

Moderate innovation cluster

The Moderate Innovation cluster (24%) primarily encompasses companies from the accommodation sub-industry (31.7%), restaurants and catering (30%) and tourist activities (20.8% compared to 18% among the general sample). More than half of the companies included bill under €500,000 (28.3% bill between €100,000 and €500,000, while 21.7% bill under €100,000).

In terms of innovation management methods, a large part of the companies in this cluster declare that they have no intention of formalising innovation within their firms (34.7%). As regards general innovation investment areas, the Moderate Innovation cluster is one of the groups that diversify its investments the most, investing primarily in new products and services (21.7%), technology (18.4%) and commercialisation and sales (17.6%). The companies included maintain a moderate investment level in all the other areas.

Last, the most important innovation focuses for the companies in this cluster are product performance (4.9 out of 7) and brand (4.9), followed by processes (5.1) and channels (5.1). Based on our data, we can determine that companies in this innovation cluster feel that all three areas are important: product, client orientation and internal organisation (Figure 3).

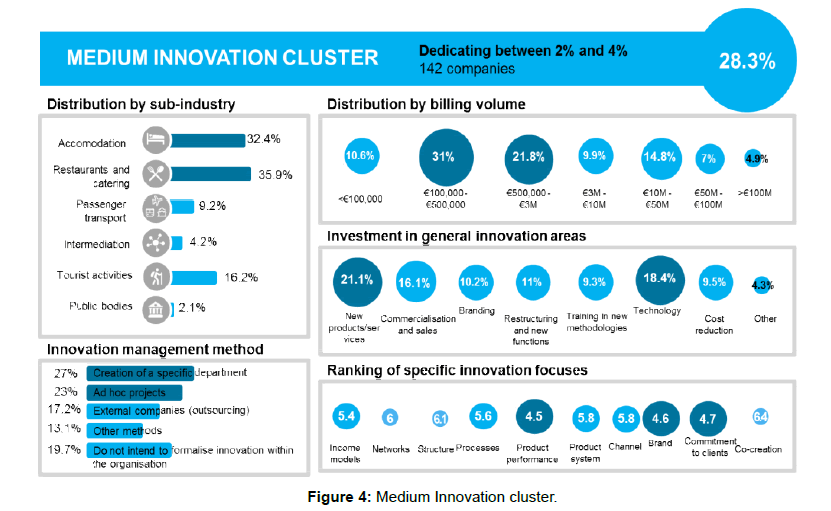

Medium innovation cluster

The Medium Innovation cluster is the largest, encompassing 28.3% of tourism industry firms, through primarily from the restaurant and catering (35.9%) and accommodation (32.4%) sub-industries. These companies mostly manage their innovation efforts by creating a specific department (27%) or through ad hoc projects (23%). On average, the companies bill between €100,000 and €3,000,000 (31% bill between €100,000 and €500,000, and 21.8%, between €500,000 and 3 million euros).

Creating new products and services (21.1%) and technology (18.4%) are the key investment areas for this cluster, followed by commercialisation and sales (16.1%). In terms of their ranking of specific innovation focuses, the companies in this cluster give greatest importance to commitment to clients, the brand and product performance, thus giving greater weight to the product and client orientation types of innovations (Figure 4).

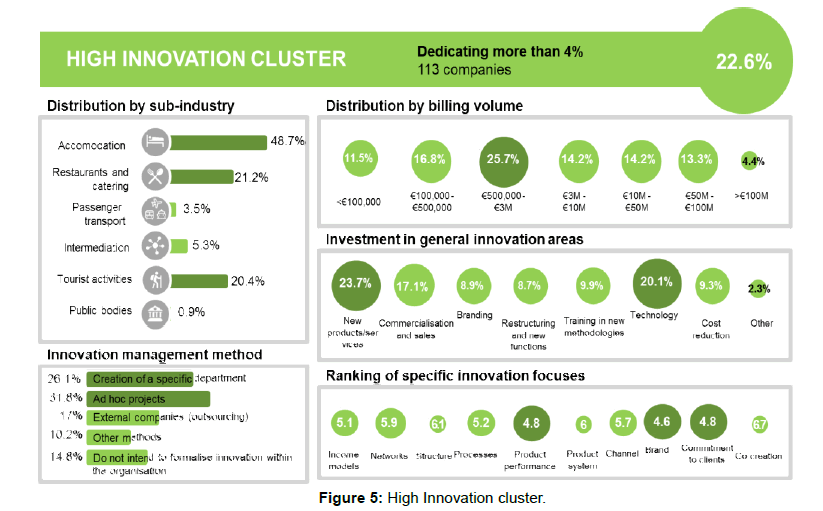

High innovation cluster

The High Innovation cluster (22.6%) stands out for the number of accommodation sub-industry firms (48.7%), followed by those from the restaurant and catering (21.2%) and tourist activity (20.4%) areas.

A significant part of this innovation cluster bills between €500,000 and €3,000,000, while the companies in this group primarily use ad hoc projects (31.8%) and specific departments (26.1%) to manage their innovation efforts.

In terms of general innovation areas, these companies favour the creation of new products and services (23.7%) and technology (20.1%). The commercialisation and sales area also stands out with respect to other clusters (17.1%). In terms of the most important innovation focuses, this cluster favours those linked to client orientation (through the brand and commitment to clients) as well as the product (via product performance initiatives) (Figure 5).

Given the above, our first hypothesis (H1: The greater the billing volume, the greater the investment in innovation) is significant statistically and holds true. We can observe that more than 65% of the companies that bill over 100 million euros are included within the High and Medium Innovation clusters, while more than 75% of the firms billing less than €500,000 are included in the Low and Moderate Innovation clusters. Also worth noting is that 34% of all the companies surveyed does not intend to innovate internally over the mid-term; significantly, the companies that are most averse to investing in innovation are among those billing the least in our sample.

To validate H1, we carried out a chi-squared test, using the Gamma function to determine the direction of the association. To apply the test, we grouped the two clusters billing the most (between €50,000,000 and €100,000,000 and over €100,000,000). By using the chi-squared test (p-value near 0), we can see a clear dependence between the innovation cluster to which the companies belong and their billing volume. Via the Gamma function (positive and p-value near 0), we can deduce that the association is positive (Table 7). Consequently, we can argue that H1 is significant statistically, that is, the greater the companies’ billing volume, the more they innovate.

| Value | Df | |

|---|---|---|

| Pearson’s chi-squared | 89.171a | 15 |

| Likelihood function | 88.918 | 15 |

| Linear by linear association | 56.514 | 1 |

| Number of valid cases | 501 |

a0 cells (0.0%) with an expected count less than 5. The minimum expected count is 10.60.

Table 7: Chi-squared tests on H1.

Our results also confirm our second hypothesis (H2: The greater the investment in innovation, the greater the efforts tourism-industry companies dedicate to client-orientation initiatives). By grouping the general innovation investment areas into three types, we can see that the client orientation area stands out above the other two (internal organisation and product): 5.6 out of 7, versus 5.52 and 5.24, respectively. Not in vain, co-creation (6.60) and networks (6.20) lead the ranking of innovation focuses. Thus, we can see that client orientation becomes more important the greater the investment efforts in innovation.

To validate this hypothesis statistically, we created a mean variable for all the variables included in Table 7 related to client orientation. When comparing it to the variables for each cluster, we can see that there is a clear trend in support of this hypothesis. We cannot assume data normality to carry out a non-parametric test (ANOVA). Consequently, we carry out the Kruskal-Wallis test. Our results (chi=7.35, p-value=0.061) indicate that the differences favour our hypothesis (Tables 8 and 9).For an even clearer comparison, we can create two clusters: “Less Innovation” (encompassing the Low and Moderate Innovation clusters) and “More Innovation (including the Medium and High Innovation clusters). The “client orientation” type of innovation focuses within the Less Innovation cluster achieves a mean score of 5.7480, while they achieve a mean score of 5.4696 in the More Innovation cluster. To determine the statistical significance of these values, we can compare the two by means of the Mann Whitney U test (the non-parametric equivalent to Student’s t-test). We thus obtain statistically significant results for the mean (p-value=0.009). For the Less Innovation cluster, client orientation receives a higher score and is consequently less important for those companies (a mean range of 268.17) compared to the firms in the More Innovation cluster (a mean range of 234.43) as H2 states.

| N | Mean range | ||

|---|---|---|---|

| Client Orientation | High Innovation | 113 | 241.74 |

| Medium Innovation | 142 | 228.62 | |

| Moderate Innovation | 120 | 268.79 | |

| Low Innovation | 126 | 267.58 | |

| Total | 501 | ||

Table 8: Kruskal-Wallis test on H2.

| Client Orientation | |

|---|---|

| Chi-squared | 7.353 |

| gl | 3 |

| Asymptotic analysisa | 0.061 |

aKrushal-Wallis test

Cluster variable: Clusters by % dedicated to innovation

Table 9: H2 test data.

The third hypothesis (H3: The greater the investment in innovation, the greater the innovation efforts tourism companies dedicate to technology) holds true in part. By adding up the total investments in innovation, the technology area is the one favoured by companies: 48.5% of the sample declares that it invests in this area over that invested in channels (41%), branding (39.1%), cost reduction (38.8%), training in new methodologies (37.9%) and restructuring and new functions (29.6%). However, when we compare the mean investment amounts in each area, the new product area exceeds technology in the following ways: in the accommodation sub-industry, 25.3% versus 22.5%; in the restaurant and catering sub-industry, 22.9 versus 21.6%; and in the tourist activity sub-industry, 20.3% versus 19.9%. The two areas are tied in the transport sub-industry (17.9%), though technology slightly beats out the new product area in the public bodies’ sub-industry (15.0% (product) versus 15.8% (technology)). Thus, we cannot affirm that greater investment in innovation implies greater interest in technology. Spanish tourism-industry firms have previously developed the technological component, especially after the end of the economic crisis between 2013-2015, and are now intensifying their differentiation efforts by means of their products.

When applying the Kruskal-Wallis test (chi=1.282 and p-value=0.738) (Tables 10 and 11), we can see that there are no significant differences.

| Technology | N | Mean range | |

|---|---|---|---|

| High Innovation | 95 | 140.09 | |

| Medium Innovation | 86 | 131.81 | |

| Moderate Innovation | 57 | 126.61 | |

| Low Innovation | 28 | 130.36 | |

| Total | 266 |

Table 10: Kruskal-Wallis test on H3.

| Technology | |

|---|---|

| Chi-squared | 1.262 |

| gl | 3 |

| Asymptotic analysisa | 0.738 |

aKrushal-Wallis test

Cluster variable: Clusters by % dedicated to innovation

Table 11: H3 test data.

Based on our results, we also have to reject our fourth hypothesis (H4: Reducing costs is the key innovation objective among all tourism firms). Cost reduction efforts only represent 8.9% of all innovation investments, lower than even branding (9.0%), training in new technologies (9.2%), restructuring and new functions (9.3%), commercialisation and sales (16.5%) and technology (19.9%). We can also attest that something similar held true the previous year when, for example, cost reduction was ranked third out of nine innovation areas in a study carried out by Valls, Parera and Andrade (2012) among Spanish tourism companies. However, we cannot infer from our study that cost reduction is a primary innovation objective among Spanish tourism firms.

We do not have to carry out any analysis to test H4 given that we can simply see that it does not hold true by looking at the data. At any rate, what we can do is confirm its statistical significance. For this we use the Friedman Test (chi=445.69 and p-value=0.000). Cost reduction’s mean range (4.06) is far below at least new products (5.95), technology (5.57) and commercialisation and sales (5.43). We can thus reject the hypothesis that reducing costs is the primary objective of innovation efforts in this industry.

Finally, we cannot affirm that our fifth hypothesis (H5: Concern for the companies’ income models will decrease as firms increase their investments in innovating themselves) holds true either. In fact, we can deduce the contrary by examining what each cluster dedicates to its income model, receiving scores as follows: 5.14 (out of 7) in the Low Innovation cluster; 5.21 in the Moderate Innovation cluster; 5.42 in the Medium Innovation cluster; and 5.13 in the High Innovation cluster. Rather, concern for the companies’ income models might seem to increase the more they invest in innovation, though we can also see significant differences among the sub-industries: accommodation (5.5 out of 7); public bodies (5.3); restaurants, intermediation and tourist activities (5.2); and transport (4.5). Consequently, we cannot argue that, as companies consolidate and achieve a stable income model, the latter is no longer a priority innovation area.

Furthermore, when applying the Kruskal-Wallis test, we can also see that there is no significant difference between concern for the income model and investment dedicated to innovate the firms (chi=0.902 and p-value=0.825), with a mean range in the Low Innovation cluster of 245.99 and 246.17 in the High Innovation cluster.

Conclusions

We have been able to detect a certain relation between the level of innovation implemented and the companies’ sub-industries, their billing volume, innovation management models and general innovation areas and ranking of specific innovation focuses.

Taking into account the high number of Spanish tourism companies that have still not formalised innovation though they intend to do so (37% of the total), we have found that accommodation and tourist activity companies stand out over the others for the amount they invest in innovation. The contrary occurs with intermediation and transport companies as well as restaurants. These are the most traditional firms of all. Restaurants are among the companies investing the least in innovation despite being as traditional as hotel and tourist activity companies; perhaps their primarily small size weighs too heavily. Transport and innovation companies are in the medium range. Despite these trends, we have not been able to establish a correlation between the level of investment in innovation and tourism sub-industries.

Another key result is that greater business volume motivates companies to dedicate more resources to innovation. In our study, 52.2% of the companies that bill the least are in the Low Innovation cluster, while 51.7% of those that bill between 50 and 100 million euros and 38.8% of those that bill more than 100 million are in the High Innovation cluster. However, this holds true in every case. We have found high investment levels in all the billing ranges and subindustries and vice versa.

Among the general innovation areas, new products and services and technology stand out. Though technology received more attention than new products and services until recently, the opposite is now true, especially as companies invest more in innovation. It would seem that the industry’s companies are well prepared technologically speaking and now aim to differentiate themselves by innovating in their products and services. Despite no significant difference, creating new products exceeds investments in technology.

In terms of innovation management models, ad hoc projects are the most used (32.0%), and 20.4% of these companies intend to continue to use those types of projects. This contrasts with companies that focus on the technology area, which favour the creation of a specific internal department (18.8%, with 21.9% intent on continuing to use this system). The difference between both is that the former feel that ad hoc projects help to solidify innovation within their firms, while the latter feel that an internal department helps to make sure that innovation doesn’t become rigid. Firms focusing on the commercialisation and sales area tend to adopt the previous management methods as occurs with firms prioritising the restructuring and new function, training and branding areas.

The most noteworthy innovation area is client orientation. This includes co-creation, networks and commitment to clients. Contrarily, we have internal organisation (structure, channel, processes and income model) and product (product system and performance).

Cost reduction is the least important innovation area of all despite its leading role as the preferred innovation focus in previous years.

Main Contribution of this Paper

The main contribution of our study is having found certain relationships between the level of innovation investments among Spanish tourism companies and the type of sub-industry, their billing volume, the management innovation model and areas of action. As the industry is in an innovative phase, these results may be useful for other, similar scenarios.

Limitations and Future Research

The limitations of our study stem from the fact that we did not create our sample to be able to analyse the industry by types of tourism (sun and beach, urban, interior, etc.) or by other factors (cultural, business, assets, ecology, etc.). By adjusting our sample to examine sub-industries, our study is unable to carry out more indepth analyses of these factors.

Future research should aim to compare these results to other, more mature areas of economic activity to determine if there are any correlations between the different business communities’ attitudes towards innovation.

References

- Najda-Janoszka M, Koperaa S (2014) Exploring barriers to innovation in tourism industry- the case of southern region of Poland, Procedia. Soc Behav Sci 110: 190-201.

- Hjalager AM (2010) A review of innovation research in tourism. Tourism Manag 31: 1-12

- Instituto Nacional de Estadística (INE) (2017). Informe Empleo en el sector turístico 2016.

- Scheidegger E (2006) Can the state promote innovation in tourism? Should it? In OECD, Innovation and Growth in Tourism, OECD Publishing, Paris.

- Keller P (2006) Innovation and Tourism Policy, in OECD, Innovation and Growth in Tourism, OECD Publishing, France.

- International Classroom for Tourism Innovation (AIIT) ESADECREAPOLIS (2017). State of Tourism Innovation in Spain, June 2017.

- Organisation for Economic Co-operation and Development (OECD) (2005). Oslo Manual: Guidelines for Collecting and Interpreting Innovation Data. (3rd edtn), Paris.

- Rodriguez-Sanchez I, Williams AM, Brotons M (2017) The innovation journey of new-to-tourism entrepreneurs. Curr Iss Tourism 1-28.

- Weiermaier K (2006) Chapter 4. Product improvement or innovation: what is the key to success in tourism? In OECD, Innovation and growth in tourism, OECD Publishing, Paris.

- Schumpeter J (1934) The theory of economic development. Cambridge: Harvard University Press, USA.

- Vargo SL, Maglio PP, Akaka MA (2008) On value and value co-creation: A service systems and service logic perspective. European Manag J 26: 145-152.

- Larsen S, Mossberg L (2007) The diversity of tourist experiences. Scand J Hosp Tourism 7: 1-6.

- Nawijn J, Mitas O, Lin Y, Kerstetter D (2013) How do we feel on vacation? A closer look at how emotions change over the course of a trip. J Travel Res 52: 265-274.

- Prahalad CK, Ramaswamy V (2004) Co-creation experiences: The next practice in value creation. J Interact Mark 18: 5-14.

- Jamal T, Stronza A (2009) Collaboration theory and tourism practice in protected areas: Stakeholders, structuring and sustainability. J Sust Tourism 17: 169-181.

- Beesley L (2005) The management of emotion in collaborative tourism research settings. Tourism Manag 26: 261-275.

- Jamal T, Getz D (1995) Collaboration theory and community tourism planning. Ann Tourism Res 22: 186-204.

- Reed MG (2000) Collaborative tourism planning s adaptive experiments in emergent tourism setting. In Branwell & Lane (eds.), Tourism collaboration and partnerships: politics, practice and sustainability, Channel View Publications, Cleveron

- Mannell RC (1987) Psychological nature of leisure and tourism experience. Ann Tourism Res 14: 314-331.

- Zouni G, Kouremenos A (2008) Do tourism providers know their visitors? An investigation of tourism experience at a destination. Tourism Hosp Res.

- Tsiotsou R, Ratten V (2010) Future research directions in tourism marketing. Mark Intell Plann 28: 533-544.

- Romero C (2015) Innovation in tourism. Retrieved from Seggitur Turismo e Innovación.

- Kotler PH, Jain D, Maesincee S (2002) Marketing moves: A new approach to profits, growth, and renewal. Harvard Business Review Press, Cambridge, USA.

Spanish

Spanish  Chinese

Chinese  Russian

Russian  German

German  French

French  Japanese

Japanese  Portuguese

Portuguese  Hindi

Hindi